The Broadridge whitepaper that explains a lot about the change underway in the fund industry

The best thing you could do right now is bounce from this post (go on, it’s fine) and download and read the full 24 pages of Broadridge’s recent whitepaper U.S. advisor-sold asset management: This time it’s personal. It’s a rich analysis of the fund industry and you’ll get value out of every word.

Still here? You’re welcome to read along with me. My notes and takeaways—not meant to be comprehensive or even balanced—follow. Whenever I see a hefty piece like this, my highest interest is in the impact of distribution trends on marketers, and there’s plenty of that in this document.

- Personalization: the industry’s greatest near-term challenge. 43% of U.S. asset managers identified personalization as the topmost disruptive trend retail asset managers face between now and 2027—that’s more than consolidation, regulation and disintermediation.

- Investors’ needs are diverging. For most of the U.S. asset management industry’s history, individual investors—predominantly baby boomers—shared a common need for wealth accumulation. Most now need income but younger generations need wealth accumulation among other things (e.g., tax, income, other nonfinancial objectives). This “raises the need to personalize investment outcomes for varied and ever-narrower cohorts of customers.”

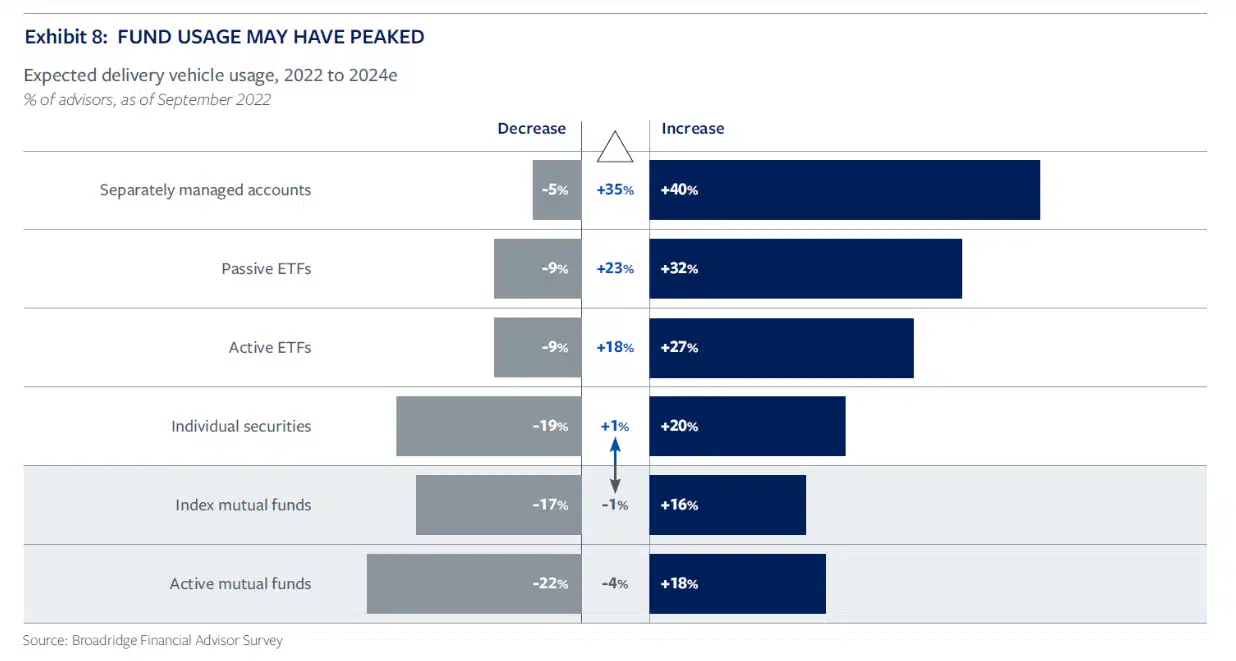

- Fund usage may have peaked. Just four years ago, most households (58% in 2018) invested the bulk of their liquid variable-return portfolios in actively managed mutual funds. By the end of 2022, that number had dropped to 44%. The mix of mutual fund, ETF and individual stock holdings has significantly changed, with Gen Z rapidly shifting away from funds and toward direct investments in equities.

Separately managed accounts (SMAs) appear poised for the greatest increase (40%) in usage by 2024. This is a common theme among research published this year and last and is no doubt driving the energy around direct indexing and custom SMAs.

- Stealthy SMAs. Most of the advisor-sold segment’s net organic growth for the past four years has come from non-fund vehicles—with SMAs representing the bulk of new business and growing at about twice the rate of funds. Just let that sink in, and then go check out an asset manager’s home page. Fund performance dominates, and maybe that’s right for now. SMAs are lucky to merit a mention and a link. But that’s just what we can all see. Within Marketing, a resource shift away from funds and to “what’s selling” is inevitable, isn’t it?

- Investors care about ESG more than advisors. Demand for ESG capabilities continues to rise overall, particularly among younger, female, and more affluent investors. This divergence further emphasizes the demand for personalization. The Broadridge data echoes what’s been reported by multiple studies—that a higher percentage of clients (35%) have a higher focus on ESG than advisors do (23%). Three out of 10 advisors still have no focus on ESG compared to 13% of investors who don’t.

- Model portfolios are driving change. The implications of the growth of model portfolios—projected to double by 2027—for asset managers are dramatic. Model proliferation further distances them from the client, convincing some asset managers to connect more directly with clients and advisors by creating their own models.

- Distributors’ needs from asset managers are changing. Personalizing portfolios has driven asset diversification away from funds. Other drivers are cost, taxes and technology. (“Plummeting trading costs coupled with fractional shares, custom indexing capabilities, and [potentially] distributed ledgers and tokenization all combine to make holding equity portfolios easier.”) Bottomline: Distributors believe they need less help from third party asset managers for portfolio implementation and investment advice.

- Advisors are embracing alternatives. Advisors’ use of liquid and less liquid (private markets) alternative investments has skyrocketed across all wealth tiers and channels. Driving this demand is “comfort with alternatives, a desire to differentiate from other advisors, and wider access to more sophisticated investments within their platforms.”

- Concentration and the “elbowing” out of asset managers. Only 19 asset managers serve as a top five partner to one of the 10 largest distributors, and those 19 asset managers control 49% of mutual fund assets across those distributors.

- From vehicle-agnostic to vehicle-specific. Broadridge comments on the “vehicle-agnostic” approach most managers take when introducing new capabilities to distributors, often involved providing many strategies across multiple vehicle types. Indeed, the approach is reflected by the very organization of asset manager websites showcasing capabilities.

Going forward, successful managers “will custom-design new investment strategies specifically for use solely in a mutual fund, ETF, or SMA, optimizing portfolio construction and security selection around a vehicle’s specific advantages. This will reshape product development and management processes throughout asset management firms.”

Yes. Not to mention the disruption of the existing (typically Marketing-managed) product-based systems responsible for reporting on investment performance.

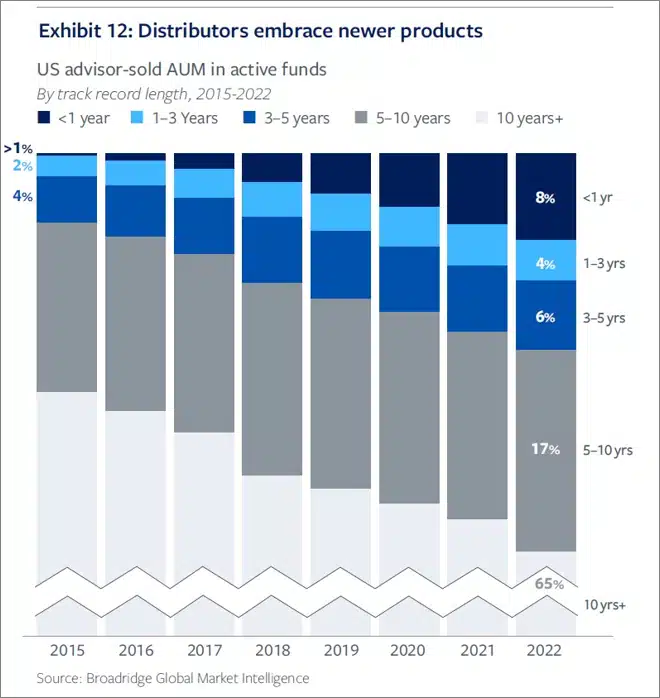

The paper gives a nod to the need for managers to build operational infrastructure robust enough to support multiple vehicles and delivery models, adding that “distributors view asset managers’ proprietary technology as a potential differentiator, which partly explains why investment firms have recently shopped for direct-indexing providers.” - Why newer products are gaining traction quicker. When I made the switch from mutual fund to ETF marketing years ago, the biggest, most exciting difference was that Day 1 of a fund’s life mattered. This was in contrast to mutual funds, where we’d hustle to launch a fund…and then wait three years for it to mean anything to anyone.

That’s changing, according to Broadridge: “There are signs that U.S. distributors, longtime stubborn advocates of seeking three-year track records for product placement, are easing these requirements for newer products that better match current investor demands.” The paper includes a chart showing that 97% of advisor sold active fund AUM in 2015 were in funds older than three years; most funds sold were 10 years or older. In 2022, 35% of active fund AUM was in funds younger than 10 years, including 12% three years or younger.

- Distributors within the same channel are not alike. Organizing distribution efforts by channel makes less sense as channels become more heterogenous, Broadridge says. The firm suggests that additional taxonomies (model usage, wealth tier, level of discretion) will dictate product and engagement strategies. Similarly, individual distributors are different from one another, leading to distinctly different needs and opportunities.

The whitepaper includes an analysis of the top 10 largest distributors of AUM in high net worth accounts showing wide swings firm to firm. For example, 34% of one firm’s AUM is in $2.5 million accounts or larger versus 5% at another firm. Those differences continue when considering where the assets are held. Firms with more in smaller accounts use twice as many (72% vs. 35%) active funds/ETFs.

Broadridge spells out steps it expects successful asset managers to take. The suggestion to reorganize and potentially dechannelize (“Some asset managers will assign each external wholesaler to financial advisors who share certain characteristics or clientele, rather than segmenting coverage solely on registration status”) is reminiscent of what SS&C and others have proposed. - More differentiators are surfacing. Marketers will be particularly interested in the paper’s comments on brand. When the competition between asset managers was based on investment performance, few firms invested in brand. Those that did focused on non-differentiating attributes (fiduciary responsibility, investment excellence, client centricity). But Broadridge says a greater number of fund buyers are citing more competitive differentiators related to product and distribution as key selection drivers.

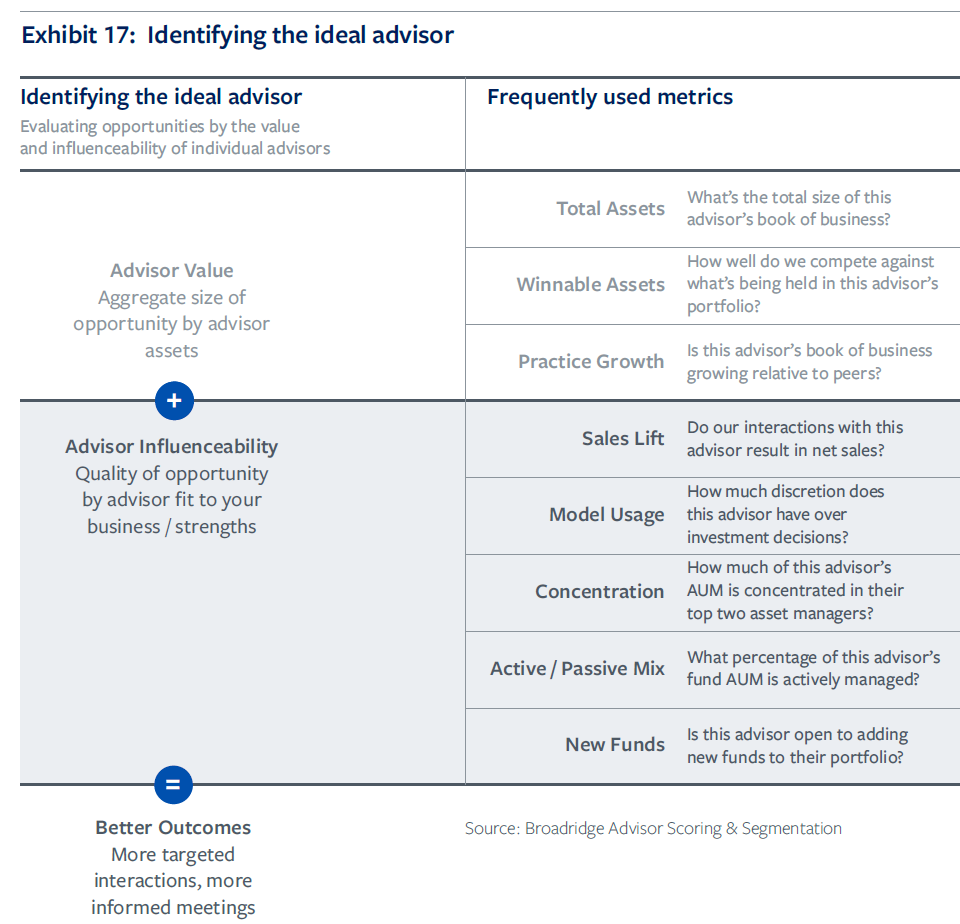

Competitive differentiation going forward should find marketing playing a greater role in distribution. I zeroed in on the comment that content and analytics should be placed at the center of brand support. “Advisors prefer asset managers that provide investment viewpoints, thought leadership, and online analysis tools, all of which aid more complicated portfolio construction. Intermediary platforms also like such content—if it doesn’t conflict with their own.” As most in the trenches know, that last bit—systematically syncing/tracking asset manager messaging to firm views—is easier said than supported. - Scoring the ideal advisor. If you and your firm are working on lead scoring and segmentation, you’re going to want to check out the paper’s illustration about how to identify the ideal advisor, as shown below. The matrix considers advisor value and frequently used metrics (total assets, winnable assets and practice growth) with advisor “influenceability” (sales lift, model usage, concentration, active/passive mix and new funds).

Below we show an excerpt of the table—download the whitepaper to see the third column headed Illustrative scoring, which illustrates how one advisor gets scored.

Effective advisor segmentation yields enhanced sales, says Broadridge: “Advisors who closely resemble an asset manager’s ideal target—based on the firm’s business model and competitive advantages—yield eight times the gross production of advisors who share far fewer prioritized attributes.”

- Cue digital marketing. The paper includes a segmentation case study involving a sharpened focus on delivering top tier and scalable service to higher quality opportunities, resulting in a 50% reduction in the number of targeted advisors. Non-targeted advisors—what Broadridge calls the long tail of smaller opportunities—then become the province of digital marketing. In the case study, the reconfiguration resulted in an 8x increase in production among the highest scored advisors.

Clearly, Broadridge expects Marketing to take on this heightened role in the distribution model of the future.

In short—if I can really say that after 1,500 words—the Broadridge paper outlines a period of significant change ahead for mutual fund and ETF providers. My read is that it’s all upside, including added responsibilities, resources and influence for digital marketers. Reach out to us for help preparing.

Subscribe.

Receive the latest news and insights from Lowe Group.