TikTok, not Google, is now the go-to for basic investment searches

Someday we’ll think of these as simpler times—as in: “Remember when all we worried about was ranking in Google search?”

It’s becoming apparent that if you’re an investment firm hoping to use content to meet people—younger information-seekers in particular—you may need a TikTok strategy (posting and then optimizing) to be in the mix for investment-related searches that take place on that platform. Less relevant to most but if crypto is in your product roadmap, you’ll also need to step up what you’re doing on YouTube.

A study released earlier this month illustrates that the battle for winning investment-related searches has extended to multiple fronts. The finding is included in broad research conducted by Rise at Seven, a UK-based creative agency. In its analysis of more than 5,000 keywords, it determined that Google no longer dominates consumer search for basic keywords across multiple sectors (i.e., travel, fashion, hair and beauty, automotive, home, gaming, technology.) No time frame was provided in the otherwise excellent report.

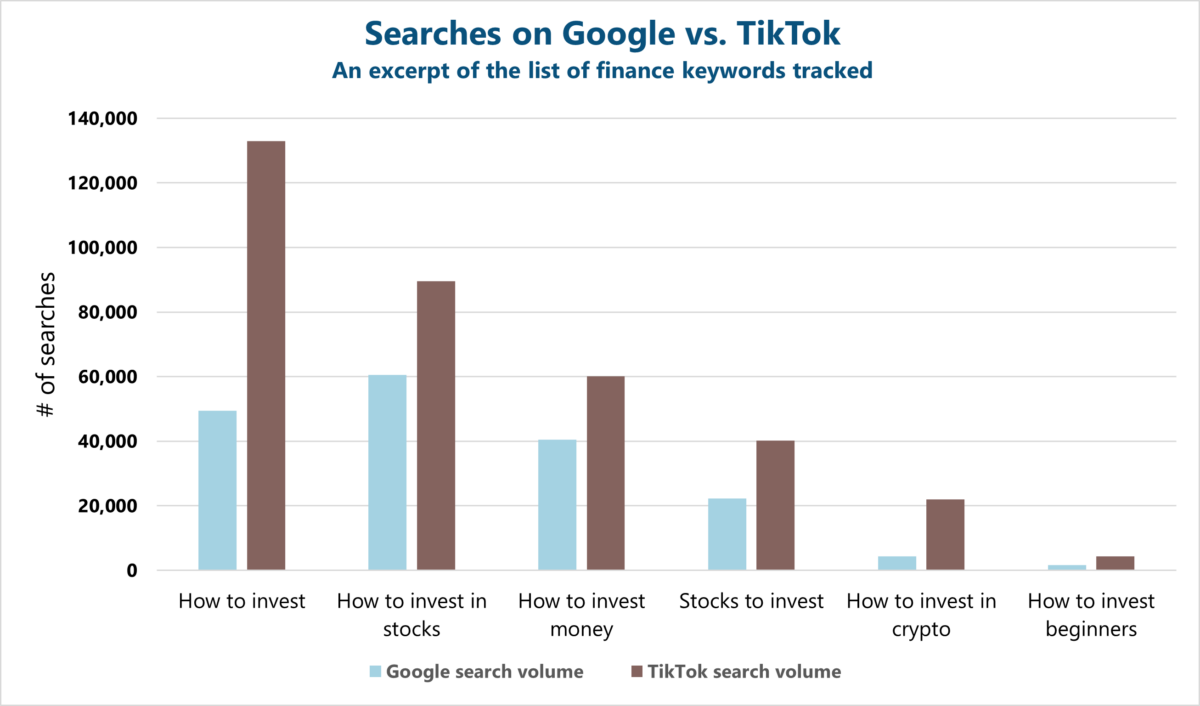

The table below shows six of the most relevant investment-related search terms from the Finance sector. Not shown are other tracked terms related to budgeting and saving.

These searches are high level and informational. Who loses when they migrate to TikTok? Of the above terms, the one with the highest volume search on Google is “how to invest in stocks.” Ranking for that term is very competitive—or “super hard” in Ahrefs terms. A quick check of Ahrefs for “how to invest in stocks” shows that three firms (Td Ameritrade, Wells Fargo, Fidelity), several media sites and FINRA also rank in the top 10. Presumably, those sites are seeing a decline from traffic from those searches. “How to invest” is also super hard, with Schwab being the only investment site to break into a top 10 dominated by media sites.

More significant than just these searches, though, is the incontrovertible evidence that people are thinking of TikTok first. Although smaller in number, other searchers are likely to use TikTok to look for information or ask other questions that your business might find more relevant, producing traffic that’s more valuable.

To see for yourself, check out the Keyword Tool TikTok keyword search. You won’t get far without a paid subscription but, if you’re responsible for digital strategy, it’s just a matter of time before you’ll need one.

These findings reminded me of a conversation with Lowe Group interns last summer, when they confirmed that not only do they turn to TikTok for information, it’s providing everything they need (see Gen Z and traditional investment providers: where, how will their paths even cross?) Is it realistic to expect those who’ve developed a reliance on TikTok’s short-form videos to somehow age out of TikTok and return to traditional search engines powered by long-form keyword-heavy content? That ship may have sailed, my friends.

Another Alphabet property, YouTube, fares better in the Rise at Seven research. “YouTube shorts may be new, but short-form content is becoming a faster way for users to get answers to their queries … Want to see what things look like in real life? Want in-depth detail about the brand-new Range Rover? YouTubers are giving that detail away in ways Google just can’t,” says CEO Carrie Rose in the report.

This helps explain why “crypto” searches totaled 211,000 on Google—and a whopping 2.7 million on YouTube.

Of course, you need a site that’s well optimized for those who think to look for you or what you have to say on Google. But increasingly the data is pointing to the fact that your firm needs to be out there and discoverable on the networks where a growing audience goes first and exclusively.

Would you like to talk more digital strategy? Lowe Group’s LG Digital offers a range of services related to digital marketing, send us a note for more information.

Subscribe.

Receive the latest news and insights from Lowe Group.