Why your website needs to be even better than BlackRock’s

Two reports focused on the asset management industry were published in the last few weeks, and they are more related than may meet the eye.

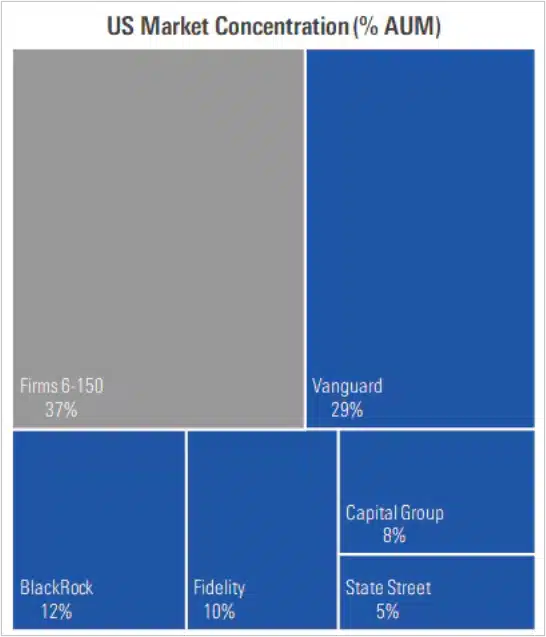

First was the publication of Morningstar’s Fund Family 150 Digest, reporting, among other things, on the industry’s consolidation over the last 10 years. In 2014 the top four firms (Vanguard, Capital Group, Fidelity and BlackRock) accounted for 43% of fund assets under management. Today those four and State Street represent 63% of AUM.

That leaves the rest of the industry to battle over the remaining 37%. Those involved in the sales effort at fund companies that are not in the top five know how difficult it is to get financial advisors’ and other professional investors’ attention, let alone their business. Driving sales requires constant hustle.

Heightened urgency for marketing to hold up its part of the AUM-raising bargain comes in the form of research focused on U.S. advisors’ online experience. Annual research from J.D. Power & Associates has established a tradition of continually documenting asset manager websites’ failings. That’s the case again this year, although the top-line is less harsh than in 2023 when the press release started with the headline “J.D. Power finds one-fourth of advisors say asset manager websites do not meet basic foundational needs” and headed south from there.

Asset management consolidation: The top 5 and everyone else

The 2024 work focuses on the importance of delivering “an easy experience.”

“When returns are removed from the equation, the most important variable influencing asset manager selection is ease of doing business, with 37% of advisors saying it is their primary reason for using a particular asset manager,” says J.D. Power, citing the website as playing a critical role.

Few would dispute such an anodyne finding. But there’s more to it, especially in the context of the industry’s consolidation.

“The average number of asset managers used by advisors has fallen to seven after holding steady at eight for the past three years. As advisors consolidate their asset manager relationships, they are increasingly investing with those who make it easiest for them to do so,” says the firm. This work echoes Broadridge research that last year reported that just 19 asset managers are a top five partner to the 10 largest distributors, and those 19 asset managers control 49% of mutual fund assets across those distributors.

Marketing shares the burden of proof

Why would an advisor work with a fund company other than the handful of firms that already get most of their business? The burden of proof is on both the Sales team and the Marketing team—including and especially the digital marketing team whose job it is to grease all digital wheels. Sales and Marketing share the responsibility of driving advisors to their firm websites in the interest of fostering engagement that can lead to sales.

A poor experience undermines the collective effort, not to mention the firm’s prospects for remaining viable in a shrinking industry.

The J.D. Power research makes clear that the days of less dominant firms, and especially boutiques, getting a pass for their dated online appearance or capabilities are over. You and your colleagues are hoping to persuade advisors to check out your products and services? You need to match the ease with which they use the big firms’ sites, at the minimum. Ideally, your site offers more—more data, different insight, anything that warrants consideration in the form of a visit.

Thanks to Craig Martin, Executive Managing Director, Global Head of Wealth & Lending Intelligence, for sharing the “J.D. Power experience hierarchy,” which pinpoints where asset manager sites continue to fall short. According to the hierarchy, there are three, cumulative parts:

- Foundational: There’s work to be done but 73% of advisors said that the sites they visited practiced what J.D. Power identified as “foundational” best practices (appearance reflects brand expectation, modern appears, website presents info in an organized way, website speed and response met expectations) are in place.

- Findable: Advisor assessments start to slip here, with just 55% of advisors agreeing that “findable” best practices (easy to find information tools on the site and easy to select navigation links and buttons) are being followed.

- Valuable: Nope, just 17% of advisors say “valuable” best practices (website is useful for helping understand products and provides helpful investment insights and educational content on the site) are in place.

These are familiar themes from previous studies, which Martin updated in an email exchange with me.

On the subject of findability, he encourages firms to do more to train advisors how to use their sites.

The task: Making infrequent visitors comfortable

“Frequency of use tends to have a material impact on satisfaction in digital. Giving a quick tutorial one-time or an online tutorial is not likely to get an advisor to a level of proficiency/comfort with an asset manager site that they may be using infrequently,” he wrote.

Especially in the last few years, fund company websites have gotten more complex (see SMAs and model portfolios stake their claim on asset manager websites).

“I do think part of the issue is that the depth and breadth of the content on the sites can be overwhelming, and big picture the point of using technology is fast and efficient access to what the advisor needs. We’ve seen in other digital studies that if it takes more than a couple of clicks to find something the end user tends to give up. In digital, especially on mobile devices more is not always better.”

The low score on the “valuable” findings are a call to action for marketing, product management and investment marketing. We acknowledge the challenge of trying to match the output of the content factories of the industry’s mammoth firms. But we need to side with advisors who reasonably expect firms to provide information that explains their perspective and their products. If your firm offers a superior alternative to a BlackRock offering, you’d better be able to explain why and how.

Because, in fact, there can be a payoff: the J.D. Power work has consistently linked digital engagement and intent to invest. The “digital experience has a profound impact on asset acquisition,” according to the study.

My last question to Martin sought to flesh out any improvement in the dreary advisor satisfaction report from last year.

But for smaller firms determined to compete, even his response seems like both a cautionary tale and a reason to light a fire under your plans to improve advisors’ experience with your site: “We have seen some improvements made but it’s not a universal improvement,” said Martin. “The largest/most well capitalized firms are starting to separate a bit more from the pack.”

Reach out to us for ideas on how you can enhance what you’re offering advisors online. As a result of our digital and public relations work exposing some of the same blindspots the J.D. Power work highlights, we’ve created our Visibility Grader for asset managers. You could start there.

Subscribe.

Receive the latest news and insights from Lowe Group.