Asset manager, wealth manager social media outperforms other finserv: Hearsay study

Ordinarily, I have limited use for research that combines asset management and wealth management with banking and the many flavors of insurance (property & casualty, life & annuities). We just don’t have enough in common, and insurance and banking data tend to overwhelm everything—with the potential to misdirect.

Fortunately, Hearsay’s Social Selling Content Study published a few weeks ago reported some data at the line of business level. And, Todd Kowalski, Vice President, Enterprise Accounts, and crew were nice enough to share some additional data with me so we can get a good look at what’s what.

Industry insights are so valuable for the digital marketer eager to benchmark the effectiveness of their social media program. You may know how you’re doing on a quantitative basis (and hopefully you’re measuring more than just likes, shares and follows). If you support a Sales team, you may get plenty of feedback on what you’re producing to be shared. And, there’s no shortage of random comments heading your way.

But to be strategic and effective requires more than all that. You need a broader perspective and that’s what studies like Hearsay’s can be good for—to the extent that the experience of their platform users can be extrapolated to your experience. If your social program is less expansive or less structured, your results will vary but there should still be something in it for you.

Hearsay’s overall study is based on more than 13 million published social media posts, which produced more than 21 million engagements across Facebook, LinkedIn, X (formerly Twitter), and Instagram. You’re going to want to read the study in its entirety (download here and there’s an on-demand webcast available too). My takeaways below are focused on reported outperformance by asset managers and wealth managers.

Teams are using what Marketing is providing

The breaking news: The report includes some particularly positive findings for asset management social media efforts supported by the Hearsay platform. This doesn’t contradict the overall social media malaise we commented on a few weeks ago (and heard more about after the post published), but it does provide some justification for plotting a way forward.

First, let’s look at the content that’s prepared for the teams in the field. In a social media program where Sales is reliant upon Marketing to provide content for them to share, there’s always the potential for a disconnect, resulting in frustration and waste on both sides.

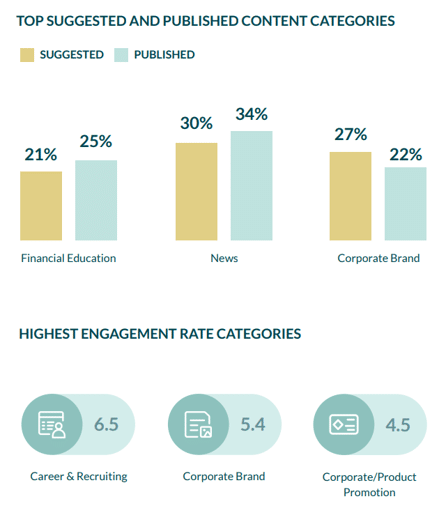

Scroll through the study and you’ll see big gaps between the content being provided by Marketing in some verticals—“suggested,” as Hearsay describes it—and used/published by their sales teams. Asset manager marketing leads on this dimension, as shown below. The content made available in the three categories of financial education, news and corporate brand is largely being used. Users showed a stronger preference for the news content than the brand content.

And, Hearsay data shows asset management content is seeing high engagement rates, too.

“Asset management excels on LinkedIn by sharing trusted, hard-hitting analysis with followers,” according to the report.

Asset Management

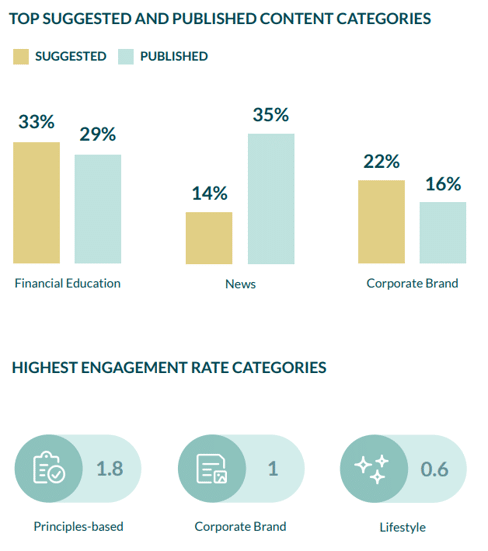

If you’re a wealth management marketer, the Hearsay data may be of some directional help. Look at the gap between the supply of News content and the demand for it. Also, the report notes, principles-based content (including ESG, DEI, Women, and Sustainability) made up only 1% of wealth management content published in 2023 but it attracted the highest engagement rate.

Wealth Management

The original content advantage

In our post Tepid social media results may require a pivot in asset managers’ approach, Todd made the point that firms may need to evolve toward original content creation to realize a greater return from social media, primarily LinkedIn.

On this point, the Hearsay research brings the receipts, reporting a significant performance difference between the types of content shared.

The firm parses content into three types:

- Original content, which is created by the person posting it. Original content is least common because of the risk it represents to regulated firms. And, Hearsay, whose platform is meant to mitigate the compliance risk, reports a decline in original content from 2022 (6.5% to 4.4%). However, financial services creators who can be original see an average engagement rate of 5.2%.

- Modified content, posts made available in a library that can be modified by a user before posting. This kind of content averaged a 1.7% engagement rate.

- Unmodified content, posts that need to be published verbatim from the corporate content library. Unmodified content brings up the rear with barely a heartbeat and a 0.5% engagement rate. When you’re writing for all, you have to keep things pretty vanilla which is at odds with an individual’s authentic voice, and Todd says explains the underperformance. May I add that if you happen to follow multiple people from a single firm, you know what a scourge unmodified content can be. As a user, a minimum expectation is that social posts not be identical.

If you’re a marketer at an asset management or a wealth management firm, you know what you want to do on social media. You want to use it to call attention to your firm and your people and your products and services. You want to meet people on social networks and lure them back to your websites where you can control things.

Completely understandable, I’ve been there. And, just keeping it real, that’s what we want to do at Lowe Group too.

But that’s just us trying to fit our square pegs into round holes. It’s not working. On LinkedIn, as well as on X and other platforms, too, actual participation on the platform is what gets rewarded by the algorithm—and what leads to stronger engagement.

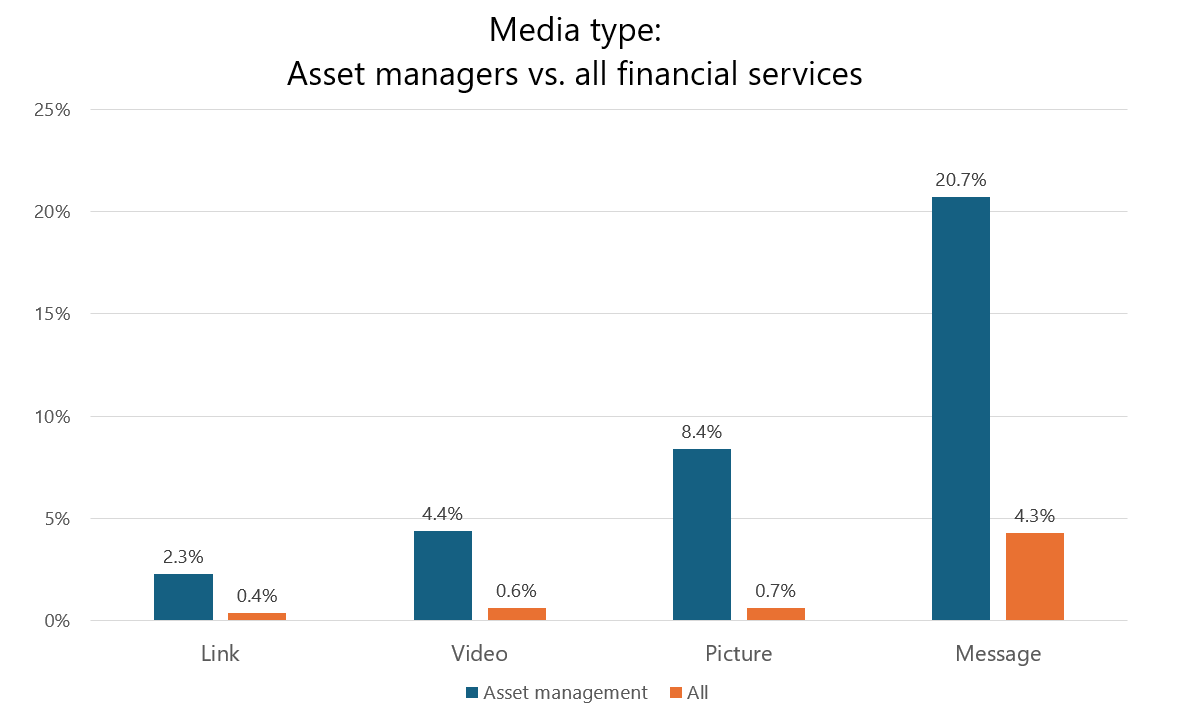

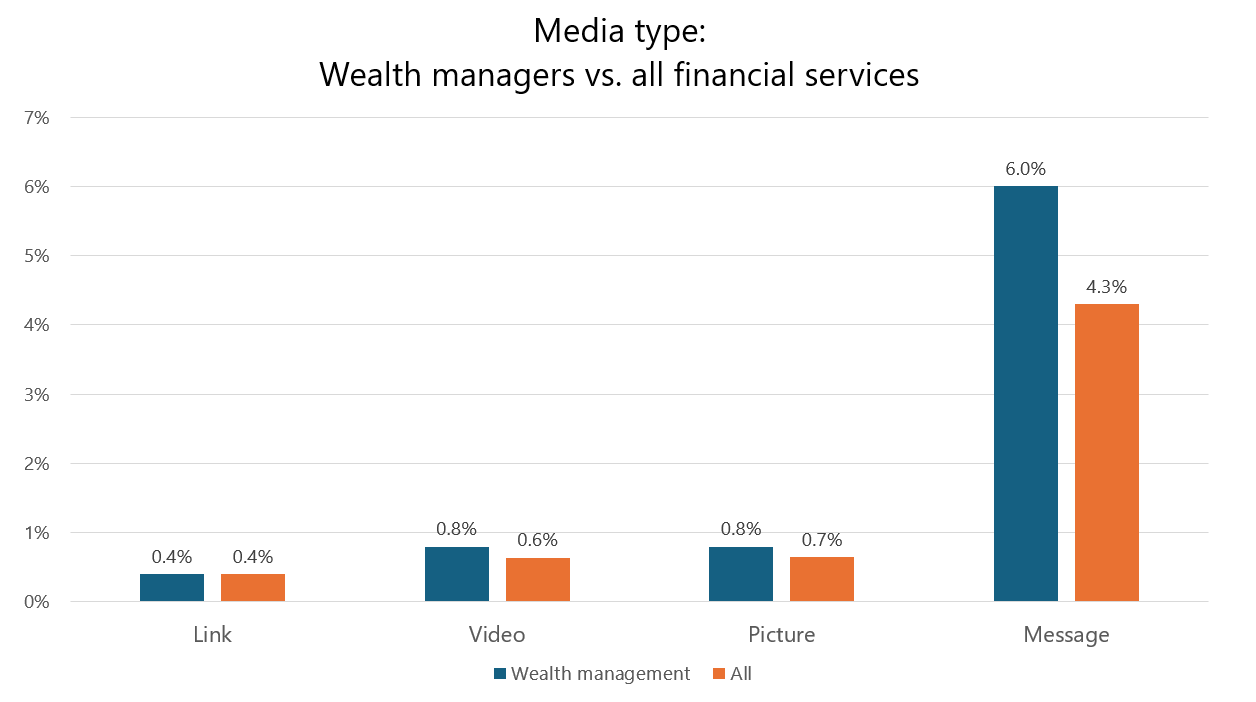

The Hearsay whitepaper included engagement data by media type, but this is what I followed up on to see if we could get more detail. I’m grateful they obliged because the business line data elaborates on where the asset management and wealth management social media outperformance is.

Most dramatically—with text messages (original content that does not contain links, pictures or videos) producing a 20.7% engagement rate—mutual fund, ETF and other institutional sales teams are killing it compared to other teams in other financial services verticals. (And, we probably need to acknowledge the Compliance reviewers enabling the authenticity, too.) Even asset manager posts with links outperform 2.3% to the financial services standard of 0.4%. So, yay all around.

Wealth management also is outperforming on every media type other than the posts with links. “Wealth management firms are doing a phenomenal job of selective focus—enabling their financial advisors to build a strong personal brand across Facebook and LinkedIn,” according to the report.

Hearsay confirms that most of this social activity for both lines of business is concentrated on LinkedIn.

If I were in Sales, I think I’d look at this data and conclude that my counterparts at other firms creating original content are making the best use of their social media time. Digital marketers, what are your thoughts? Send us a note.

Subscribe.

Receive the latest news and insights from Lowe Group.