SMAs and model portfolios stake their claim on asset manager websites

A recent sweep of asset manager websites confirms the trend: Mutual funds and ETFs increasingly are sharing website real estate with separately managed accounts (SMAs) and model portfolios.

As market preferences shift, it makes sense that asset managers are becoming more public and explicit about what they do. Both SMAs and model portfolios are proving to be an effective means of building business (especially with RIAs) and the assets can be stickier.

In January, Escalent reported that an advisor preference for SMAs (with allocations forecast to grow to 26% in 2026 from 18% today) was happening at the expense of model portfolios.

Updated model portfolio insights came from Broadridge on Monday with a report on the dominance of ETFs in the portfolios. ETFs make up 51% of the $5.2 trillion US model portfolio market, according to Broadridge. By comparison, ETFs represent just 31% of the $26.5 trillion held in collective vehicles, according to the Financial Times reporting.

SMA, ETFs, model portfolios, whatever. The bottom line: Despite their hold on some $20 trillion in U.S. assets (and see our tribute post to the 100-year-old wrapper), mutual funds’ share of the spotlight is waning and other more marketable assets are grabbing attention.

"This adds further complexity to the display and to the requirements of the underlying data publishing, content management and marketing automation systems."

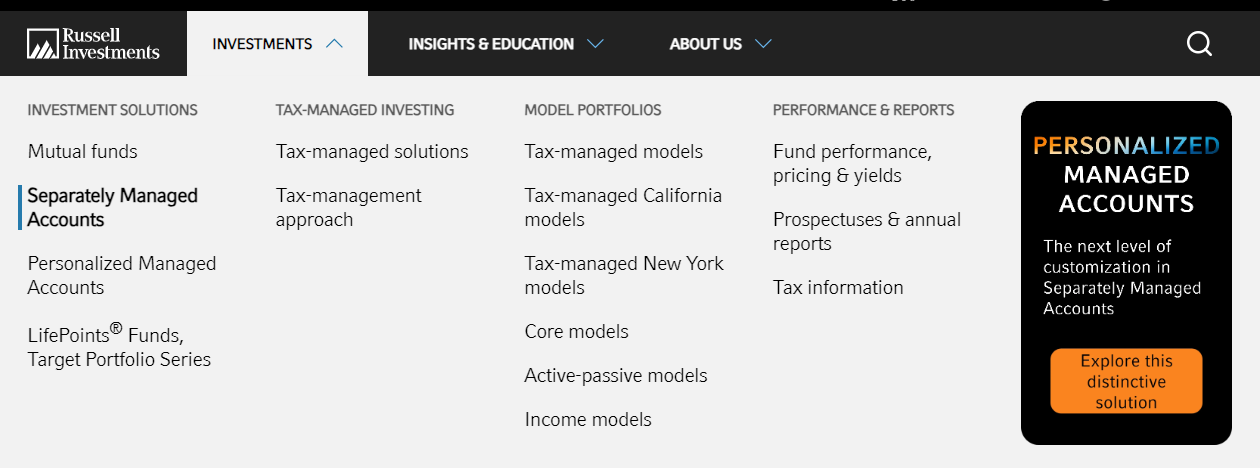

Nowhere is that more obvious than on the megamenus of the investment company sites where “Mutual funds” is but a single entry surrounded by a bevy of other investment approaches. This post focuses on SMAs and model portfolios but closed-end funds, annuities, CITs, 529 plans, interval funds are among the other product types getting top billing.

For digital marketing teams, this broadening of the expression of the business’ capabilities adds further complexity to the display and to the requirements of the underlying data publishing, content management and marketing automation systems.

If your firm isn’t among the leaders cited below, expanded SMA and model portfolio content and data is likely heading your way. The traditional providers seem to have the jump—Broadridge data notwithstanding, expansive model portfolio information is not yet common on ETF-only sites.

There’s more work involved, and some requirements are new. But these expanded offerings have the potential to heighten reliance on your site—some of what’s being published is available on other platforms but yours will be the most comprehensive source—and Compliance may require advisors to register to see some of it. All of this should help advance your digital engagement strategy. It’s more work but it’s good work.

Let’s take a look at the state of play. The examples below show what’s available to a generic financial advisor user profile. There’s variance, to be sure: While some sites provide open access to an extensive amount of portfolio and performance data, others require a log-in.

Separately managed accounts

Although it’s been common for managed accounts to merit inclusion somewhere on the top nav, SMAs’ web presence has expanded well beyond a static intro and a series of links to fact sheet PDFs. They now command multiple pages of content including investor and financial advisor guides and case studies. See the lavish amount of attention paid to SMAs by Invesco. At Blackrock, separately managed accounts is its own blog category (ostensibly representing an intention to keep posting about them. That was never a given when it came to managed accounts!).

Other managers, including Allspring Global Investments, Russell Investments and Natixis, expand on their managed accounts capability in the context of their custom SMA/direct indexing offers—which also rate a place on the top nav for financial professionals if not for individual investors.

Model portfolios

The appearance of model portfolios in product dropdowns is relatively recent. What’s more, make a selection and you’ll see a wealth of information and data being shared.

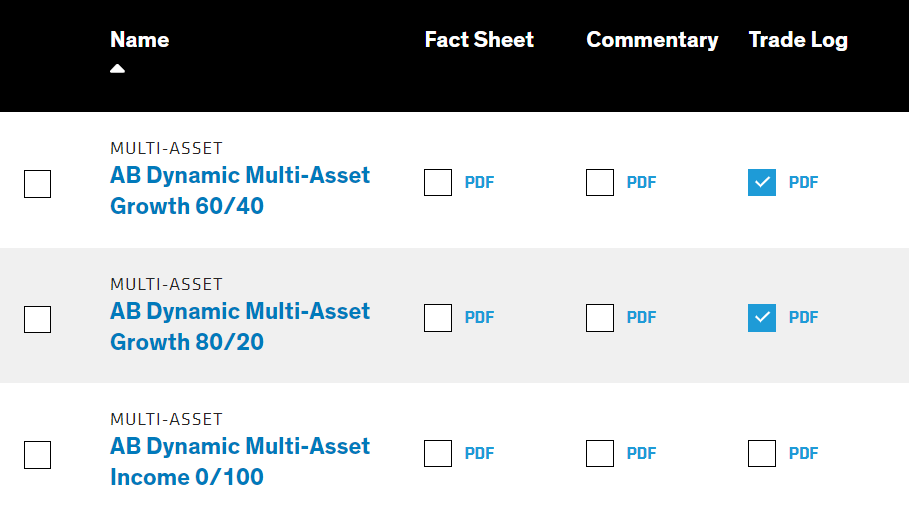

In addition to fact sheets and commentaries, Alliance Bernstein also offers Trade Logs, which appears to be yet another periodic publication.

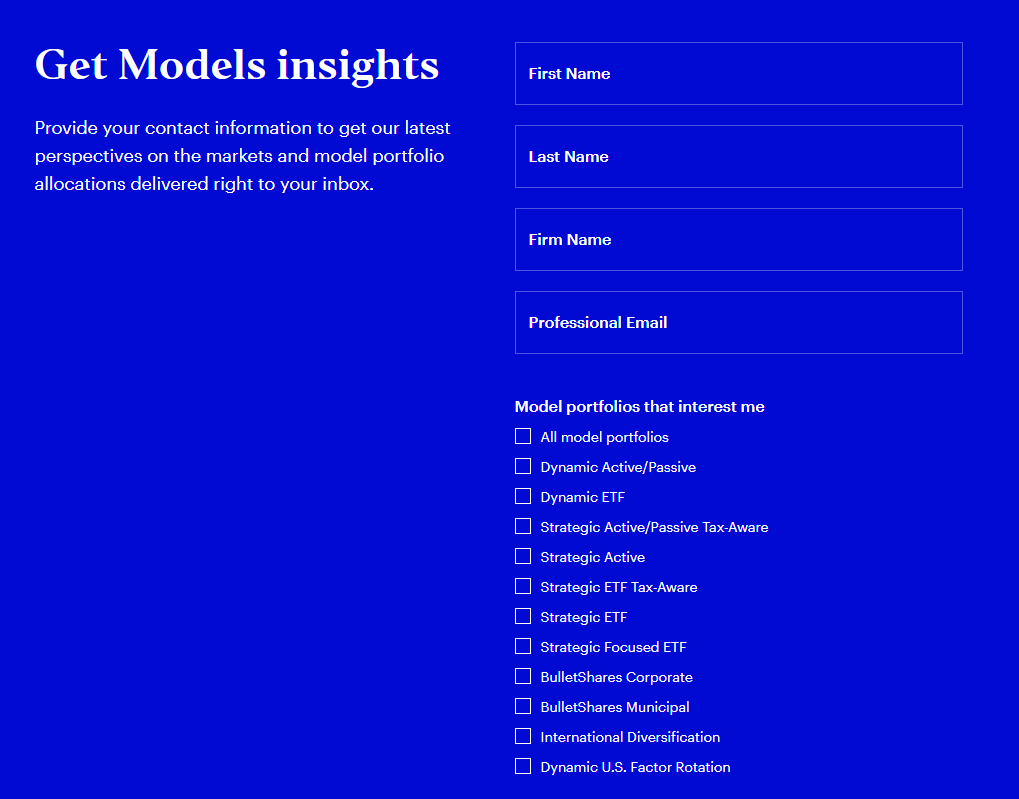

J.P. Morgan and Invesco are among those that offer subscriptions to trade updates and insights.

Nuveen’s site offers popovers notifying about allocation updates.

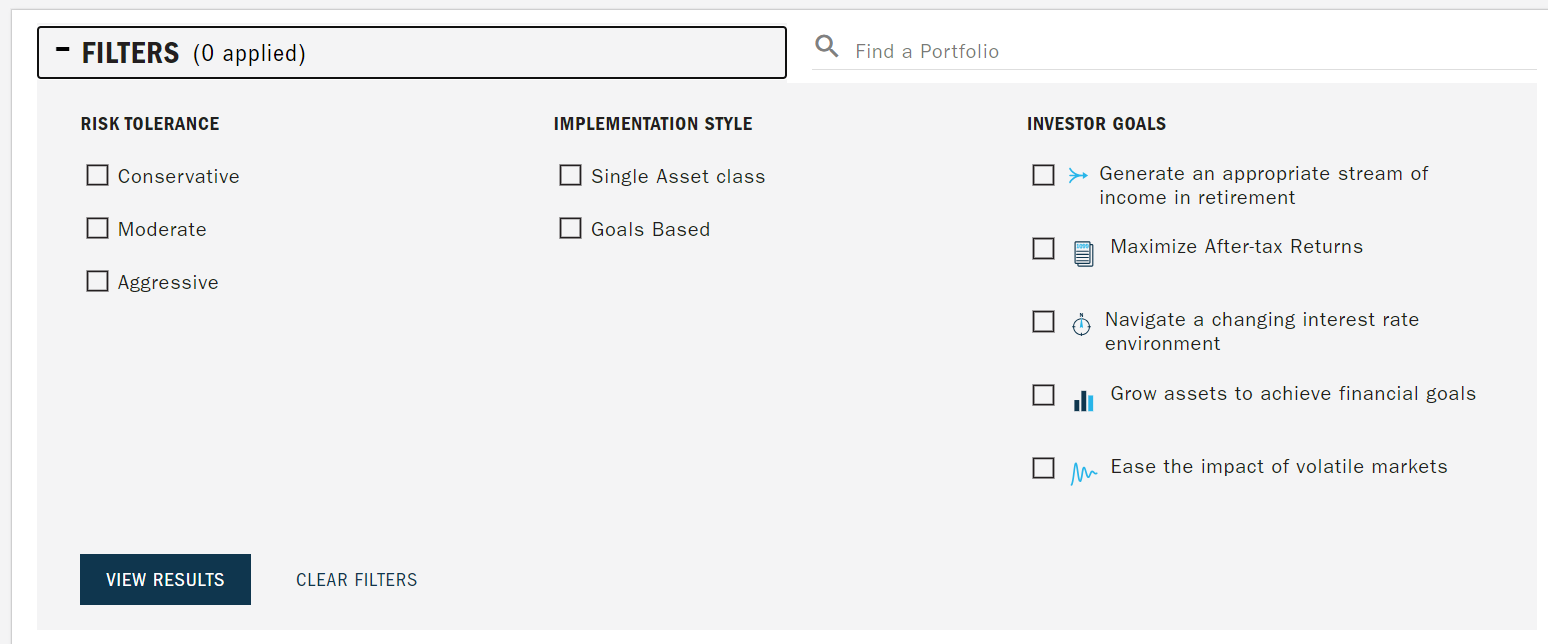

As suggested by this screenshot of available filters on the Columbia Threadneedle site, a search for model portfolios needs to support properties different from what’s available for mutual funds or ETFs.

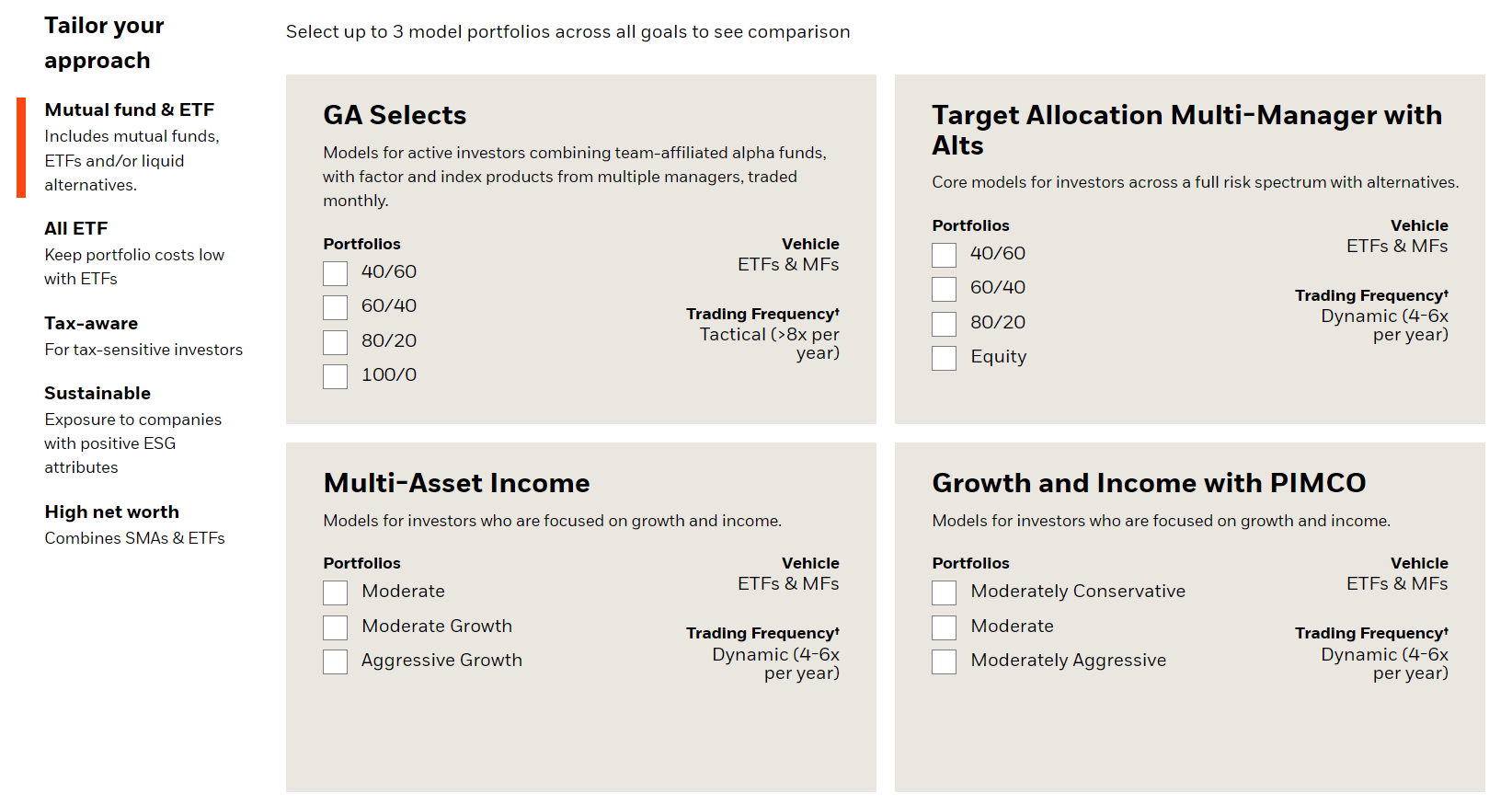

And then there’s BlackRock’s wizard designed to simplify the advisor’s selection process.

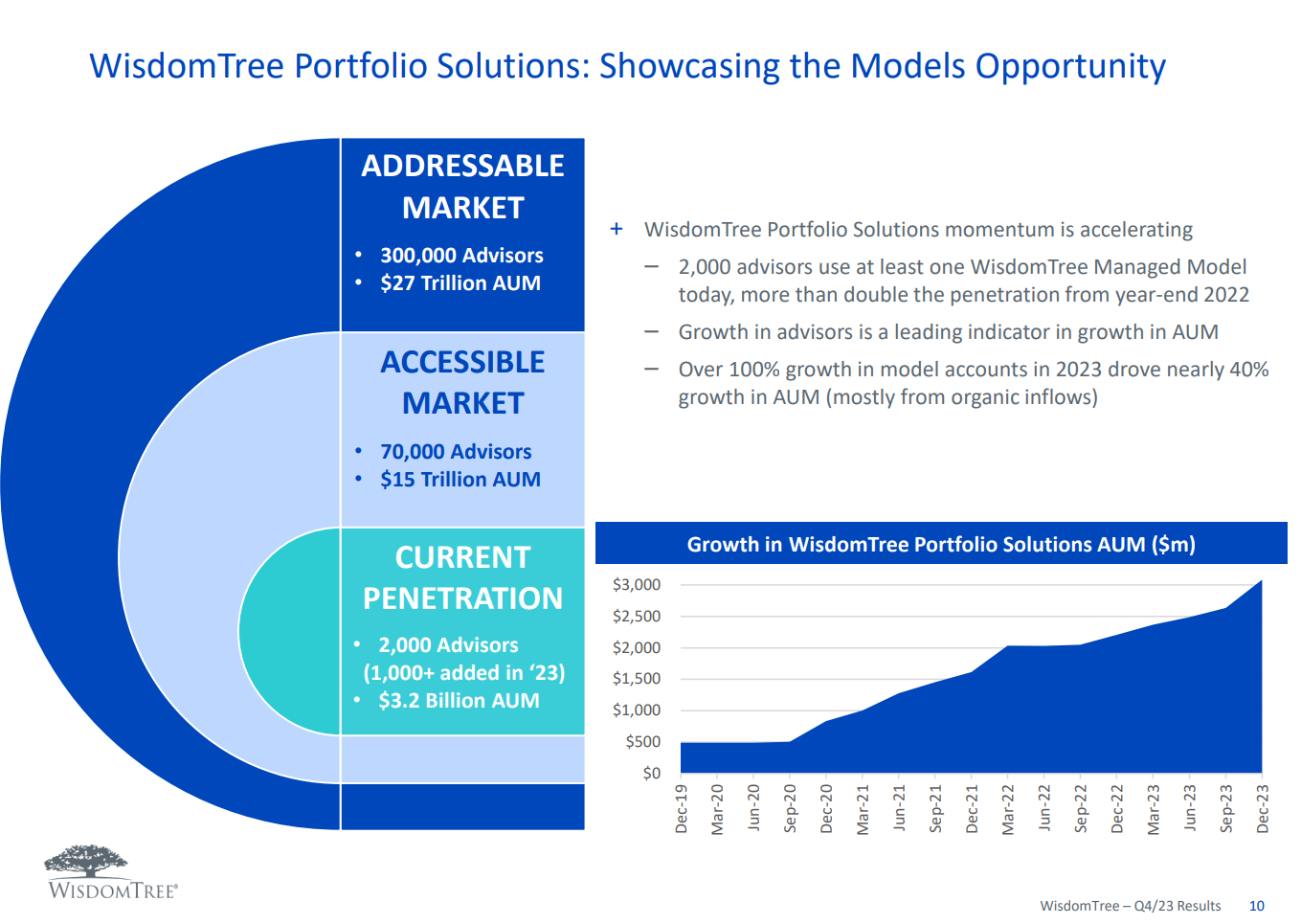

This graphic from WisdomTree’s last earnings call explains the appeal of models to the ETF provider—and why it goes to town with its Model Adoption Center including extensive resources for advisors, most behind a log-in.

Digital marketers (and all other marketers who have been recruited to build this content out), we see you and we’re here to help. For questions about LG Digital services, send us a note.

Subscribe.

Receive the latest news and insights from Lowe Group.