3 words for new ETF issuers: Go all in

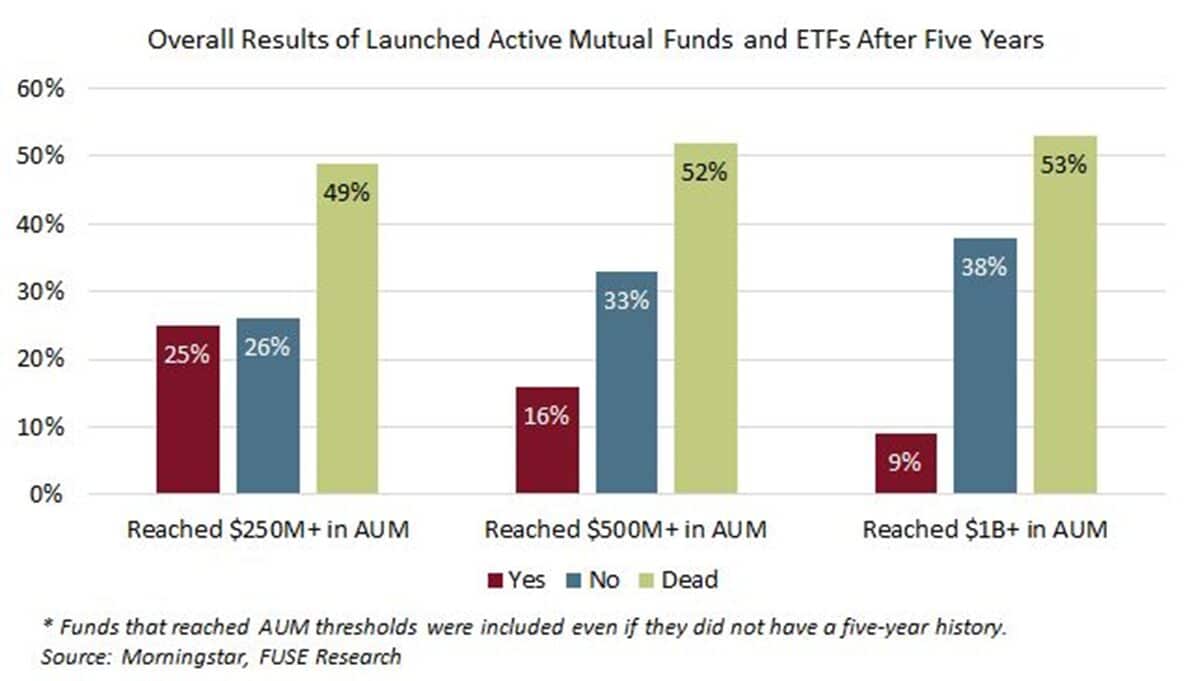

Recent Fuse research cited by Ignites.com (subscription required) illustrates just how daunting it is to launch a successful ETF. Through May 29 of this year, at the same time as there have been 258 launches, nearly two-thirds as many (174) were shuttered. Since 2014, the data is even worse with 5,222 launches and 4,654 closures. There is a reason Bloomberg’s Eric Balchunas refers to the undertaking as a “terrordome.”

But while the pressure may be on to attain a “profitability threshold,” fund marketers and communicators can support their firm’s ETF products with proactive planning and a full-on commitment.

At the outset, Marketing teams need to recognize a few things. First, ETFs are not mutual funds, and the playbook is different. As Head of LG Digital Pat Allen summarizes in our ETF Marketing Guide, the clock starts ticking on Day 1 with ETFs.

With traditional mutual fund launches, marketers and their distribution partners generally delayed promotion until the product achieved a three-year performance record or AUM threshold. Attention to ETF volume and flows begins almost immediately with teams celebrating important milestones along the way. Also, ETFs trade on an exchange. You won’t have complete information on who is doing the trading. So it is imperative to capture information about both clients and prospects whenever possible.

Here are a few tips to make sure your ETF is among the survivors:

- Reeducate your traditional mutual fund team on the capital markets milieu. A different set of experience is needed. Elevate your ETF leaders and make sure they spend time bringing your team along.

- Identify your point person to champion your ETFs. It is generally not a portfolio manager but a product champion who understands and engages with the new competitive set.

- Talk about the ticker… Since its early days, ETFs have expressed their creativity (and flexed their upstart vibe) with the ticker symbols they’ve adopted. Some of the most memorable over the years: MOO (Van Eck Vectors Agribusiness ETF), TAN (Invesco Solar ETF) and CYA (Simplify Tail Risk Strategy). Whatever yours is, make sure to include it prominently—in BIG BLOCK LETTERS—on all fund materials

- Continue to publicize beyond the launch. ETF partner firms can help you put together a launch plan including a bellringing and other communications support, but you will need to continue to surface opportunities beyond Day 1. Leverage your ETF product champion to talk widely not just about your product but about your area of expertise. Then leverage every bit of coverage as reprints to share at conferences or email to prospects or reposts on your ETF landing page or social media.

- Work hard at telling your story. It is more than just your fact sheet—though that too is critically important. Communicate your fund’s value proposition and your domain authority in the full range of contexts, including blog posts, video, podcasts, webcasts, whitepapers.

- Consider your marketing materials and presence. Traditional mutual funds? Conservative. Blue. ETFs? Cutting edge. Colorful. Vibrant. Think carefully about how to channel your ETF’s voice and personality into differentiated social campaigns.

- Don’t be pennywise and pound foolish. Commit to the kind of marketing spend needed to break through and build awareness both at launch and ongoing.

If you are new to ETFs or looking to refresh your next ETF launch, send us a note.

Subscribe.

Receive the latest news and insights from Lowe Group.