Give in order to get: Leveraging expertise for PR and brand-building

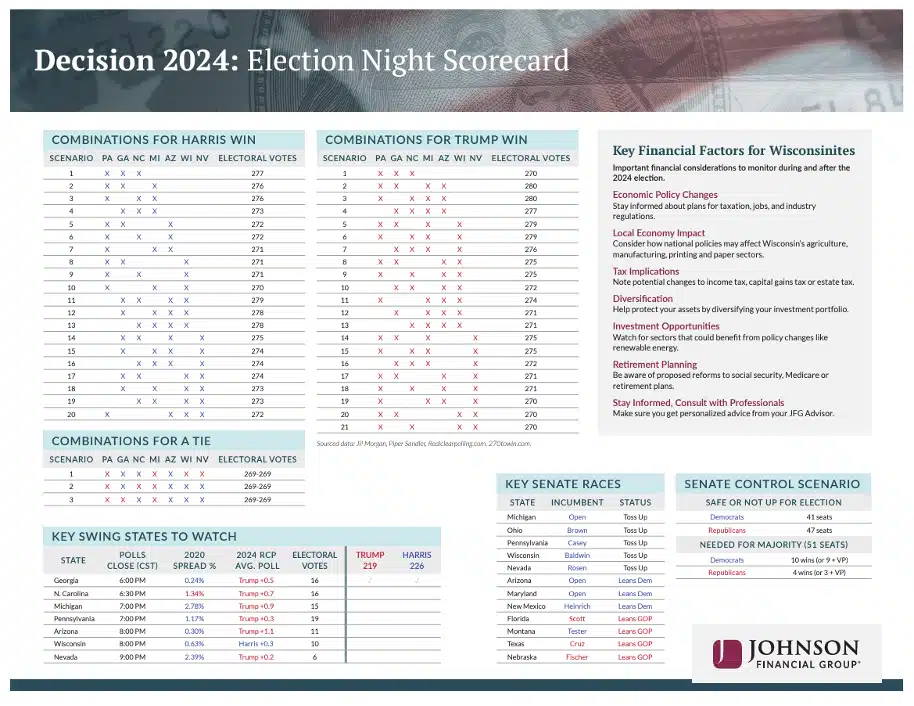

The bounty of election-related commentary and analysis produced this election cycle by asset managers and financial advisors illustrates a winning approach to public relations that can be practiced year-round.

Sometimes called “authority marketing,” demonstrating one’s expertise by sharing what you know can help to build your reputation and ultimately lead to business opportunity.

Many investment professionals—portfolio managers, analysts, advisors—often tell us they are too busy to explain what they do. Some are also concerned about sharing proprietary information or giving away their “secret sauce.” However, we advise our clients to “lift the curtain” and transparently explain what they do and why it is important.

Tying how you think to a news event like a highly anticipated national election helps tap into an already alert audience, as has been demonstrated the last few months.

A generous example

One advisor we work with is always generous with his time in educating clients and the media, discussing topics of importance to them and writing thoughtful educational pieces. His practice has been very successful, growing and gaining assets over the years. Despite being extremely stretched for time, he always finds a moment to share insights when asked.

He shared his philosophy: “You have to give in order to get.” By investing the time, he strengthens relationships with clients, prospects and the media. He also gains loyal clients, regular media exposure and asset growth.

The heart of good public relations

In our view, this philosophy is at the heart of good public relations. To be perceived as a credible source for media, you need to share your insights. Don’t expect that every interaction will lead to a sales lead or new assets. However, by positioning yourself as a credible expert—to clients who read your articles and media who regularly use you as a source—you can build brand awareness that ultimately supports your growth.

Here are a few ways asset managers can share their unique insights:

- Short-form articles or posts. Interesting content doesn’t have to be long. As we’ve seen, portfolio managers, analysts or other experts can create articles to post to a website or social media on topics that are timely and in the news.

Articles should be educational and take a look at how a geopolitical event affects markets or reassure investors that they are in good hands in times of uncertainty. Some financial media outlets will take outside contributed content on timely topics provided it is educational and not self-promotional. Pensions & Investments, Barron’s, MarketWatch and others occasionally take content from financial experts.

Although you can see more by clicking on the link, First Trust delivers a succinct, helpful message in this post on X.

- Whitepapers. Longer-form whitepapers focused on an interesting dynamic or the markets can offer readers a deeper look at an aspect of your approach. Deep-dive pieces should be focused on topics your clients and prospects are interested in or concerned about.

We’ve seen terrific whitepapers about investment opportunities in India, optimizing tax loss harvesting, behavioral finance mistakes, understanding emerging market indices or interesting investment opportunities in more esoteric parts of the markets. - Webinars. Opportunities to participate in sponsored or earned webinars allow investment professionals to talk about a topic and respond to questions in real time. A recorded version of these webinars can usually be posted to your website or shared via social.

Giving election insights to possibly later get SPDR business, State Street Global Advisors’ webinar brought together a prominent Democratic and Republican strategist for an event moderated by State Street’s investment strategist.

- Earned media coverage. Be available for interviews with reporters covering your market. By being quoted as an expert in the Wall Street Journal or Barron’s, or appearing on one of the market-focused TV networks like Bloomberg or CNBC, you are widely viewed as an expert and gain credibility.

The ‘giving’ test

The most important guidance, and this is where we get at the key theme of “giving,” is that the information shared needs to be timely, relevant and useful. Offer expertise with the genuine intention of helping others make better decisions. When clients see content on your website or your firm quoted in the media, they will respect you and think of you as an expert, a position that accrues positively to your reputation over time. For prospects, this information helps them get to know your firm and gain trust. They need to see who you are and how you think in order to become more confident about partnering with you.

It’s helpful to provide rich detailed examples including individual stocks or bonds that illustrate your point. For some this can be a compliance nonstarter, but it doesn’t have to be. While some managers have a blanket rule that they don’t talk about individual investments, in our experience most can discuss individual securities if a)doing so illustrates their investment approach b)they aren’t conflicted in any way or actively trading in those securities.

Real examples make for richer content and can lead to more media opportunities as well.

So, get going and start giving away your ideas. You’ll be surprised at what you get in return.

Subscribe.

Receive the latest news and insights from Lowe Group.