This slowpoke recession is clogging inboxes everywhere

Whether you’re a marketer, financial advisor or a money manager, to be a communicator in the investment industry is to accept that there will be some repetition in your work. The required quarterly, semi-annual and annual reporting and updating make certain of that.

But changing market cycles keep things interesting, leaving plenty of room for variety and creativity in investment communications … until lately.

It’s been 15 months of communicators noting that the yield curve is inverted, and that inversion is a historically reliable predictor of recession. And yet nothing—where is this recession we speak of? And, for the weary among us, how many ways are there to say “a recession is coming, a recession is coming”?

For actual data, we turned to Michael Ruffing, Senior Sales Director for Competiscan. Competiscan maintains a database of emails sent to financial advisors, a treasure trove for querying who’s saying what. While email may be the most important channel when it comes to communicating directly with advisors, it’s the most difficult to monitor if you yourself are not a financial advisor. We appreciate Competiscan’s ability to provide a glimpse into what asset managers are up to.

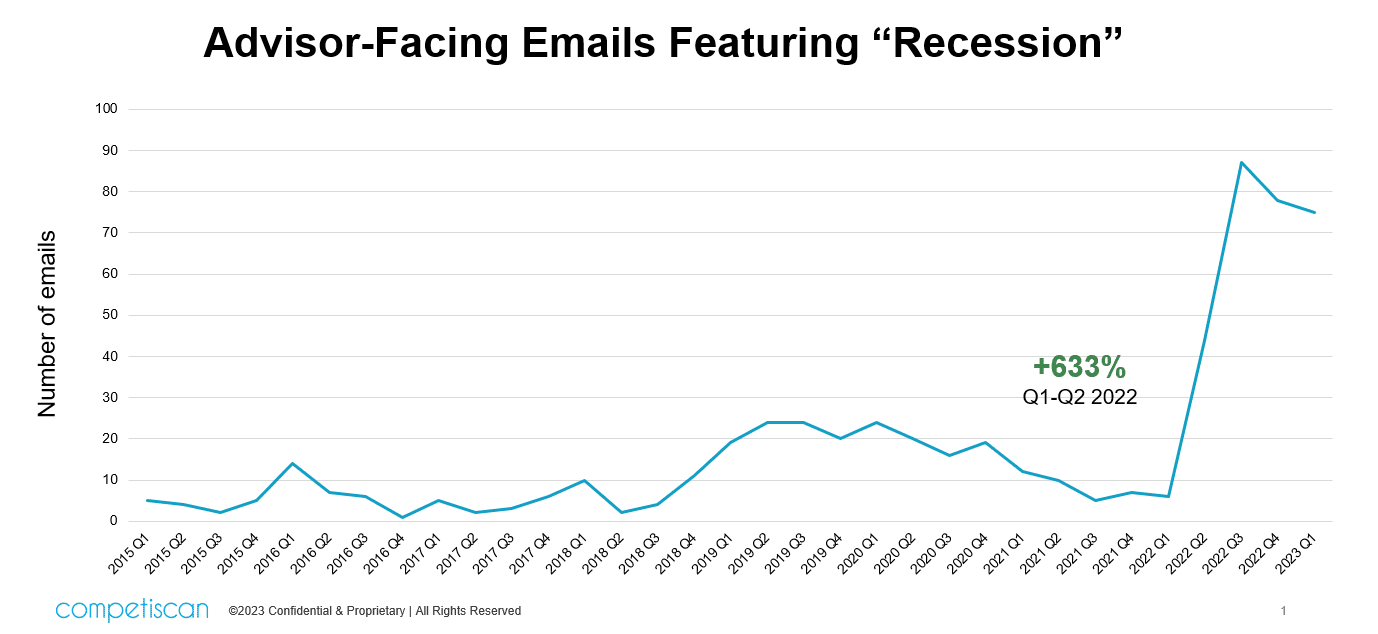

Here’s the topline of the custom research as provided at our request by Glen Means, Competiscan’s senior analyst:

- In the three months between the first and second quarter of last year, there was a 633% increase in emails to financial advisors mentioning the word “recession”—and a further doubling the following quarter. From last year’s first quarter to the end of this year’s first quarter recession-related emails increased 1,150%. Note the dip in the last two quarters.

- Competiscan counts 3,092 recession-related emails in its system dating back to May 2007. Of them, one-third (1,072) were sent since April 2022. If every advisor were to receive emails from every firm in the system in the last 15 months, that would have been the equivalent of more than three recession-related emails per business day. “Recession” emails include those whose focus was recession as well as those that mentioned its imminence in a newsletter or webcast invitation.

That’s a lot, for both senders and receivers.

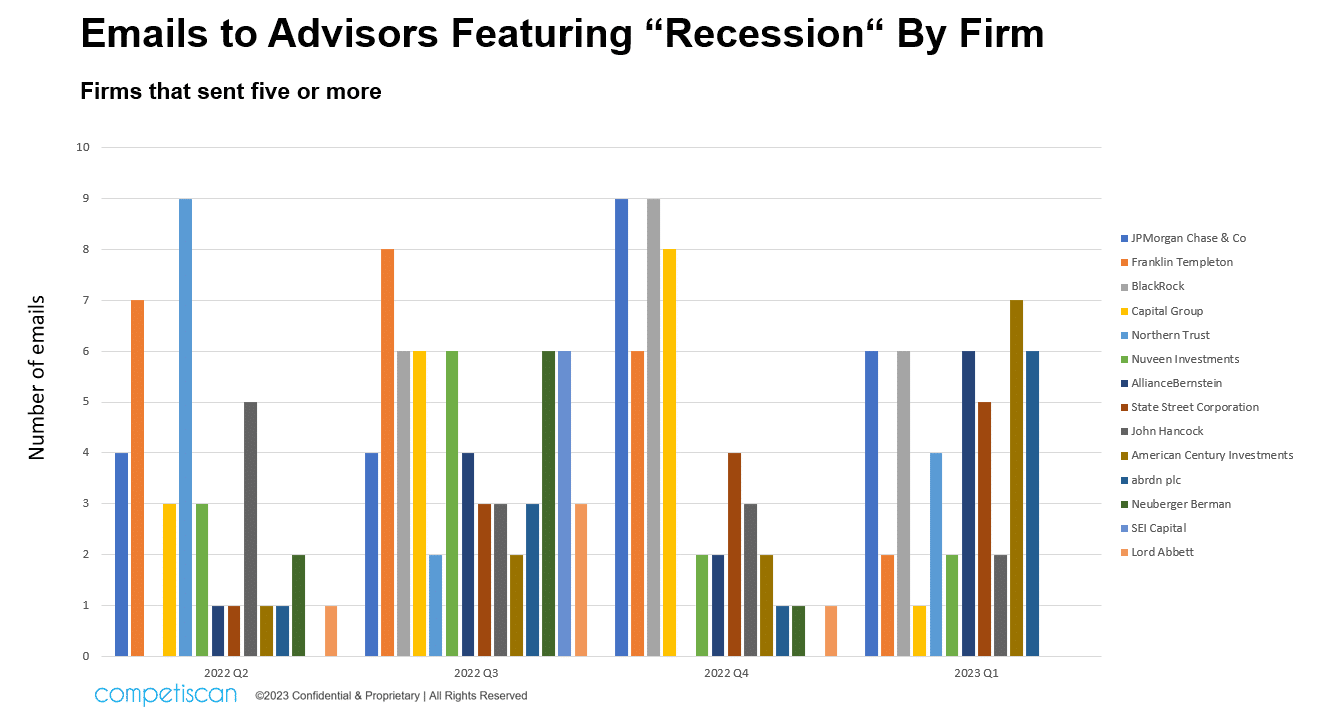

Competiscan data includes 124 individual emailers, including the largest and most prominent firms, over the period. The leaders were JP Morgan and Franklin Templeton, having sent more than 23 since April of last year.

The chart below shows the firms that have sent at least five or more emails, including those that focused on recession as well as mentioned it in a newsletter, webcast invitation. Ask Competiscan for specifics on which firms predicted the recession, which predicted there would be no recession or, by this time, have done both.

From my spot-checking of the set of a thousand, there isn’t a lot of variance in the message. These subject lines suggest the serial nature of an event that refuses to materialize: “Have the odds of a U.S. recession this year increased? Are banks capitalized for another recession? Are we in or headed towards a recession? Are we already in a recession?” Imagine being on the receiving end of these.

Don’t forget the website

I’m keen on what email analysis can show us because “recession” is an example of a topic that can heat up fast. In ordinary times, because there’s no time to spin up a landing page or campaign, valuable content gets published in emails. At a time when everyone’s focused on the same burning issue, it helps to see what others are saying. Ideally, you’ll have something different to share.

There’s another step that firms would be well advised to take, and that’s to memorialize informative email content by adding it to the website, for discoverability whether by humans or search engines. Remember that the media don’t get your advisor emails and advisors visiting your website may not yet be in your CRM.

How do you support the emergence of “recession” (or any other hot topic) as a temporary theme on your site? What are you doing to aggregate content by theme?

For this post, I took a quick tour of a few dozen asset manager sites. Despite the intense focus on recession as demonstrated by the emails being sent, almost none carved out a special section—call it a violator, even—on their home page for recession-related content. And, the search capability on many sites seemed to have no knowledge of the recession-related PDFs that the emails were linking to. They’re stored in a different folder or even in a different database, maybe? I could find recession content by clicking on Insights and drilling down, but what would an advisor do?

Today’s ETF and mutual fund sites, powered by sophisticated content management systems, are gorgeous and everything is ordered just so. But things don’t have to be so tidy. Sometimes I worry that form is overtaking function and usefulness. Break the rules for fresh, timely insights that people may be coming to your home page for because they don’t know where else you’ve filed it away—and they shouldn’t need to!

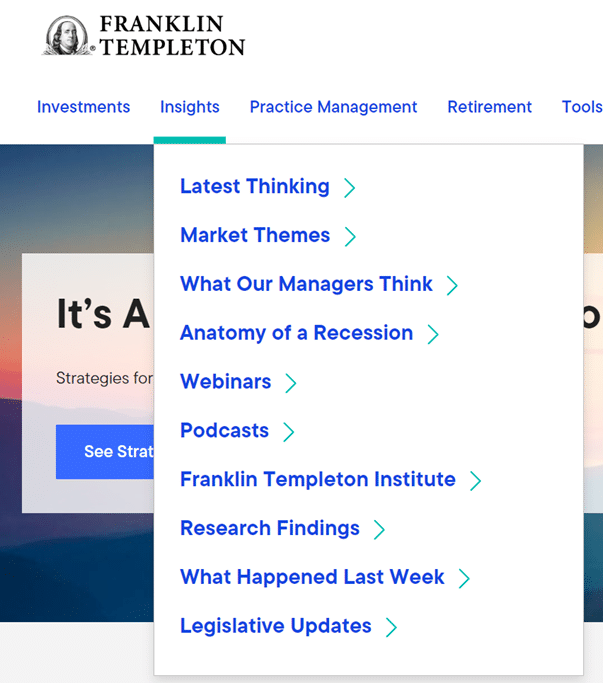

Of all the recession emailers, Franklin Templeton may be the most engaged. ClearBridge Investments, one of the firm’s specialist investment managers, has offered an Anatomy of a Recession (AOR) program since 2016.

Competiscan tracked only one Anatomy of a Recession email prior to 2022—and 13 AOR emails since January last year, whether promoting webinars or updates to the Recession Risk Dashboard. Too much? Not in my opinion. This is finally their time and they are making hay while the sun is threatening not to shine.

And, check out how Franklin Templeton supports the recession program in the second level nav of their site. I Iike how they don’t try to force their offerings into generic headings. For the advisor looking for recession content, it couldn’t be easier to find.

Having fully exhausted this topic, let me leave you with two final notes. The good news: With a recession yet to come, there’s still time to refine and support your firm’s evolving perspectives. The bad news: you may have plenty of time to work on your “recession is coming” messaging—some recession forecasts are now being pushed to 2026!

LG Digital offers a range of services related to your online presence, send us a note for more information.

Subscribe.

Receive the latest news and insights from Lowe Group.