The investment industry stories we’ll remember from 2023

As the days count down to the end of 2023, we’re taking a quick random look back at some of the ongoing stories we’ll remember from the year. What would you add? We invite your comments below.

A new co-worker.

We all got a new co-worker this year as artificial intelligence capability in the form of ChatGPT and other tools swept through firms, with the potential to disrupt how most of us work. We’ll refrain from going down that rabbit hole here, except to say: Marketers, AI can change your day-to-day in transformative ways. Do as much as you can to engage now while we’re all just learning and experimenting.

‘Bonds are back, baby!’

That assessment came from one of our clients noting that for the first time in well over a decade fixed income yields look competitive with equities—on an absolute and not just risk-adjusted basis. Another clever client argues that while the 60/40 portfolio may be dead, it’s reciprocal, the 40/60 is very much alive.

All this has resulted in inquiries from reporters who make up for their, ahem, novice level technical knowledge—”so the yield moves in the opposite direction as the price?”—with enthusiasm for this hot new asset class everybody’s talking about.

Putnam’s run.

Even in an industry where mergers and acquisitions are de rigueur, the news of Franklin Templeton acquiring 85-year-old Putnam Investments for $925 million packed a certain wallop (a deal still to close this year, according to Ignites in November). Putnam was a communications leader, first with its literature, then its website and in the last several years its social media research and work. Well done, Putnam marketers. We look forward to seeing the marketing wonders the Franklin Templeton/Putnam business combination yields.

Even in an industry where mergers and acquisitions are de rigueur, the news of Franklin Templeton acquiring 85-year-old Putnam Investments for $925 million packed a certain wallop (a deal still to close this year, according to Ignites in November). Putnam was a communications leader, first with its literature, then its website and in the last several years its social media research and work. Well done, Putnam marketers. We look forward to seeing the marketing wonders the Franklin Templeton/Putnam business combination yields.

Taylor $wift, that is all.

We can’t miss an opportunity to include a photo of the queen! Steve Jurvetson / CC

If we weren’t before (and, truth be told, we were), we became confirmed Swifties in April when it was reported that Taylor knew enough to pose the question“Can you tell me that these are not unregistered securities?” while negotiating a deal with promoters of crypto exchange FTX. A month later we learned from a tweet that Taylor is a fan of discounted closed-end funds. She’s so cool.

Yes, we subsequently heard that it was Sam Bankman-Fried and not Taylor who walked away from a proposed sponsorship deal. That report was based on anonymous sources. For our money and until we get confirmation, the benefit of any doubt between two who dominated this year’s headlines goes to the megawatt pop star over the convicted fraudster.

The long march back to work.

In the first year of the pandemic, the empowerment of millions of investment professionals working from home was big news. Subsequent coverage of individual firms’ and CEOs’ positions on recalling the workers back to the office and the value of closer collaboration was relatively interesting. But now, almost four years later? There have to be more interesting topics.

Threads, the social media platform that could.

Remember the summer hoopla accompanying Meta’s launch of Threads, using Instagram credentials? Positioned as an X (formerly known as Twitter) alternative, Threads shot into the country’s consciousness, but enthusiasm quickly faded. Work on the platform continues, however, with the recent testing of hashtags and trending topics.

Remember the summer hoopla accompanying Meta’s launch of Threads, using Instagram credentials? Positioned as an X (formerly known as Twitter) alternative, Threads shot into the country’s consciousness, but enthusiasm quickly faded. Work on the platform continues, however, with the recent testing of hashtags and trending topics.

Fintwit’s perseverance on X proves that the investment industry needs a breaking news social network. But we’re increasingly worried about the consequences of investment firms patronizing the site, severely deprecated and compromised under Elon Musk’s leadership. If Threads can bolster its capabilities in year 2, there’s every motivation to give it another try—and for more asset managers to consider setting up shop.

First enforcement of the SEC Marketing Rule.

It was inevitable: Two years after the SEC Marketing Rule went into effect in May 2021, the first enforcement action came this year. A firm was fined for “using hypothetical performance metrics in advertisements that were misleading” and for “multiple compliance failures.” Uh-oh. See our post for the seven “general prohibitions” under the new rules.

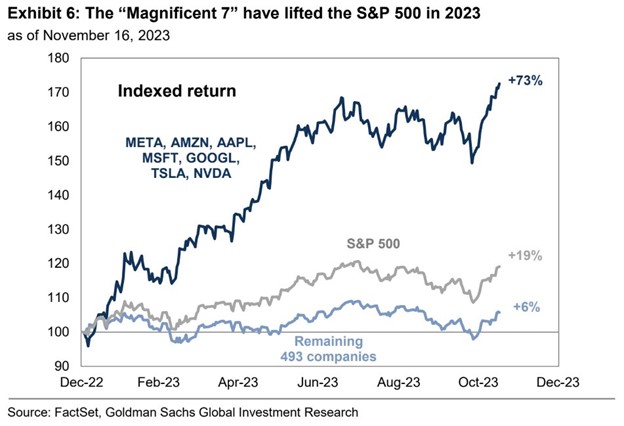

Magnificence in the markets.

2023 is the year that market dominance represented by FAANG stocks—an acronym coined by CNBC’s Jim Cramer 10 years ago and embedded in investment communications for a decade—gave way to the Magnificent 7. The Mag 7 was first used by Bank of America analyst Michael Hartnett in a May research note to cluster the seven U.S. technology stocks Meta, Apple, Amazon, Alphabet, Microsoft, Tesla and Nvidia.

The Magnificent 7 represent a mega amount of the S&P 500 total market cap (29% as of November 18) as well as an oversized contribution of the S&P 500 return year to date. The effect has dissipated some in the last few weeks, but this expression could be around for a while.

A transitioning product line.

It’s just a fluke of the year (historically high rates paid on short duration money market mutual funds drove a whopping $1.1 trillion) that mutual funds will lead flows in 2023. ETFs, and especially active ETFs, dominated the energy and interest in the retail channel. But for the fastest growing product category per Cerulli Associates, we need to give a shout-out to “direct indexing” (the catch-all for equities and fixed income) via custom SMAs. Direct indexing came out of the gate strong and kept building momentum throughout the year.

FOMO nomo.

![]() Everybody who is anybody knew enough to head to the beach for the Future Proof conference in September. In its second year, Future Proof—produced by Advisor Circle, whose backers include Josh Brown and Barry Ritholtz of Ritholtz Wealth Management—established its position as an industry disruptor. Other event organizers are scrambling trying to match the “festival’s” innovation and energy. Attendees appreciated the “open architecture, scale, lack of channel conflict and the overhang of a custodian, publication, trade group or a company using the event to push its interests,” reported RIABiz’s Brooke Southall, and we saw first-hand, too.

Everybody who is anybody knew enough to head to the beach for the Future Proof conference in September. In its second year, Future Proof—produced by Advisor Circle, whose backers include Josh Brown and Barry Ritholtz of Ritholtz Wealth Management—established its position as an industry disruptor. Other event organizers are scrambling trying to match the “festival’s” innovation and energy. Attendees appreciated the “open architecture, scale, lack of channel conflict and the overhang of a custodian, publication, trade group or a company using the event to push its interests,” reported RIABiz’s Brooke Southall, and we saw first-hand, too.

The long wait for a spot Bitcoin ETF.

Investors’ decade-long wait for a spot bitcoin ETF may be approaching a positive conclusion even if the last few months have been excruciatingly suspenseful.

The SEC hasn’t said it will approve an ETF, but it’s held a lot of meetings. Grayscale, which wants to convert its Bitcoin trust to an ETF, met with the SEC last week … and so have BlackRock and Hashdex in recent days. In all, there are 13 firms contending for an ETF, half of them firms you’d recognize. Most financial advisors still treat Bitcoin gingerly, but that’s likely to change if a spot ETF launches and endures.

Among those waiting for the news is the genius (or genius team) running the VanEck X account. They’ve entertained us (and all of fintwit and more) with their cheeky tweets—or xeets—as they’ve continuously banged the drum in anticipation. Can’t wait to see how they celebrate when the ETF is approved—which is precisely why they need to take a vacation and rest up while they can, Jan Van Eck (also in on this running joke).

Should vaneck intern be permitted to take vacation before a tbd uncertain launch of a spot Bitcoin ETF? @JanvanEck3

— VanEck (@vaneck_us) November 10, 2023

Hoping to see more of these spirits across the board in 2024! Also see Our take on what’s ahead for investment industry digital marketers in 2024.

Subscribe.

Receive the latest news and insights from Lowe Group.