How mutual fund, ETF communicators sprang into action when SVB surprised

We see you, asset management marketers who dropped everything this week to communicate about the Silicon Valley Bank crisis and fallout. And we celebrate you. Hope you hear the same from the Sales and call center/customer service representative teams you armed with on-the-spot analysis.

Communicating as things are happening—even when the situation isn’t fully sized and even when specific perspectives may not be fully formed—is behavior to be expected from mutual fund and ETF firms in this day and age. (That would be particularly true for more than 300 mutual funds with holdings in SVB, as reported by Ignites. JP Morgan is reported to have the largest number of funds with exposure.)

Even so, not all firms do. National accounts, financial advisors, investment consultants and others who look to you for insights give proactive firms credit for communicating, and they remember.

We’re calling the work out here because as this work pinged around each firm—from the market strategists, investment teams, management teams, and compliance—it eventually arrived as a “get this out there STAT” project for PR, digital marketers, website, webcast, email and social media teams to carry across the finish line. In some cases, it seems as if PDFs were the preferred format to package something up quickly—kudos to the design teams, too.

A few notes for next time

There’s no judgment, just admiration in what we saw as we visited lots of sites to get an idea of the state of play.

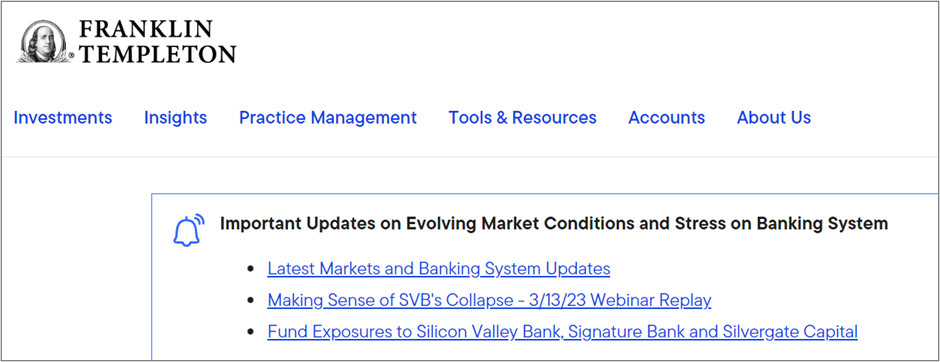

Especially noteworthy: Franklin Templeton and JP Morgan both hosted webinars on the topic on Monday (!), and JP Morgan held a second one Wednesday. As of this writing, Franklin Templeton has published six posts.

Capital Group accompanied its statement with a PDF listing their funds with holdings in both SVB and Signature Bank. BlackRock did the same, minus the kind of analysis that Capital Group provided.

But for next time: Even when time is of the essence, you might want to mind the following. We offer these to help assure your work gets the maximum visibility it deserves:

- It’s tax time, lots of products are being launched, and the home page is just how you like it. Even so, if your team has collaborated to produce a special communication about a financial system threat that seemingly came out of nowhere, it merits mention on the home page. That’s where people will be looking for it. Don’t take the chance that people come to the site looking for analysis, see your January 2023 outlook—and leave without knowing that your firm had something to say this week. Something that you hustled to get out there.

By the way, this is one of the moments when using a carousel on your home page can work against you: Can we really expect urgent information-seekers to advance through as many as eight slides to reach the one timely piece of content?

It’s not as attractive as everything else on its home page but Franklin Templeton’s alert—plunked at the very top of the page under the nav—gets the job done.

- No doubt this copy was deliberated over, and higher powers wanted to go broader in some cases. It’s a decision not without consequence. Experience suggests that this crisis will long be referred to by some derivative of “SVB crisis.” Avoiding the term will just make it that much harder for people searching for this content on your site, and for your prospects in search rankings, too.

- At a time when your content could be competing in search results for very similar-seeming other content, a thoughtfully worded meta description could win the click. Take the time to get one written. No need to wait for next time for this, you can still add or edit a description to something that’s been published.

- Your commentary may have been created for many and varied account relationships. Even so, as long as you published it on your website, why wouldn’t you also post something about it to social media? A bit of a stretch, maybe, but was a press release even considered (see Financial PR and digital marketing: How they work together)? Here’s where silos at firms can obstruct the full leveraging of work.

- Of interest to me was firms’ decision to offer their commentary under the Market Volatility heading. I guess so? Here again my reaction is less about the substance and more about the discoverability of SVB content in that category.

- If your rush communication was delivered by PDF, what’s your plan now to mainstream it—as in creating a page or blog post and linking to it so it’s not just a one-off orphaned piece on your domain? Also, remember that PDFs are indexed by Google. Give your document a chance by optimizing it for SEO. That includes giving consideration to the filename, its title, the author and a meta description.

LG Digital offers a range of services related to your online presence, send us a note for more information

Subscribe.

Receive the latest news and insights from Lowe Group.