An early look at alts marketing—it’s a steep climb to the second trillion

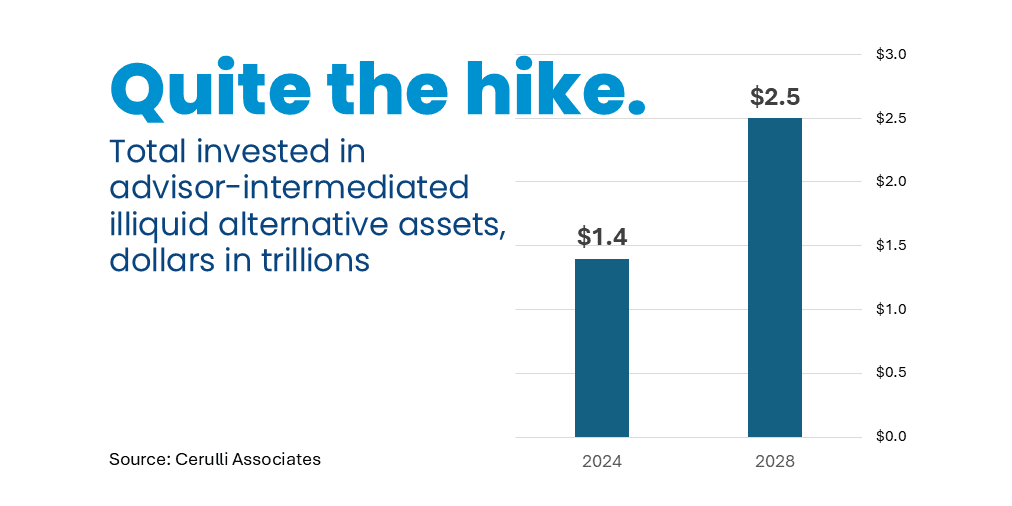

Do you have the same reaction I do when I read Cerulli Associates’ forecast that the amount invested in “less than fully liquid” alternative investments owned by financial advisors will shoot from $1.4 trillion to $2.5 trillion by year-end 2028?

To gain more than $1 trillion in four years would be massive. That would be an AUM raise the equivalent of the largest equity and bond ETFs—SPY ($440 billion), VOO ($404 billion) and AGG ($100 billion).

To be sure, such a level of adoption could get a big assist from firm to firm opportunities created by the many strategic partnerships being announced between institutional providers and traditional asset managers. But much of the energy today is directed at encouraging financial advisors to move their clients into alts. Alts managers estimate that 13% of their AUM comes from retail channels—a number they expect to jump to 23% in three years, again according to Cerulli.

I see these expectations and my mind goes straight to: How many events, videos, presentations, emails, CE webcasts, advertising, social media, PR, training will be needed in order to raise $1 trillion in less than four years?

It stands to reason that more marketing dollars will be directed to communications support. Paid media partners are likely looking at several good years. ETF issuers and mutual fund managers (many of whom offer their own flavor of alts) will be pursuing their growth agendas at the same time.

I’m also curious about what the newer competitors for advisors’ attention will bring to the space. How will they present their solutions and the impact of including them in otherwise public markets portfolios? While they may be new to retail marketing and the bread-and-butter tactics that the intermediary space is accustomed to, the new entrants to the retail space are often described as "sophisticated." (Our work to date with alts firms can confirm that.)

And, how will these new types of investments will be explained to clients? (Retirement plan providers may be recruited to help. In an interview this week with Ignites, Cerulli director of product development Daniil Shaprio predicted that investors will be proactive about asking for access including adding the options to 401(k) target-date plans.)

There is so much to say, to promote, to explain, to educate, about. What kind of high level wizardry are we in for?

Time will tell, but I decided not to wait. Just for fun this week I dipped into the LinkedIn Ads Library and searched for advisor-targeted ads by some of the most prominent alts providers. What I found: To date no new ground is being broken. The surprise, if there was one, was how high level the messaging continues to be. The focus of most of this small sample of promotions is the case to be made to advisors about alternatives. It will be a long march to $1 trillion.

Have a look.

Hamilton Lane: The value prop

Advisors weary of the typical public markets charts and stories can look forward to new perspectives such as this chart, an excerpt from the Hamilton Lane 2024 Market Overview.

Ares Wealth Management: Big budget event for RIAs

Ares Wealth Management didn’t need more than 1 minute to flash highlights of a Beaver Creek Private Markets Summit for RIAs while commenting on the “pairing of the democratization of alternatives with the institutionalization of retail.”

This appears to be strictly a flex on Ares’ part—there’s no link to pursue more information. Money was paid just to promote what looks to have been a swanky event.

Blackstone: Other fish in the sea

This Blackstone ad is the most beautiful of the set reviewed, and it’s a metaphor advisors can easily use with clients. Here, too, though, its message to advisors is little more than foundational.

Venn by Two Sigma: Subscribe

Here’s a move familiar to traditional asset managers. Venn by Two Sigma publishes insights and guides for advisors and they’re using their ad to drive subscriptions. Of course, makes sense, might be helpful to show an excerpt of the newsletter.

Partners Group: Thought Leadership + Whitepaper

It’s a sure thing that alternative investment managers comes with their own vocabulary—like “thought paper,” as mentioned in this Partners Group ad.

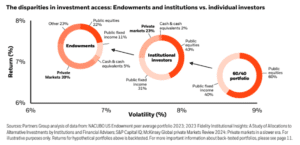

Inside the paper, here’s an endowments and institutions vs. individual investors argument that we are likely to see again and again, and not just from this BlackRock strategic partner. In the alts world retail investors in 60/40 portfolios are the have-nots.

Apollo Global Management: Alts for retirement income

Apollo Global Management likely paid a bit for this CNBC Leader interview doubling as a video ad featuring CEO Marc Rowan. The landing page stands out because it goes beyond the description of alts in its discussion of using alts to provide retirement income, Apollo’s roots.

Of course, this early LinkedIn advertising provides the narrowest of lens to look at what will be a monumental undertaking and transformational shift over the next several years. This promises to be a high energy, challenging time not just for the providers and advisors being asked to help introduce retail investors to the private markets but also for PR and marketing communicators.

Let us know where we can help.

Subscribe.

Receive the latest news and insights from Lowe Group.