Vanguard ban on bitcoin ETFs [A communications case study]

UPDATE: On January 24, Vanguard posted a Q&A featuring its ETF and brokerage platform leaders Janel Jackson and Andrew Kadjewski defending the firm’s position and explaining why they barred trading in spot bitcoin ETFs. Until yesterday, the firm had only commented reactively in response to press inquiries.

Jackson said, “We understand that our decision on crypto is not popular among some investors, but many know that we’re being consistent with our policy and practice.” Kadjeski said, “The easy step for us would have been just to allow full access to crypto-related products. But as a firm and a brokerage platform, we’re purposely structured to meet the needs of our investor-owners, most of whom are long-term, buy-and-hold investors.”

Good on-brand comments in our opinion. While it might have been helpful for them to post a communication like this before announcing the policy, it is good to see them proactively explaining their position and educating their community.

The recent backlash on Vanguard’s ban on spot bitcoin ETFs—observable on social media—provides a fascinating case study in communications strategy. We’ll leave the merits of the policy for others to debate. Instead, our focus is on the strategy that resulted in the kerfuffle we’re all watching play out, mostly on X.

Transparency tug of war

Companies usually seek to minimize pushback when making a difficult announcement, and communications pros often face tradeoffs when seeking to be transparent while also looking to minimize negative news. Deciding when to be proactive versus reactive is a critical part of reputation management.

In this case, Vanguard chose to be reactive. Perhaps they did not want to appear to be commenting on products in registration with the SEC or trying to influence SEC policy. If Vanguard had proactively announced their policy in advance and then the SEC chose not to approve the ETFs, they might have taken heat over a non-event or they might have been blamed for influencing the SEC’s refusal.

But might Vanguard have had an opportunity to be more proactive in owning and announcing its position on this topic? While the firm must have decided on their policy long before January 11 (or at least we hope they did), Vanguard waited for the policy to be discovered and even then seemed unprepared when publicly acknowledging the policy.

On January 12, Vanguard added fuel to the fire by announcing that it would restrict trading in bitcoin futures ETFs on its platform too. Couldn’t they have announced this additional news as part of their January 11 prohibitions on the spot bitcoin ETFs? Whether it was the case or not, the apparent lack of coordination suggested that management was simply reacting as the issues arose and hadn’t planned their announcements in advance.

Releasing a policy on a divisive subject is hard. Companies can face no-win situations where there is nothing they can do to avoid negative coverage. But companies generally want to minimize a negative news cycle by controlling when and how they respond.

In Vanguard’s situation, might the firm have benefited by being proactive with clients to let them know in advance? Much of the pushback came from investors on their platform who expected to be able to trade on Day 1. In these situations, it’s hard not to argue that Vanguard’s lack of transparency disadvantaged some of their clients.

ThinkAdvisor shared an X post from the @Bitcoin Bob account: “I was so mad this morning. I had both mine and my wife’s Roth ready to go this morning. All in settlement funds only to not be able to invest. Promptly transferred to Fidelity. Will take 10 days to finish the transfer. Uggg.”

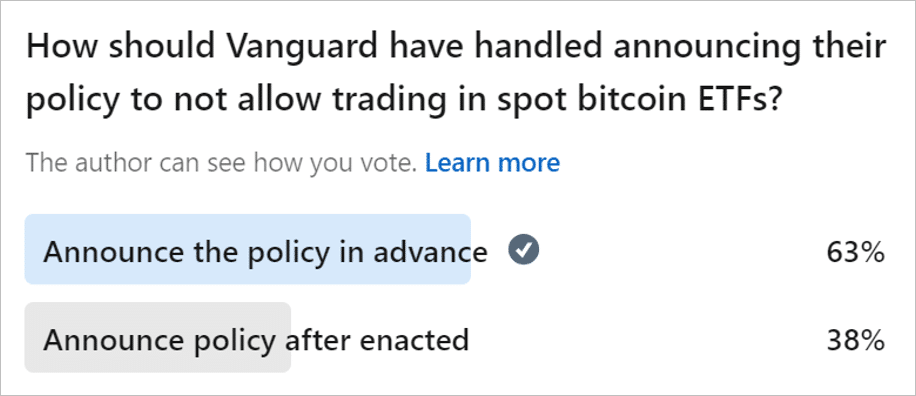

Our poll

What do you think?

We posed the question to communications professionals on LinkedIn. The small sample and our back channel conversations suggested that investment industry communications pros were reticent to weigh in. Of those who participated, 63% thought Vanguard should have been proactive while 38% agreed with their reactive approach.

I think Vanguard might have avoided the firestorm by posting a notice just to clients a few weeks earlier, accompanied by more information about the risks of investing in new and speculative products. A carefully crafted message would have both warned of the investing risks while providing notice to any diehard crypto believers. Had it leaked to media, they could easily have explained their policy and shared that clients had been notified in advance. They could even have used it as a brand-building opportunity to share educational content on the role that Vanguard wants to play, while suggesting that clients could go elsewhere for their speculative investing. Vanguard clearly doesn’t want bitcoin investing to happen on their platform, which should be their prerogative.

The Vanguard example is a high-profile illustration of decisions made by business and communications executives daily. Comms officers are increasingly contributing their counsel at the highest levels about the scope and timing of critical external communications (see our recent post on related Edelman research). Many such decisions benefit from outside thinking, and we at the Lowe Group regularly take part in helping shape and steer communications decisions that balance the best interests of all parties.

We’d love your opinion on this episode, which is likely to continue for a while. Send us a note.

Subscribe.

Receive the latest news and insights from Lowe Group.