Financial advisors are leaving Twitter, even as fintwit appears to thrive

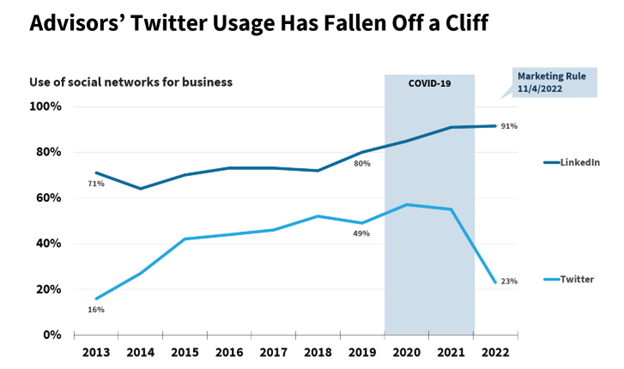

Financial advisors’ usage of Twitter has fallen to a level not seen since 2014 and less than half that in 2021. Just 23% of advisors now say they use Twitter, according to the latest Putnam Investments’ latest research. Putnam Social Media Director Jayme Lacour confirmed this includes active (tweeting) and passive (no posting, just reading) use. As you can see below, the drop began sometime in 2021, well before Elon Musk assumed ownership of what’s now called X Corp.

It feels like the end of an era and, notwithstanding Musk’s continuous shenanigans with the platform, comes at a surprising time.

The site alone is the fifth-most visited site in the world, attracting more than 6 billion visits a month, according to SimilarWeb. It is increasingly home to investment-related conversations. Heightened investor uncertainty has elevated interest in topics that range from personal finance to financial independence to cryptocurrency, all of which licensed investment professionals have a perspective on and stake in.

Also, there are the sports and political and entertainment tweets to simultaneously enjoy. One platform enables it all!

Getting to know advisors from their tweets

First, let me admit to a bias. I have long loved Twitter, in no small part due to how it enhanced what I could bring to my job. Whether you worked in marketing or sales for a mutual fund or ETF company or a fintech, if you were a communicator charged with creating communications that would resonate with financial advisors, Twitter helped.

“Financial advisors are knowable now!” I said in 2009 as I built out an AdvisorTweets website for the purpose of “listening” to what early adopting advisors were tweeting about in real-time, watching the charts and other content they were sharing, and noting their reactions to news and developments.

Advisors were intent on building their personal brands in the years following the Great Financial Crisis, a time when trust in corporate brands was flagging . Independent advisors were the first to have Twitter profiles, followed by those affiliated with broker dealers like Cambridge, Commonwealth, Raymond James and LPL, followed by Morgan Stanley et al. Michael Kitces and his far-reaching Nerd’s Eye View platform, CNBC personality and Ritholtz Wealth Management CEO Josh Brown, and The Behavior Gap’s Carl Richards all got big early boosts on Twitter.

As it turned out, the premise of AdvisorTweets was faulty and the site is long gone, having been sold to Smarsh in 2011.

Maintaining a Twitter account and consistently posting to it required commitment as well as compliance approval. Over time, it became obvious (and was tracked by the Putnam research) that more advisors would read Twitter than would post to it. Such Twitter usage would be less about raising one’s profile or the profile of one’s ideas. It would be simply about staying up to date and exposed to voices and ideas you might not otherwise see or, if you did, on a delay. My usage of Twitter has largely evolved to just reading, too, twice a day at the minimum.

FINRA-regulated financial advisors were the focus of AdvisorTweets, by design. But the investment ecosystem—fintwit—has always been much broader and richer, and today includes some hardy still-tweeting advisors along with traders, analysts, economists, strategists, investment managers, journalists, fintech, retail investors, and cryptocurrency advocates. In fact, back in the day, when publications and blogs periodically published lists of the top advisors to follow on Twitter, invariably at least a few names weren’t actual financial advisors. Fintwit has always been a messy exchange of ideas and opinion. You have to make an effort to find and follow your tweeps.

Meanwhile fintwit continues to grow

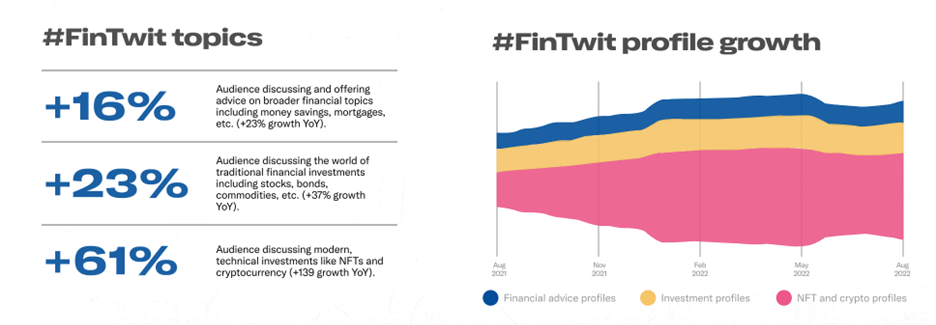

What bums me out is that advisors are losing interest and/or the ability to take part in Twitter even as fintwit appears to be thriving. Fintwit conversations—people using finance-related keywords or phrases within their profiles—are on the rise, according to a November 2022 Talkwalker report. Talkwalker reports 23.8 million mentions of financial freedom-related conversations alone between August 2021 and August 2022.

Ideally (for those of us who are interested in what advisors are thinking but also for those who could benefit from their influence), advisors would be among those willing and able to share their perspectives on fintwit. But if not that, for advisors’ own good, isn’t there a benefit to keeping at least one eye on what a range of investors are talking about?

Talkwalker reports a 61% hike in topics related to “modern, technical investments [NFTs and cryptocurrency].” Wouldn’t it help to read along as those conversations take place, for the purposes of having additional background, when a client or prospect broaches the topic? Twitter is still a relevant watercooler, and there is value to paying attention to it.

By the way, my sense has been that asset managers and other investment firms also have backed away from Twitter. We see much less tweeting on the Twitter lists we follow.

“Among our customers, Twitter represents a low percentage of posts compared to other social networks, and an even lower percentage of engagement signals,” confirms Tim Rickards, senior director at Hearsay Systems, whose clients include regulated financial services firms, including broker-dealers, asset managers and insurance companies.

Interest in Twitter has always been low but dropped further since the 2020 election and Musk’s purchase, says Rickards, calling Twitter “a bit of a goat rodeo right now.” He notes, however, that Hearsay is a social selling tool—its focus is on posting content and driving engagement versus consuming.

Our recommendation: continue posting to Twitter

Even if you have no intention of engaging (and most corporate financial brands never did), the Lowe Group continues to recommend posting your content to Twitter. Because most firms post the same to Twitter as they do to LinkedIn, the incremental work involved is minimal.

True, fewer financial advisors may come across it. But financial journalists and influencers continue to rely on Twitter as a source of information. Thanks to your timely insights and smart use of hashtags and keywords, they may very well discover you and what you have to say.

Is LinkedIn all anyone needs?

Today brands appear to be plenty pleased with what they do on LinkedIn and the engagement in those posts. Many believe they can get everything they need there. I have my doubts.

As Putnam’s research has reported through the years, advisors have experienced measurable value from the networking, relationship-building and even communications opportunities LinkedIn provides. That’s for the here and now.

But LinkedIn wasn’t built to support the kind of person and trend-following, insight-gaining, question-posing, or random discoveries and exchanges that are possible on Twitter. By contrast, Twitter offers a friction-free way of following a hashtag and the accounts that use it, all without extending formal invitations or a lot of repetitive, manual work. Too, Twitter enabled a rich set of tweet-following tools for monitoring.

LinkedIn boosters are quick to point out that the user interface is improving, including its support for polls and other functionality. Longer discussions with more back and forth are becoming more common as well.

Long discussions were never what Twitter was about, though. It’s about quick takes and incremental insights. Unlike on Twitter where people tend to mix it up with their reactions to daily or breaking news or questions, LinkedIn members take a more measured, one might even say packaged approach. LinkedIn has been compared to an organized playdate versus Twitter’s unruly playground. Surely, that difference is part of LinkedIn’s greater appeal to advisory firm management and compliance.

“You’re asking where advisors are going for what’s happening in the moment and for diverse viewpoints,” says Hearsay’s Rickards. “You’re asking what comes next for staying informed. I don’t think we know,” he says, adding that his own interests have led him to explore a range of AI platforms.

To be sure, other ways of “knowing” advisors—my original objective—have emerged since Twitter was a new sensation. Rob Shore, CEO & Founder of Wholesaler Masterminds, illustrated this on LinkedIn recently when he suggested a time-saver for wholesalers, using artificial intelligence: Just paste your best RIA prospects’ monthly outlook from their website [or their most recent blog posts] into ChatGPT-4 and ask for a summary in bullet point format, Rob suggested. Such instant analyses are part of what’s driving the ChatGPT/CRM integrations being planned. I haven’t seen yet how ChatGPT supports the serendipitous as Twitter does.

Openai ChatGPT, the emergence of closed models (see this about BloombergGPT), and other efforts underway to use AI and machine learning to “systematically harvest data” from social and digital sources (see this recent Brunswick Group survey on how institutional investors access information) all today are shinier objects than Twitter.

“Twitter is cigarettes,” Josh Brown wrote last November, dismissing the protestations of those who said they intended to leave Twitter because of Musk. “I can stop anytime. No, you can’t. You can announce that you’re stopping. You’re not stopping. Because you don’t have anything that can replace it.”

I agreed with Brown. At least for now, there still is nothing like Twitter. It’s a still-vital, still-mainstream network to access and learn from, if not to raise awareness and influence—and to maintain relevance. If desired, legal/compliance and technology systems at most firms could figure out how to accommodate some kind of fintwit monitoring, if not full participation.

However, the Putnam research and Hearsay experience make clear that financial advisors are having no trouble kicking the Twitter habit. Fintwit will have to carry on without them.

LG Digital offers a range of services related to your online presence, send us a note for more information.

Subscribe.

Receive the latest news and insights from Lowe Group.