Ether ETFs debut: the crypto marketing thrill isn’t gone, just muted

Did Ethereum provide any additional marketing inspiration for the eight teams responsible for launching the spot Ethereum ETFs Tuesday? Let’s take a look.

It would have been hard to match the sheer thrill of January 11 when 11 spot bitcoin ETFs went live and ETF marketing went wild. For one, marketers had a longer run-up to the bitcoin product. As early as October 2023, commentators considered SEC approval likely—giving launch teams about four months to prepare.

The likelihood of an SEC greenlight for the Ether ETF was moved from 25% to 75% by Bloomberg only a month ago. Yesterday’s go-live date was set last week. That’s not much notice to fire up videos, explainers, even ad campaigns. What I most noticed yesterday compared to the January launch was how few ads were running. I’d look for that to change in short order.

Ether ETFs traded less than one-quarter of the blockbuster $4.66 billion of bitcoin ETFs on their first day. Even so, more than $1 billion in volume is an impressive early showing.

Data shared by Bloomberg ETF analyst Eric Balchunas showed that the iShares and Fidelity Ether ETFs (ETHA and FETH, respectively) far outpaced the Day 1 volume of the 600 non-bitcoin ETFs launched in the last 12 months. The volumes of the Bitwise, Grayscale and VanEck products (ETHW, ETHE and ETHV) ranked them in the top 20 for the same period. Yesterday’s flows leaders were iShares, Bitwise and Fidelity.

That means the crypto ETFs were the two most successful product type launches of the year to date—a fact not likely to be overlooked by asset managers not involved in this significant fund-raising. Contrary to what #tradfi might have believed last year, there’s investor demand.

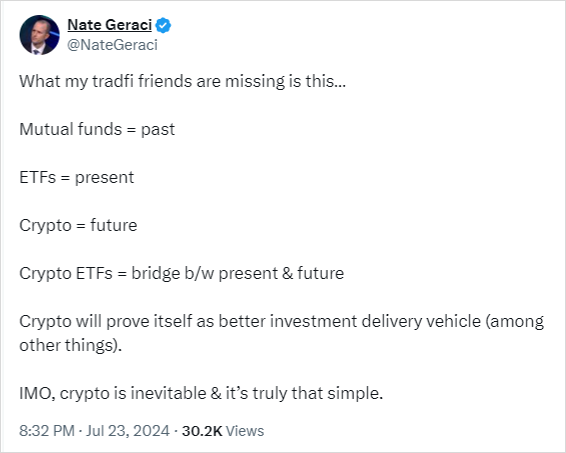

You may not have participated in crypto product efforts to date and you may have even considered it the fringe part of asset management, but it’s not too early to pay attention to this space. Consider this comment last night from ETF Prime podcaster, long-time crypto advocate and RIA Nate Geraci.

Many of the same moves

With this second crypto product and on a shorter timeline, first-day issuers were many of the same players using many of their same, winning moves. Namely:

- The beloved, bedraggled intern managing the VanEck X account was back at their post, tweeting sonnets, etc., despite admitting to being tired the day before. VanEck has been championing crypto for a long time.

- As it adopted laser eyes for the bitcoin ETF, the Franklin Templeton X account profile pic was updated to bear the Ether diamond icon. And, as in January, CEO Jenny Johnson took over the account and sent 10 threaded posts about EZET and digital assets.

- Bitwise published to X the on-chain addresses of its holdings, a disclosure meant to help build trust because the addresses enable investors to independently confirm the AUM directly on the blockchain. The firm did the same for its bitcoin ETF too, but not on Day 1.

- As with the spot bitcoin ETF, Vanguard will not make the Ether ETFs available for purchase on their platform.

Also, having dubbed the race to raise bitcoin assets the “Cointucky Derby,” Balchunas referred to yesterday’s launch as the “Ethness Stakes.”

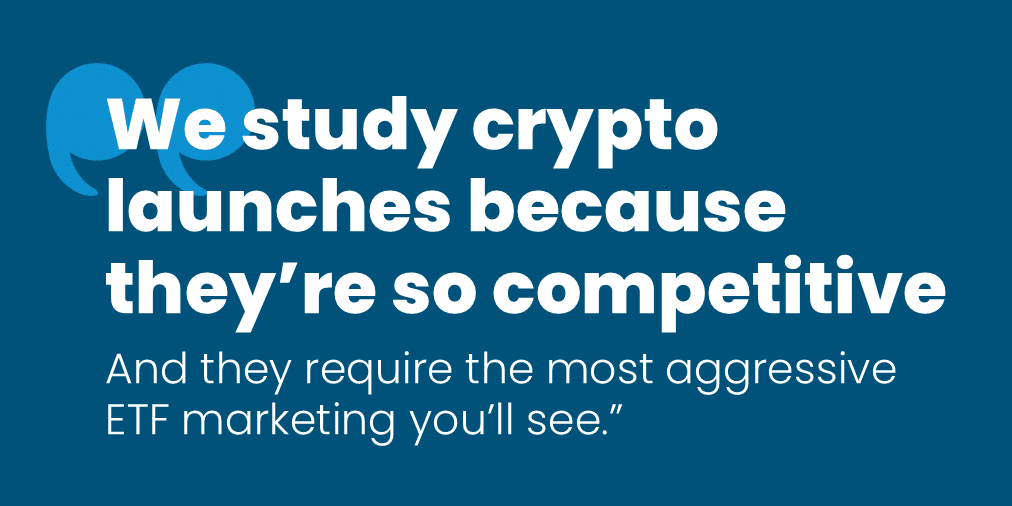

I study these launches not so much because I’m crypto crazy (intrigued yes, crazed not yet) but because this is the most aggressive, most competitive ETF marketing you’ll see.

Let me note at this point, as you’ll read on each fund’s landing page, these ETFs are not registered under the Investment Company Act of 1940 and are not subject to regulation under the ’40 Act, unlike most mutual funds or ETFs. However, they’re issued by asset managers and distributed by intermediaries, as well as heavily marketed to retail investors—in scope for us, in other words.

A strong Day 1 is so important for ETF issuers (see our guide to ETF marketing). But everything is accentuated for the crypto products. As a measure of the early interest, Balchunas on X provided periodic updates throughout the day Tuesday, including just 15 minutes in. The pressure was on to see which issuer would jump out early.

Here’s some of what I noticed on Ether’s Day 1.

Home page takeover

“How important is this fund to us?” That’s a key question a web team needs answered well before the launch date, the question goes to the prominence of the fund on the home page. For a firm that has more than 400 ETFs, as iShares does—including its $22 billion in the IBIT bitcoin ETF—it’s meaningful support to place a new fund front and center.

Fund companies “leaning in” is not lost on the pundits, including Bloomberg ETF analyst James Seyffart.

VanEck, Franklin Templeton and 21 Shares also gave their new funds home page treatment.

Another option: Grayscale’s hard-to-miss pop-up on its home page. When your firm has big news, make sure your website visitors hear about it!

Disclosure tacked on

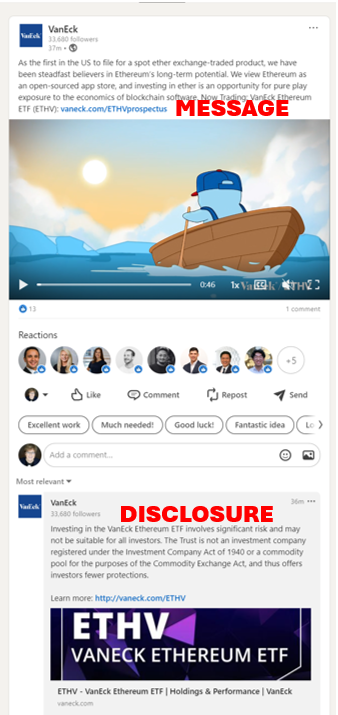

There’s a disclosure twist that’s a relatively new development not specific to the Ether launch but used by a few firms yesterday: Rather than consume precious space in the first post, issuers are starting to post disclosure or added information in a follow-up, whether as the first comment on the LinkedIn post or as an X reply.

If you haven’t considered this treatment yet, you might want to talk to Compliance.

Media helps!

For an example of how media attention can help a new fund, look no further than Axios’ coverage of Grayscale’s ETH. Fee waivers are the rule as opposed to the exception with the crypto launches, but Grayscale is alone in promoting the low share price—$3/share—of ETH. It inspired an editorial headline and graphic that money can’t buy: “Grayscale’s mini ether ETF could cost less than a Big Mac.”

While the Grayscale-originated social posts are straight down the middle, the social media team wisely jumped on the Axios coverage. Here too, see how moving the disclosure to a second post in the thread makes for a nice clean first post.

Give the people what they want

Imagine what it would be like to introduce a product that investors have not just been waiting for, they’ve given some thought to how you might promote its benefits.

In fact, Richard’s suggestion above is worth considering—my perusal of the fund landing pages revealed a shortage of educational content on Ether. Less than for the bitcoin launch, was my impression. No doubt the content machine is working overtime to close that gap.

Yes, but who is investing?

Not a question to be answered after one day, but I liked this tee-up from Coindesk:

“Are we getting family offices and hedge funds looking for asymmetric gains? Old school financial advisors looking to somehow combat inflation? Degenerate 25-year-olds trying to make huge gains so they can retire early and travel the world while they still have their youth? Is this the ether ETF strictly for institutional play while retail investors will stick to holding their ether in Coinbase or Robinhood?”

Time, and future 13F filings, may tell. Meantime, congrats to all those involved in yet another important, and successful, launch for the industry.

Subscribe.

Receive the latest news and insights from Lowe Group.