Are you ready for AI to summarize your emails?

Anyone emailing for business would be well advised to take note of what’s happening. Below I’ll focus on issues for the ETF and mutual fund marketer.

Financial advisors receive too much email

For years we have known two things to be true:

- Email is the most effective channel asset managers employ to reach financial advisors. Advisors consistently say as much (see these industry reports).

- Financial advisors consistently complain that they receive too much email from asset managers. Targeted emails are more palatable, but it’s still too much, they tell one survey-taker after another.

This has been a predicament for which AI offers an obvious solution.

Since November 2022 the trade media has been diligently covering the many ways AI can improve financial advisory practices and individual advisor productivity. I’ve been holding my breath just waiting to hear that one of these timesavers involves the deployment of AI to take a first pass at emails flagged as coming from asset management marketing teams.

How would an AI assistant begin to help with an advisor’s crowded Inbox? And how would asset management marketing emails fare in the interception and curation?

The AI email summarization capabilities released in the last few months by Microsoft CoPilot, Gemini for Gmail/Google Workspace, Apple Mail and Yahoo email provide a first look at the technology being applied in a basic way. (In fact, while summarization has just become widely available, I wouldn’t rule out the possibility that this and conceivably more capabilities are in place and being tested inside firms. If you know, please share!)

Design and content will need to evolve

The ultimate user scenarios will not involve the manual steps I went through to produce the illustrations below (click on the images to enlarge). I just couldn’t wait to see what AI makes of the types of emails that are currently being sent—not to mention relied upon—today.

As I suspected and my random spot-check confirms, ETF and mutual fund email design and content decisions likely will need to evolve.

I’m sharing what I found over a few days last week with lots of qualifications:

- It’s early—can’t say that often enough.

- I sampled a few AI email summarization tools in two leading email solutions (Copilot in Microsoft 365 and Gemini in Gmail/Google Workspace both on the desktop and on an Android phone). Many advisors use other email systems.

- “Results” varied from tool to tool and versions in the case of Gemini Advanced and Gemini.

- This was simply an exercise, not a real test, just to try to get a glimpse of what the future might bring.

- The samples I used are from some of the best emailers in the business. In most cases, just excerpts of emails are being shown and for that reason you may not see all the disclosures you’d expect. They’re in place, rest assured.

Summaries are light on the details

Until now, emails have served as compact communications to provide all the details you’d need to know about a product. That could change.

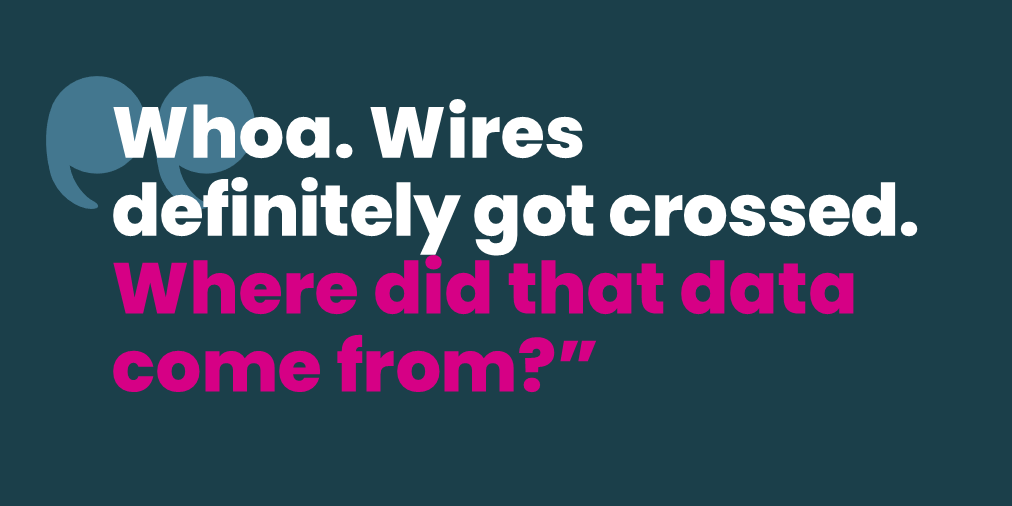

I selected this Innovator ETFs email for two reasons. I expected the all-text to be easy to read but wondered about all the datapoints. As you can see, Copilot gave it more of a go than Gemini, which chose to high level it.

In all of these examples, the summaries seem to prioritize disclosure-type language.

Lost in translation: images including logos and charts

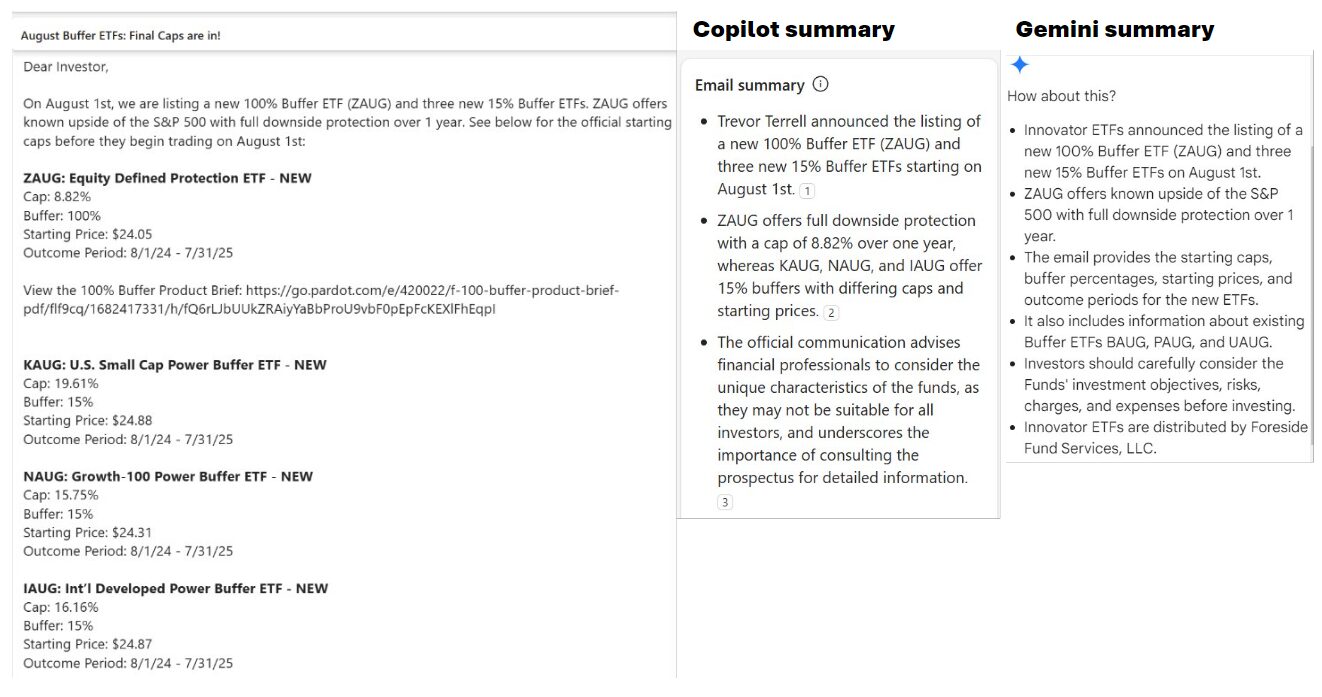

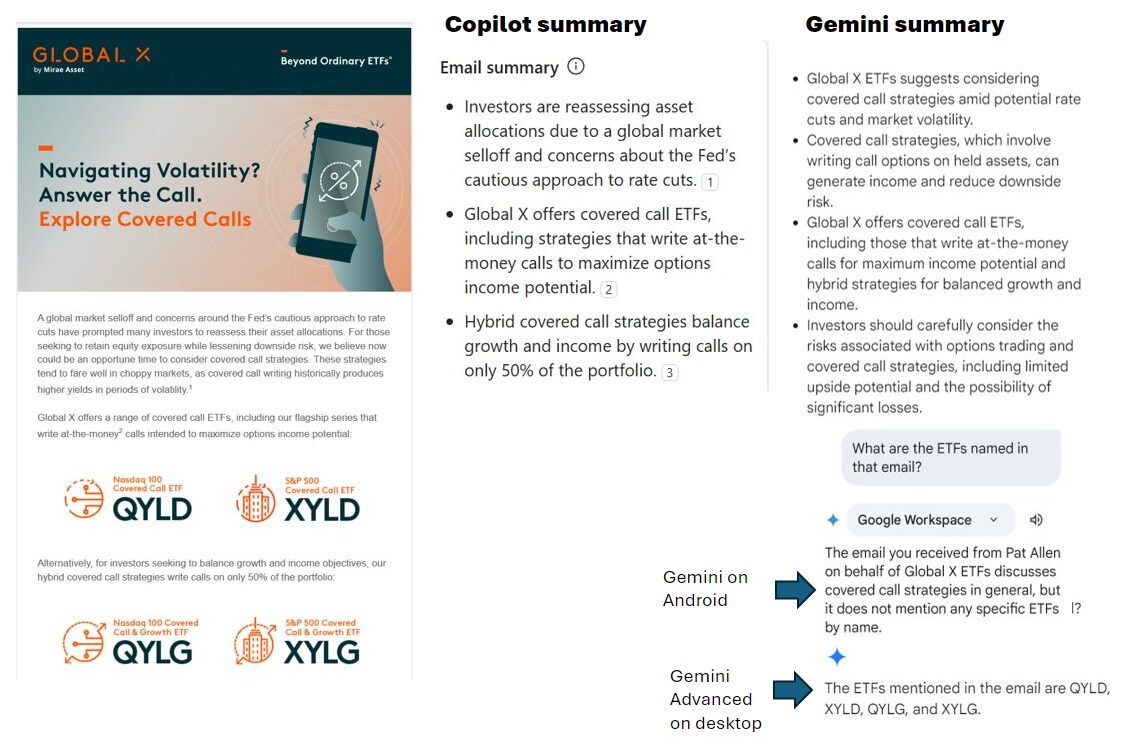

Summarizing information contained in images will pose a challenge. Neither Copilot on the desktop or Gemini on the phone extracted anything from images or charts. Alt-text, when it was in place, was of no help.

Such image blindness had a range of consequences. GlobalX’s use of images for the ticker symbols in its visually attractive email meant that neither the Microsoft and Gemini summarizer on Android picked up on the tickers. In my follow-up question to Gemini, it’s obvious the AI didn’t see the images. However, note that Gemini Advanced on the desktop did.

In the New York Life Investments email, the logo is an image. Although the company’s name is included in the footer, Copilot doesn’t seem to pick up on who the email is from. Gemini on Android denied the presence of the chart, but Gemini Advanced aced the assignment.

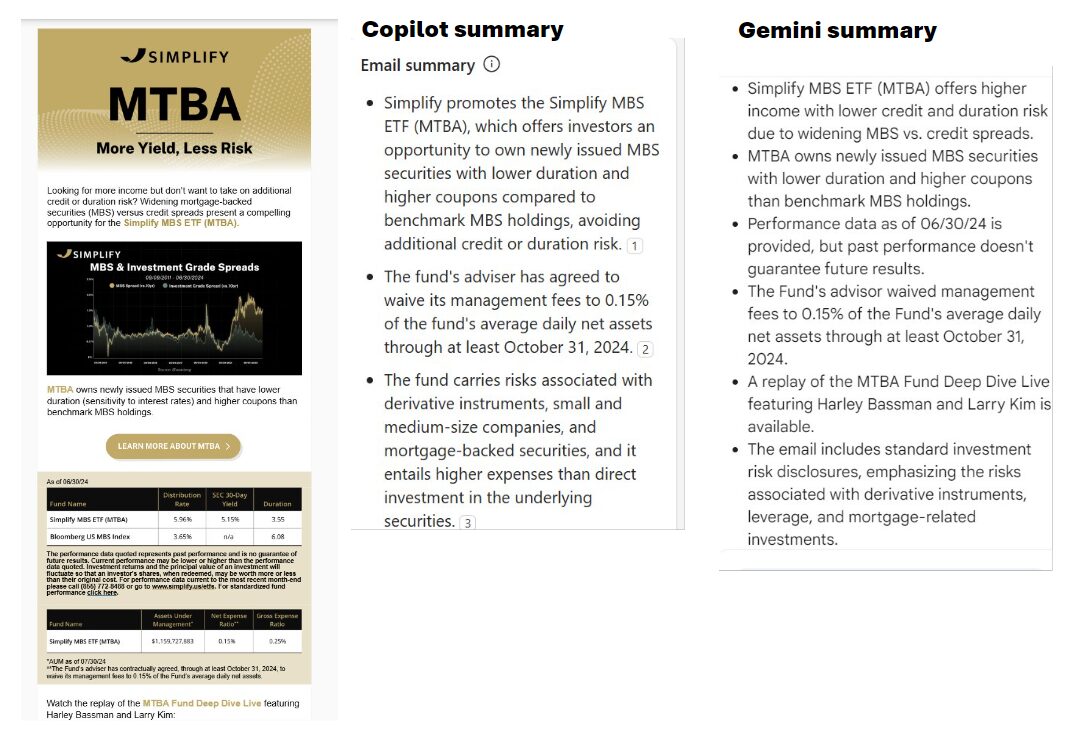

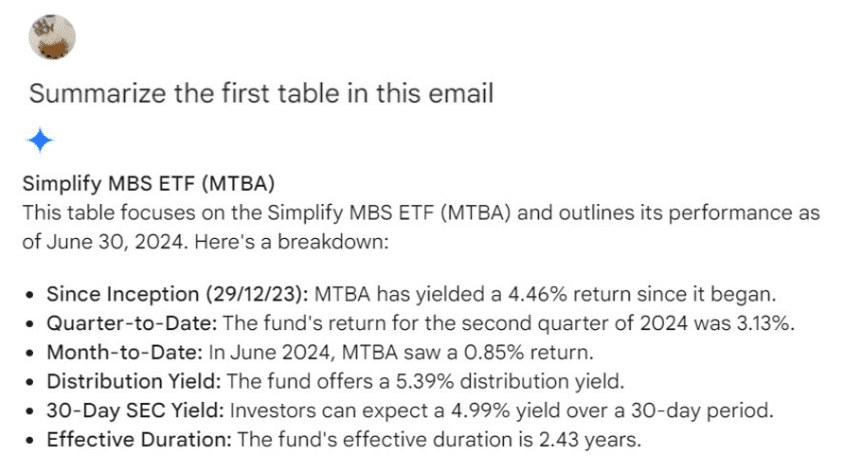

There’s a lot of information in this Simplify email. The summarizers overlooked some of it—including the existence of the chart!—preferring again to pass on some of the disclosure.

Rather than let a chart speak for itself, going forward email marketers may need to be explicit in the text about what’s being shown in provided charts. The same would be true if you’re providing data in a table that’s an image.

When I asked Gemini about the chart, it actually did a good job of describing it. But things headed off the rails when my follow-up asked for a summary of the first table, which the first summary made no comment about.

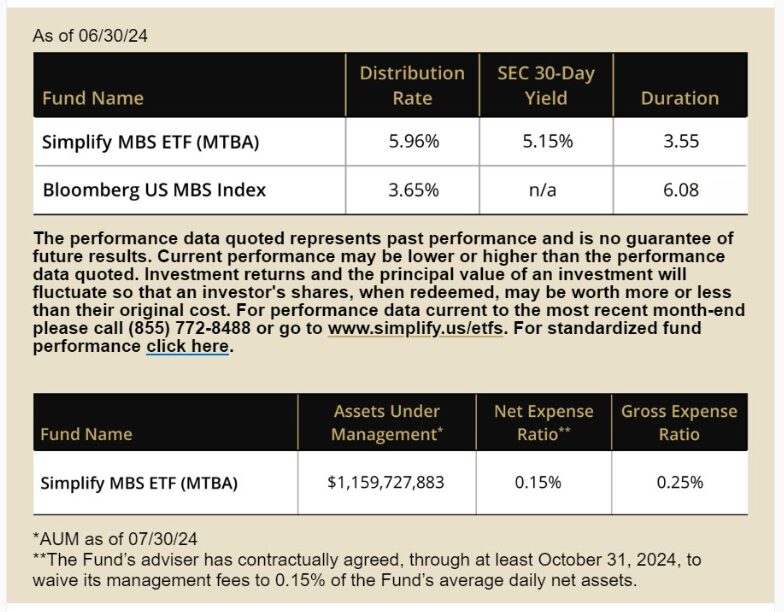

Here’s a closer look at the table at the bottom of the email above. Directly beneath it is Gemini’s summary.

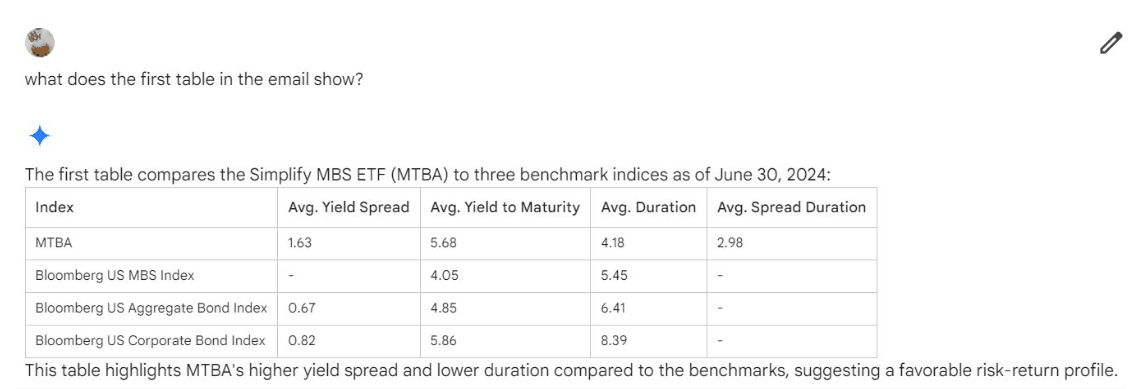

Whoa. Wires definitely got crossed. Where did some of this data come from?

Then I changed the request, thinking that “summarize” might be a confusing prompt. The result below showed more fictitious data—this time in tabular format. I ran about 50 of these illustrations and this is the only response that included a table. So wild and worrisome. Gemini improvise?

AI can hallucinate, we know this. It’s just so jarring to see it happen with investment communications that need to be correct—and are correct when a marketer gets the greenlight to push Send.

Both Microsoft and Google display warnings on their summaries that they may display inaccurate information.

At risk: digital engagement insights

No links were included in the summaries I saw. When I explicitly asked for a summary of the URLs in the email, the answer was incomplete—the URL to the MTBA fund profile, arguably the most important link, was missing.

Advisor reliance on email summaries, if this comes to be, may jeopardize digital engagement insights.

The future scenario

In conclusion, there is no conclusion to be made at this point. The viability of email as a channel to reach financial advisors would be in a hurting place if the development of AI summarization stalled here, but does anyone doubt that Microsoft and Google (and Apple and others) will figure this out?

Another essential point: what I’ve done for this exercise isn’t the use case. While in a Microsoft Outlook and Gmail inbox, I clicked on an email and then clicked on a panel to the right and waited for a summary. That’s not how I envision this summarization capability being used by power users.

My guess is that a future scenario will enable advisors to set up an AI email assistant to select a) the firms whose emails they want summarized and b) the topics they care about. It could work the same way an app like Google Discover now enables users to curate their news feed, although further informed by the history of previous interactions with emailers and emails.

Or, they might just identify all asset managers’ emails as Product Ideas or Market Commentary and ask for a summarization of the whole lot altogether.

If you’re using email to meet an advisor and your firm isn’t on the advisor’s “watchlist,” it will be on you as the email crafter to make sure that you’re coming in with topics the advisor cares about using the very words advisors use. From what I’ve seen and read, efforts to be creative or provocative with subject lines and copy may not break through the first line of resistance, sad to say.

Further, it seems obvious from the Apple Intelligence automated email summarization capabilities Apple previewed Monday that machine learning will be deployed to help with the curation. As I understand it, by the way, when summarization is taking place in the background, the recipient will not interact with the email. This means there will be no opens, no clicks, no response whatsoever available for the sender to analyze and learn more.

We’re paying close attention to all things AI and communications at the Lowe Group. Reach out if you’d like to learn more.

Subscribe.

Receive the latest news and insights from Lowe Group.