4 must-reads if your job involves reaching and engaging financial advisors

To me, there’s little better than submitting to a plane ride with a collection of whitepaper PDFs that I’ve been meaning to read. Ah, the sheer bliss. The stack always tends to include some I wish I hadn’t wasted the toner ink to print while others will help carry me away.

Here’s my report on some of the highlights from a recent trip: four whitepapers from SS&C Technologies, unparalleled experts on the parts of the asset management industry that most directly affect digital marketing strategy and work. There’s a lot of generic financial services marketing commentary out there. This analysis is riveting because it’s so on point. In addition to mutual fund and ETF marketers, those involved in fund management and distribution will find value in these, as well. In fact, distribution teams are the primary audience. I’ll seek to justify my tardiness in catching up with these, which were published over the last nine months and the final two last month, by suggesting that they read even better as a set.

SS&C’s perspectives assume technology and resources that are more prevalent at the largest of investment companies, which the firm acknowledges especially when it comes to data.

“The list of data available continues to get larger and larger. The price tag and complexity around data acquisition and integration also continues to get larger, so business intelligence [BI] leadership must prioritize and focus their budgets and efforts on the most impactful programs and initiatives.” Across the industry, there are plenty of firms today that don’t have budget to buy data, let alone a BI lead to leverage it. Content resources are in short supply at many companies, as well. These reports draw what are becoming bright lines between the data haves and the data have-nots.

Product content/commentary may influence advisor decisions more than Sales

Let’s start with the oldest of the set, 3 Key Ways to Influence an Advisor’s Product Choices (June 2022), which drops a data bomb: “Firms might assume their best opportunity to impact advisors’ product decisions is by having them talk with their salespeople. But that doesn’t provide an opportunity very often, since 43% of financial advisors say firm salespeople are rarely or never involved in their product decisions and one-third say they’re only involved occasionally.” Wait, what now?

The report continues with the finding that it’s the firm’s product content and commentary that was very or moderately important to product decisions made by 58% of advisors. Compare that to the 21% who consider firm salespeople important. This data is all according to the SS&C RAC, Influence Survey, in association with Horsesmouth, 2022, research, and it is good to know.

You’ll want to read the full document for the elaboration on the three key ways to influence product choice but here’s the top line: 1. Spark a need and become the choice to beat, including with high impact investment ideas 2. Maximize your chances of making the short list and 3. Ensure opportunities for direct engagement are optimized for success.

Designing an asset manager BI strategy

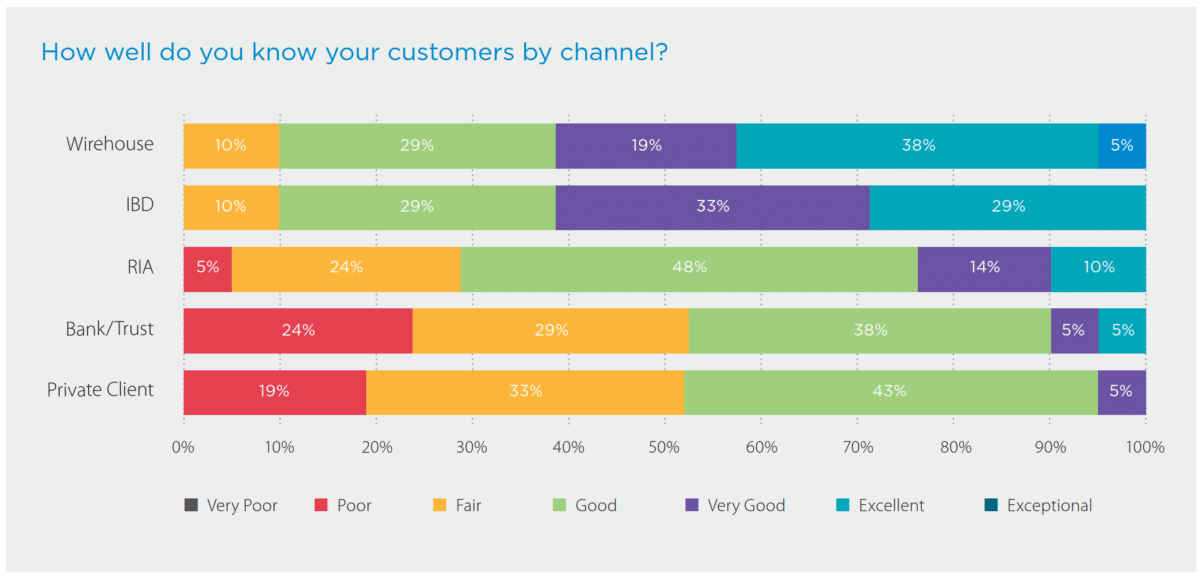

It comes as little surprise that 100% of firms believe knowing their customers is either absolutely essential (86%) or very important (14%) to their success, and yet there are information gaps in such customer knowledge. But for the first time I’ve seen, the Closing the Customer Knowledge Gap: Data Strategies for Asset Managers (September 2022) report presents a breakdown of how well mutual fund and ETF companies believe they know advisors by channel. Cool.

With this chart SS&C starts to map the design of a business intelligence strategy. BI figures prominently in this work, of course, as does Sales. Marketing’s role is invoked many times in this piece, as is fitting, right and proper (but not always a given!).

The paper considers the scope of data that BI needs to get their heads around and that sales and marketing teams need to access. On average, asset managers purchase 4.75 broker-dealer data packs which explains their greater confidence in what they know about advisors from wirehouse and broker-dealer channels (and underscores the high pay to play hurdle for small firms).

The top five programs/initiatives underway at firms today, according to SS&C’s work:

- Advisor and teams profiling/tiering/clustering

- Lead generation/engagement scoring

- Marketing engagement tracking

- Advanced data reporting/visualization for

Sales - CRM upgrades and infrastructure upgrades

That’s a lot of work to do, for which SS&C offers its IVO framework, “specifically, the data necessary to determine which advisors are the real decision-makers (i.e., those with influence), which relationships are the most profitable to the firm (i.e., those that offer the most value), and which offer the greatest potential for growth (i.e., opportunity).” Would that we all could be in position to align CRM contacts in such an orderly way today.

The whitepaper also provides a glimpse of what’s ahead. Asset managers say future programs/initiatives will include:

- Advanced advisor & team profiling/tiering/clustering

- Next best action/workflow automation

- Predictive/propensity modeling

- Better third-party data/data pack integration

- Advisor personalization and preferences and nodes of connection and touch points

Of course, you’re going to want to read it in its entirety. I seized on the repeated references to the importance of digital engagement data.

“CRM and website/email analytics are ranked as the most critical internal data sources, behind only asset and transactional data by business intelligence leaders,” wrote SS&C, citing 2022 survey data. “Firms that are collecting CRM and web/email analytics—and are utilizing this data to inform segmentation and other business intelligence initiatives—are taking advantage of an immense opportunity to integrate informative customer information into their decision-making framework. CRM and web/email analytics have many applications, though none may be more important than the ability to assess the intent and interest of your clients.”

There was just one major question mark for me in this otherwise satisfying document, and that was a callout box: “Internal data sources needing the most improvement [according to asset managers in 2022]: 50% web analytics and 45% marketing automation platform.”

I followed up with Lee Kowarski, SS&C’s head of distribution solutions, who told me that there wasn’t much more to say on that in the research. Given that this is a survey of business leaders, it’s intriguing that there is such reported widespread discontent at that level. Is it the tools themselves or the implementation and analysis? Have practitioners really pushed these capabilities to their limits sufficiently to find them wanting—and reported that up? Wish we could get more insights on that.

Fund company distribution coverage and communication strategies need focus and flexibility

“Achieving the end-state of personalized sales and marketing requires firms to embed the principles of focus and flexibility into every level of distribution strategy.” Having made that point, SS&C’s 12-page The Power of Personalization (February 2023) for asset managers lays out three pillars related to determining which advisors to cover and how, defining sales roles and territory definitions, and engaging advisors.

There was a time when the predominant advisor segmentation was geographic and therefore non-controversial. But this discussion raises some provocative ideas in support of “establishing the best advisors a firm wants to work with and matching them with appropriate support. This does not necessarily mean choosing advisors who are most open to having meetings with their wholesaler, or those who fit into a neat geographic location.”

Focus lists should be shorter, and include context for why advisors are on it and the type of opportunity. Asset managers’ overreliance on the perceived profitability of a relationship—because it’s based on the most readily available AUM and gross sales data—has led to “too many asset managers focusing on the same advisors, too many ‘focus’ advisors that need to be validated by field sales, and geographic rigidity that may cause imbalance in opportunity between territories,” according to SS&C.

Who are the best prospects based on their long term value to the firm, including those who have qualities that fit with the firm’s value proposition? The paper advocates an opportunity scoring model that considers advisor online activity as among the inputs.

Citing their research that shows advisors plan to spend an average of 40.2% of their time working in locations that are not their primary office (and these figures are even higher for RIAs), advisor mobility bolsters SS&C’s argument for what some might consider a recipe for chaos: “multiple externals should be able to cover advisors in the same physical location, and an external should be able to maintain a high-value relationship even if the advisor moves out of the territory.” A focused strategy and engagement plan needs to be established upfront, the firm acknowledges.

For years we’ve seen survey data similar to what SS&C reports about the breakdown of advisors who won’t meet with an asset manager under any circumstances (19% in this report) or conversely will meet only in person (11%). Since the pandemic there are remote meeting preferences to consider as well. Likely individual wholesalers have a good handle on the preferences of the focus list in their territories, but such insight has yet to be captured across the board in most CRMs. Institutionalizing that intelligence is a prerequisite to a personalization strategy that moves away from a geography-focused territory structure. The SS&C data suggests that doing this may be Job #1.

An advisor’s location gets a lot of attention in the report, but there’s more to personalization in SS&C’s vision. It includes the consideration of an array of wholesaler attributes as correlated with advocacy, which is the likelihood an advisor would recommend doing business with the salesperson. Six out of 10 advisors engaged with one to six sales types representing asset managers in the past year—but just one to three of those salespeople were engaged with more than once. And, advisors say they trust just one to three salespeople.

Once the firm’s focus is established, SS&C makes several recommendations for how asset managers can be flexible about mandating how their wholesalers engage. The goal: to “foster a culture that embraces digital engagement and the pursuit of quality interactions, not just checking a box for a phone call or in-person meeting.”

Two recommendations of note:

- Asset managers need to provide sales teams the tools and skills to record new data and insights gleaned from their conversations or other materials published by or about that advisor. That means updating the profile with knowledge about the advisor’s needs and preferences, and improving the feedback loop to Marketing about the firm’s content.

- Firm need to use data and AI-driven attribution to create more personalized and effective marketing campaigns and customer journeys—while effectively incorporating behavioral and preference data into the advisor’s customer profile—so both marketing and sales teams can further personalize both digital and human engagement.

When face-to-face meetings are rare, they are high risk

In the days between my plane trip and the time it took me to write this post, SS&C published yet another piece: “7 Changes Redefining the Keys to Successful Advisor Engagement.” The short report supports all of the above longer research about the need to tune outbound efforts and engagement, and repeats that advisors plan to work 40% of the time away from the office next year. When they’re at home, one in five don’t want to interact with Sales at all. Two out of five advisors don’t want any contact when they’re working out of the office.

Making face-to-face appointments will be much more difficult. “And when they do, salespeople should consider those meetings to be high risk, not just high reward, because anything short of an excellent experience will jeopardize their ability to earn another meeting with that advisor,” writes SS&C.

The report also makes the tantalizing statement “The gap is closing between digital experiences in our industry vs. others” but doesn’t go any further.

Taken together or individually, these SS&C reports underscore, highlight and add exclamation points to the urgency of your firm’s need to understand today’s advisors, including where they are, what they want and value, and Sales’ next best move, as informed by each advisor’s online engagement with what you’re producing. Marketers, let us know where LG Digital can help.

Subscribe.

Receive the latest news and insights from Lowe Group.