As capital inflows slow, PE firms need to get creative & proactive

Alas, we lost two beloved Tinas in the last 12 months. The eight-time Grammy winning Queen of Rock & Roll passed away in Switzerland in late May. She was predeceased by another TINA—the market regime where There Is No Alternative to risk-assets—a year ago this month in Jackson Hole, Wyo. That’s when the world’s leading central bankers made it clear that lots more pain was ahead in their fight against inflation.

In the interim, private capital investors have gone from the order-taking mode they’ve been in for the last decade-and-a-half to scrambling to hit their fundraising targets. That means it’s time for sponsors that want to continue growing to get creative.

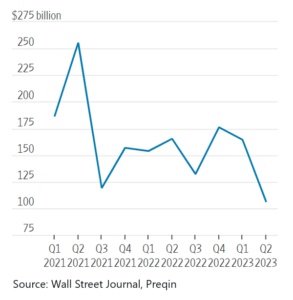

According to Prequin, private equity firms raised $107 billion globally in the second quarter, versus $145 billion in Q2 2022. The number of fund closings have been halved (source). Market participants attribute the capital-raising slump to a perfect storm of factors:

- Drawdowns in institutions’ public bond and equity portfolios last year, even as private markets held up relatively well, meaning that many are at or above their allocation targets for private securities (the so-called denominator effect).

- The same backup in interest rates that forced institutions to mark down their bond portfolios makes bonds look more attractive on a risk-adjusted basis.

- A slowdown in IPOs and M&A deal activity that would normally put LPs’ private equity dollars back into circulation.

- The longer-term trend whereby many institutional investors have already allocated to PE and other private asset classes, leaving sponsors to turn to individual investors in the intermediary channel for fresh sources of capital.

The giant, brand-name buyout firms will be just fine, but until interest rates return to near zero and some version of TINA returns, mid-sized players and those with niche strategies will be competing for the marginal private capital dollar harder than they have in many years.

PE sponsors fighting for marginal dollars need to be firing on every cylinder, from marketing materials that are crisp and professional, to a steady stream of content that illustrates their differentiated investment process (and, not to be overlooked, their operational best practices), to an ongoing and constructive dialogue with media, especially media followed by intermediaries. All of that should be optimized with an integrated digital marketing program that’s tied directly to the sales team and outside capital-raising partners.

In a fundraising environment that lifted all boats, PE sponsors could afford to treat communications as an afterthought. Like the two Tinas, those days are gone.

Lowe Group offers a range of media relations, content marketing and digital marketing services. To learn more, send us a note and we’ll follow up with you.

Subscribe.

Receive the latest news and insights from Lowe Group.