Digital marketing:

Your presence, mastered & measured.

Developing a digital marketing strategy for an asset management or wealth management firm requires a deep understanding of the business. This includes what it needs to do to grow—and how it generates revenue.

Call on LG Digital, the digital marketing strategy practice of Lowe Group, to collaborate in the development of a comprehensive plan designed to leverage and master communications and technology to acquire, engage, serve and retain clients for your ETF, mutual fund or financial advisory business. Our emphasis is on continual measurement for continuous improvement to drive business results.

Alternatively, bring us in to help on a project or problem to help you and your team go further faster.

Our services include:

- Website strategy and SEO

- Email and marketing automation

- Marketing analytics

- Training

Public relations and digital marketing strategy are close cousins. The goal of both is to get attention and raise visibility, with digital marketing providing tools that drive added effectiveness and enable enhanced measurement and attribution. When public relations and digital marketing work together, connections are made and insights are gained that elevate the contribution of both.

Your frequently asked questions, answered.

What does FurtherFaster mean for Digital Marketing?

Can you help us

with our analytics?

How can you help with social media?

Digital marketing for asset managers.

The mandate for investment firm marketers is broadening, and with it the expectations of a firm’s digital strategy. More audiences are being reached and with a fuller range of investment capabilities. This argues in favor of targeted communications across web, email, social and other channels, and learning and sharing insights from engagement data.

Digital has become the nerve center of the modern investment firm. Our clients feel the added pressure and heightened profile of their work. Our goal is to relieve the burden while bringing new ideas and approaches to keep the team and business moving ahead.

Digital marketing for wealth managers.

Financial advisory firms’ desire for profitable growth invariably leads them to digital strategies that can efficiently market, engage and convert online interest into opportunity.

Websites are relied on to communicate “right fit” client requirements. Emails are used to serve, soothe and retain. We help with strategic positioning and leveraging the digital marketing tech stack (i.e., website, email platform, CRM).

Working with LG Digital.

Initiating contact with a firm offering digital marketing strategy can give one pause.

Which of these concerns keeps you from reaching out?

Ugh, they’ll come in wanting to rethink everything, and we don’t have the time, budget or even inclination to do that.

“Underwhelmed, they’re so tactical. We need help with the big picture.”

“Stay in your lane! We have a branding partner, an ad agency, a content team, etc. We need you to do only what you do.

“Huh, ever since they got in the door, they’ve been trying to expand the assignment.”

We get it, we’ve been there. How about you tell us what you need our deep, specialized experience in the investment industry for—and we’ll get to work on that.

Digital Marketing FurtherFaster Proofpoints.

Background

In addition to everything new that comes with launching ETFs, this would-be ETF issuer needed wholesale changes made to their mutual fund-centric website in order to accommodate the new product line.

Scope of work

The client is a business unit of a larger firm whose investment operations extend beyond mutual funds and whose enterprise resources are not intimately familiar with the intermediary channel. After conducting a holistic analysis of the firm’s current site, Lowe Group’s LG Digital provided extensive recommendations for overall elevation of its presence on the web. Combining search engine and industry best practices, the findings delivered actionable steps for the internal and external development partners to best leverage their content management system and marketing automation platform.

Outcome

The shared insights provided the resource teams with a deeper understanding of what was needed to support their business unit’s important new initiative. Development of the site is underway ahead of a 2025 product launch.

Background

A significant investment was made to acquire tens of thousands of vetted email addresses matched to this investment firm’s capabilities. The ask for Marketing: engage and test the list for business potential, with the intent to graduate promising contacts to Sales for further exploration.

Scope of work

The development of a nurture strategy spans multiple functional areas (e.g., Distribution, CRM, Business Intelligence, email, content, analytics). Lowe Group’s LG Digital partnered on the full range of what needed to be done: list segmentation, content development, journey building, systems prep and measurement.

Outcome

Watch this space for an update. While the client is pleased with the strategy work to date, the pilot project is in the field.

Background

The growth of this $5 billion RIA was thanks to referrals from happy clients. The website wasn’t a priority for management, but the firm’s investors thought it was time for an upgrade. In fact, reliance on a cookie cutter website builder platform led to the site being bloated with the very same content the platform was also publishing to dozens other advisory sites.

Scope of work

A day of interviews with the principals, followed by a few light brand-building exercises, helped LG Digital and Lowe Group’s Content Services team collaborate on revised positioning. This work was followed by the development and launch of a new, contemporary, differentiated website that better reflected the unique value of the firm and its people.

Outcome

Launched in September 2024, the site has received acclaim from clients and is climbing up the search results.

Read our latest insights on Digital Marketing.

Paid search offers visibility benefits, even as costs rise and habits shift

For how long will it be a go-to tactic, especially for long tail searches?

Prepping your asset management website for a whole different kind of user

It’s time to consider a future when our clients and prospects will send their AI agents to get what they need from our sites.

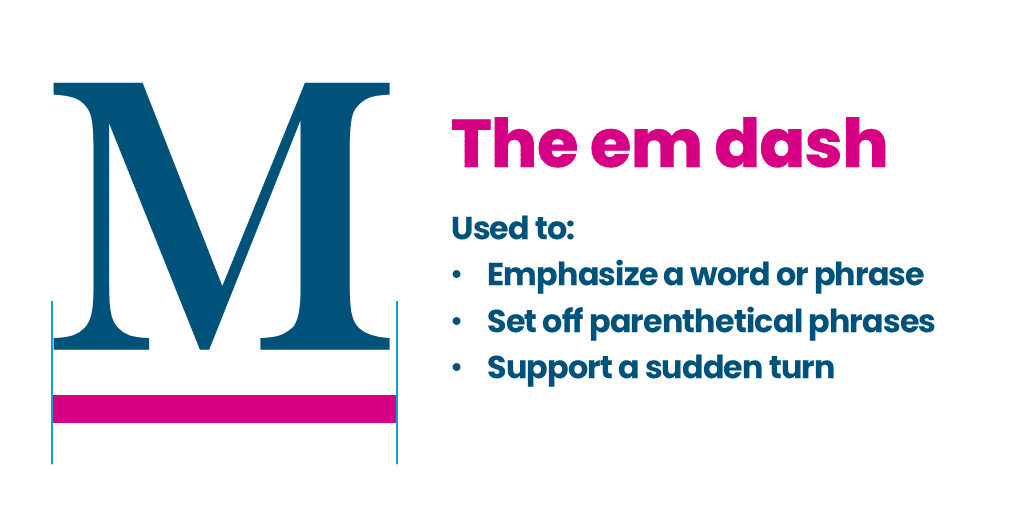

We stand with the em dash

Used by Buffett, Marks, Zweig, Benz and others, the dash doesn’t deserve to be cancelled over a silly misunderstanding.