ETF marketing gone wild: The spot bitcoin launch

Are you ready for this? Today ETF marketing takes its place in the spotlight to an extent not seen before in recent history, if ever.

If you’re on the marketing teams of the 11 firms approved to launch a spot bitcoin ETF, you well know the test ahead. (Then again, there’s zero chance that you have the time to read this.)

The rest of us are about to witness a titanic battle that started well before the SEC approved multiple applications, a long-awaited step enabling the simultaneous launch of multiple products. Interest in this development—which is expected to broaden investment interest in bitcoin because it provides direct exposure in a regulated wrapper—has been intense and is now at fever pitch.

Ten years in the making (and back on track only after a legal challenge forced the SEC to reconsider its original denial citing concerns about market manipulation and investor protections), every highly scrutinized step toward launch was reported in near real-time. The fees, the authorized participants (who need to act as underwriters, too), the seed money (as much as $200 million from one firm), and the pre-launch positioning all have added to the suspense of who will jump out as early leaders of this new asset class.

For an idea of what could be raised, check out this projection by Galaxy Research: Bitcoin ETF inflows are estimated to total $14.4 billion in year 1, ramping up to $38.6 billion by year 3 as more institutions and distribution channels warm to the investment.

Lots of commentators are weighing in on the significance of it all: the ability to invest, bitcoin’s appeal to the mainstream, its likely impact on the overall market, and the prospects for individual firms. We’ll confine our comments to the marketing—but it is the marketing that may spell ultimate success in this truly exciting horse race that’s been dubbed by Bloomberg Intelligence analyst Eric Balchunas as the Cointucky Derby. Balchunas’ coverage on X of every incremental development has been nonstop, informative and even fun.

With every bitcoin ETF holding the very same asset (bitcoin), on what basis will issuers compete? As the contenders are being loaded into the gate, here’s what we’re watching:

Old guard versus crypto guard. The preliminaries leading up to the launch suggest that non-traditional issuers in the space intend to differentiate based on their digital assets origins.

Differences between the crypto natives and the asset management industry titans sometimes characterized as tradfi (traditional finance) opportunists have been on display on X (the social network formerly known as Twitter) for months. The fact that BlackRock CEO Larry Fink in 2017 called bitcoin “an index of money laundering” has not been forgotten by the crypto natives, for example.

The nature of the engagement around this product is far different from most social network commentary about mutual funds and even the most highly traded ETFs. For starters, “ads” were created and posted on X well before the product approval. Those not yet advertising were asked when they planned to start, again something not heard of in the ordinarily staid asset manager X feeds.

See this ad from “crypto specialists” Bitwise, which debuted in late December to rave reviews on X. Made for “insiders,” the ad features but doesn’t identify Jonathan Goldsmith, who appeared as “the most interesting man in the world” in a Dos Equis beer ad that later became a meme. If you don’t know, you don’t know. The “Bitcoin is interesting” campaign is reportedly set to appear on CNBC, Bloomberg and Fox Business Network.

A word to the wise, from a man of few words. #bitcoinisinteresting https://t.co/wantGiAIqJ pic.twitter.com/x5MPbElEev

— Bitwise (@BitwiseInvest) December 18, 2023

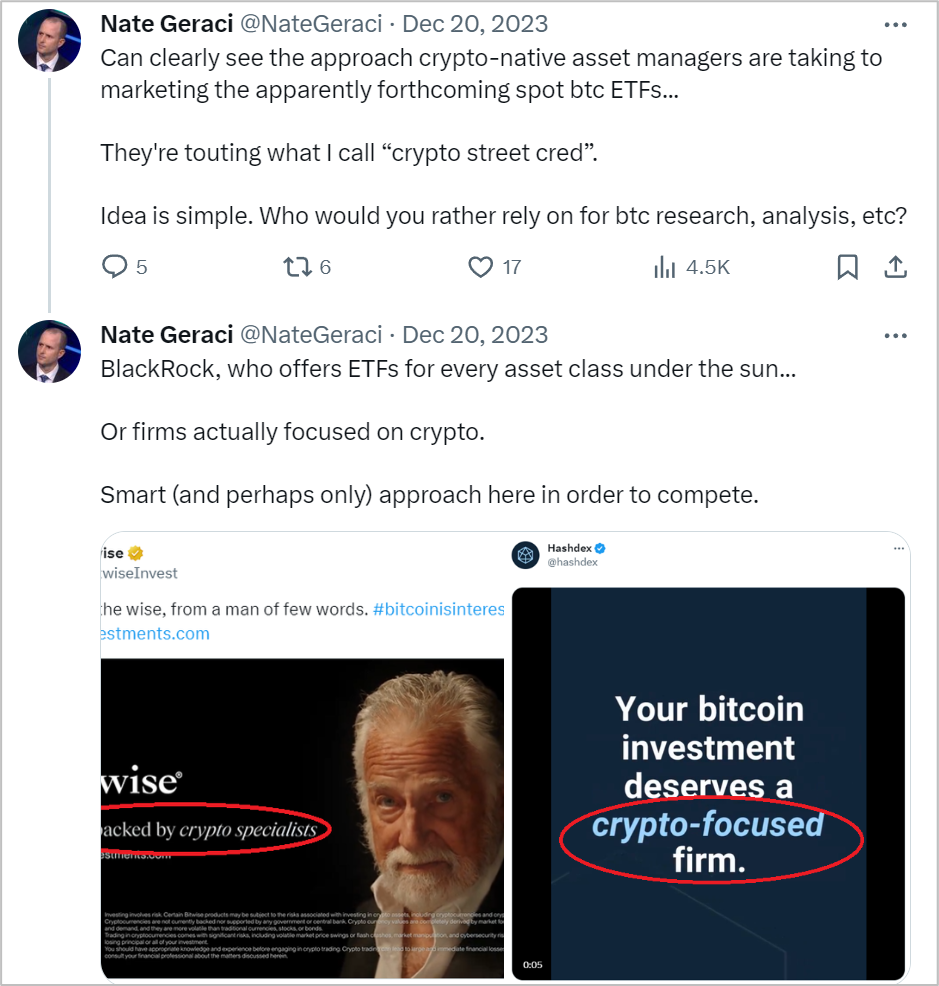

Here’s Nate Geraci’s take on the positioning. Host of the ETF Prime podcast, Geraci is a must-follow for ETF news on X and himself an RIA.

Among the more traditional asset managers, to date we’ve seen only Van Eck match the vibe and tone of the crypto trading subculture—not to mention the uncommon move of communicating ahead of an actual product being available. We’ve been cheering them on (see post) while at the same time marveling at what is a bit of a dual personality on X versus the more conventional Van Eck website and other communications. Maybe they’ve figured out how to do what others only talk about, and that’s tailoring the communication for the channel.

In addition to having its own bona fides in the digital assets world (see their post on the subject), Van Eck knows how to communicate with advisors, as illustrated in this more traditional (and yet unusual among bitcoin ETF-related posts) tweet. Shown below is an excerpt. Important to note that with as much that’s different about the bitcoin campaigns, one constant will be the extensive product disclosure needed to accompany product-specific messaging. Notwithstanding the attention being paid and the money to be spent, the new product is a ’33 Act ETF subject to tighter advertising rules than ’40 Act funds.

Individual bitcoin investors may well favor the crypto brands—but will that be sufficient to offset the ability of tradfi (led by BlackRock) to leverage their distribution capabilities to scale quickly? Will the edgy communications observed on X need to be watered down for the national accounts?

A pricing war. ETFs have gained much of their traction overall thanks to their lower expense ratios. But it’s only recently that we’ve started to see price being the benefit that some firms lead with in their product marketing.

Price looms large in the drive to raise bitcoin assets, as firms were updating their fees up until the final days. The cheapest no-waiver ETF (20 bps) is available from Bitwise. Most firms have fee waivers in place that expire after six months or at an AUM threshold. Investors’ comments on X about fee waivers have been very interesting, by the way. It’s never a good idea to underestimate an investor, and definitely not the crypto investors.

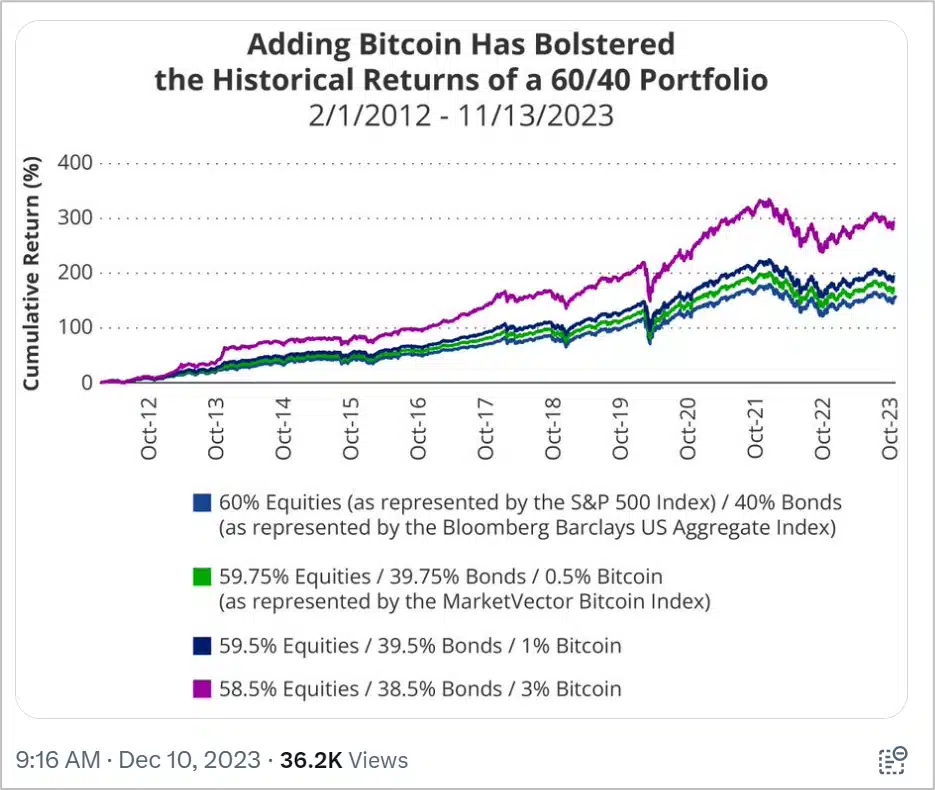

A full-on assault. Social? Well underway on X, along with other organic and paid campaigns. Webcasts? A few happened yesterday, with more scheduled this week and beyond. Emails? Firms had them staged and by 10 a.m. CT on Day 1, a few have already been sent. Advertising, including on sites not ordinarily in the purview of the fund marketer? Check. Public relations? Check and check, PR is paramount in any ETF campaign but will be crucial in this launch. And of course, what we’ll be especially interested in seeing: the wealth of content in all formats being prepped for landing pages. In order for tradfi to drive sales, advisors need to be educated on bitcoin benefits and that’s a steep uphill climb.

The effect on the broad market? The launch of spot bitcoin ETFs and the resulting demand or lack of demand could very possibly affect the market, providing some additional suspense to an already charged 2024.

X marks the spot. Unless all the wheels fall off in the next several days, X will demonstrate its relevance to this part of the investing world as X and only X is the social network where the early days of the bitcoin ETF battle will be waged. LinkedIn on a delay and in small doses, but X is where the energy and conversation has been centered and will likely continue (see related post).

If there’s any doubt that 1. This launch is big and different and 2. Tradfi is intent on keeping up, check out the tweet Franklin Templeton sent last night, the eve of the launch. It’s not every day that a $1.4 trillion asset manager adds laser eyes to its social profile photo. And don’t overlook the reaction to this: 18,000 likes, 1,000 comments, 430 bookmarks, and 4.1 million views overall by this morning.

If there’s any doubt that 1. This launch is big and different and 2. Tradfi is intent on keeping up, check out the tweet Franklin Templeton sent last night, the eve of the launch. It’s not every day that a $1.4 trillion asset manager adds laser eyes to its social profile photo. And don’t overlook the reaction to this: 18,000 likes, 1,000 comments, 430 bookmarks, and 4.1 million views overall by this morning.

Focus on what’s happening on X may pull people you care about (financial advisors, gatekeepers, the media) back to the platform or on to the platform for the first time, if only temporarily. If you’ve let your X account go stale, it might be time to reactivate to see if you can draft on any interest.

Fund obsolescence. Investors and advisors can be fickle, and most products lose their appeal over time, but some contend that the spot bitcoin ETF has the potential to make an earlier product—the bitcoin futures ETF launched with much fanfare three years ago as the only way to gain exposure to bitcoin—almost instantly obsolescent.

We’ll be watching how marketers support their funds as the market rushes to the new product. Last week ProShares gave this spirited argument in support of Bitcoin Strategy ETF (BITO). Defending an incumbent against an upstart is a conversation Sales teams regularly have in private; it’s unusual and telling that this positioning is taking place in the media.

ProShares Global Investment Strategist, Simeon Hyman, gives his thoughts on the Bitcoin ETF and its impact on futures.

He speaks with Katie Greifeld on "Bloomberg ETF IQ" https://t.co/xVLWkSXtJJ pic.twitter.com/OBnjaEQgXO — Bloomberg TV (@BloombergTV) January 3, 2024

Early pronouncements. Given the hyperfocus and the sports-like coverage of this space, the bitcoin issuers are under pressure to get off to a strong early lead in order to look “winner-ish,” and avoid “stank,” says Balchunas. “Volume and flows are a much more powerful marketing tool than any ad, especially in early days,” he said in a note he tagged on to this video.

Can anything else break through? With the volume turned all the way up on bitcoin ETFs, can any other fund company product message break through in the first quarter of 2024? Of course. Just know that the bitcoin ETF marketers will be bringing a lot of color and energy. There’s no gentle way to put this: If you’re hoping to make an impression with your quiet, navy blue, serif-heavy, safe imagery, go back to the drawing board. Otherwise, I worry you will be ignored and your campaigns will fail.

Since its early days ETF marketing has brought excitement to fund marketing and even pushed some limits, and bitcoin marketers will be competing at the top of their game. From our perspective, this will be a very, very positive byproduct of this competition. The run-up to the bitcoin ETF has inspired creativity, engagement and even entertainment from all participants to date. Hoping for more of the same from the tradfi firms who needed to wait for a live product to go public.

Considering the legal bills to push for approval, management time, resources and marketing expenses, the spot bitcoin ETF could represent the costliest product launch in the industry’s history, Geraci acknowledged in a tweet. And, he noted, the stakes are crazy high: when all is said and done, “there will likely only be one or two winners & a handful who survive.”

Best of luck to all competitors. Fund marketing may never be the same again—and, especially if this creative work demonstrates its value in driving results, that may be a good thing.

Since we published it Tuesday morning, this post has been revised multiple times. All good and as expected. But there was some late drama Tuesday/Wednesday relating to this launch that we also want to mention: the compromise of the SEC X account, which led to the sending of an unauthorized tweet announcing product approval and all kinds of mayhem.

X’s investigation revealed that two-factor authentication was not in place. This boggles the mind, what with the agency’s charge to protect investors, etc. But was it in place at one point? My bet is that it was.

Last year Twitter announced it no longer supported two-factor authentication using text messages for non-subscribers. If you’re not paying for your account, you would have had to do something extra (e.g., use an authentication app or security key) in order to re-secure it. Maybe that didn’t take place.

More to the point—and the reason I’m mentioning it here and on LinkedIn yesterday—is that you may take this as a teachable moment to check on your own accounts’ 2FA settings. You may be surprised to see that the account is not protected, and that needs to be addressed right away.

This debacle is going to be investigated and likely further undermines confidence in X, the SEC and probably crypto. But based on reports of early trading today in the bitcoin ETFs, it sounds as if there’s been no chilling effect on the new product. Onward and upward.

Subscribe.

Receive the latest news and insights from Lowe Group.