Could finsky replace fintwit?

Like millions of others in the last few weeks (see this near real-time counter), we’ve joined the Bluesky social platform. Here’s the Lowe Group account, Jody Lowe’s and mine.

And, like everyone else, we’re going in with eyes wide open.

If MySpace, Facebook, Twitter/X, LinkedIn, Instagram, TikTok, Threads and others have taught us nothing else, they’ve taught us to temper our expectations about social networks. Users tend to rush in and find the value exchange worthwhile until something—whether in how it’s used, who it’s used by, or decisions made by ownership and management—invariably alters the appeal of the opportunity, and they move on.

One more social network to join and pay attention to isn’t necessarily the welcome news its founders may hope it to be.

Bluesky vs. the other platforms

But Bluesky is different in meaningful ways. Our particular focus on it is to assess whether these differences will be sufficient to impress the investment community.

But Bluesky is different in meaningful ways. Our particular focus on it is to assess whether these differences will be sufficient to impress the investment community.

Will a new, enhanced platform and the promise of an improved, even “safer” experience be enough of a draw to attract investment and financial brands? Will Bluesky succeed in attracting all of the various players—the asset managers, the strategists, economists, financial advisors including the influencers, the media, the traders, the tech providers—who at one time spiritedly engaged on market and economic news on Twitter?

Could finsky replace fintwit?

Here are a few charts to get your attention and then we’ll get into it below.

Bluesky compared to the others

An app open to the public since February, Bluesky owes its newfound popularity to a growing dissatisfaction with X’s very active owner Elon Musk. I’m a twice/day user of X and experienced firsthand Musk’s manipulation of the feed to both support Donald Trump and to undermine Vice President Kamala Harris in the days leading up to the election.

Musk’s intervention since he acquired Twitter and changed its name to X in 2022 has spoiled for many what was a treasured, distinctive social platform. In their initial posts on Bluesky, many new accounts say they’ve had their fill with X and they’re never going back.

It was a position many wanted to take when Threads debuted last year and didn’t.

But Bluesky is different from Threads and the other platforms in important ways we’ll outline below, while encouraging you to explore further.

- Leaving X to go all-in on Threads meant leaving an environment controlled by Elon Musk in favor of one controlled by Mark Zuckerberg of Meta. Some didn’t have any more trust in the ownership’s intentions. Created and funded by Twitter founder Jack Dorsey (who since parted ways), Bluesky is primarily owned by CEO Jay Graber and team and structured as a public benefit corporation.

- Bluesky is decentralized. New members join the Bluesky host provider when they start, that’s the default setting and that makes it just as easy as joining other social networks.

But unlike most other platforms, Bluesky is a federated network, which means that users can participate through different providers instead of a centralized system controlled by Bluesky. The Verge likens it to how email works: “If you have Gmail [on one company’s server], you can send an email to somebody on Apple’s iCloud [a different company’s server], and they can reply back to you.”

- Threads was launched hastily. Although it’s attracted 275 million users, it still lacks the functionality and features of Twitter—which Bluesky offers, and more.

-

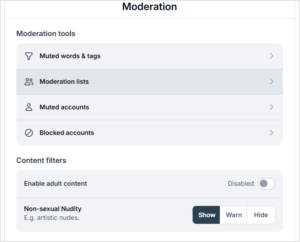

Moderation controls available to Bluesky users

Most important among Bluesky’s distinctive features is that users and not the platform control the algorithms and data sources. Bluesky encourages users to create and share custom feeds. It’s possible to follow algorithms followed by others or build your own.

- Compare that to X, which uses a central algorithm that has been increasingly influenced under Musk.

Every once in a while there would be a brouhaha in the pre-Musk years and someone would ask me if it bothered me. “That’s not happening on my Twitter. My Twitter isn’t like that,” I’d say, because I was following Twitter lists that I’d curated. Post-Musk, the manipulated stuff is purposefully injected into what I see.

Threads’ algorithm, too, is influenced by what the user does on Instagram and it offers limited options for customizing feeds. Even if you’re not a regular user of X or Threads, you’ve no doubt experienced the effects of a platform-controlled algorithm on LinkedIn. Depending on an algo that the platform owner continually alters for their benefit and not yours can be demoralizing.

Specific to the investment industry, I’ve seen two X posts this week referring to manipulation. Long-time ETF veteran Dave Nadig announced he was leaving X after having been “rate-limited (shadow-banned),” a move that X confirmed. First Trust Chief Economist and active X poster Brian Wesbury yesterday called X out for "throttling" one of his tweets.

- A key part of Twitter’s early success was that it enabled third-party developers to create a wide range of apps, which made it feel like a community ecosystem. Specialized use cases and innovation abounded before Twitter locked it all down. (I was just an asset management marketer when I was able to use the Twitter open API to build a now-defunct website called AdvisorTweets.com—those were exciting days on social media because it felt like the users were in control of tailoring their own experiences.)

Bluesky is built on what’s called an AT protocol, which is designed to be open and decentralized. One example: Sky Follower Bridge, the app you’d use to find who you’re following on X in order to follow them on Bluesky, was built and maintained by an independent developer.

- Viewed as a challenger when it launched last year, Threads management has been consistent in saying it’s not interested in serving as a news network.

- Bluesky’s boost has been largely due to defectors looking for a better place—and that implies a code of conduct that the other networks have not aspired to.

Some people describe themselves as joining Bluesky to “heal.” That some are on their last nerve may explain why the Bluesky safety team reported receiving 42,000 moderation reports in a single day last week or about 12% of what was received in all of 2023.

In the course of offering helpful tips for starting out, this Bluesky for beginners video passes on some recommendations for behavior that go further than even the most polite platform (LinkedIn?) has. Examples: no photos of a certain person (Trump), no screenshots of tweets because if people wanted to see them they’d be on X, etc.

These are one man’s recommendations and aren’t binding. I’d worry that a nanny-type oversight could have a chilling effect on adoption. Appearing too fragile might also prevent the fast-moving, markets-oriented financial crowd who will jump on a good idea and are not at all thin-skinned. Josh Brown nailed it with this post.

But…parts of fintwit is still going strong

Many are leaving X and they’re saying they’re not going back.

If you’re in the investment industry, the decision is not so cut and dried. Even during the turmoil of X’s ownership, fintwit not only continued, it’s been energized by several events in just the last year. Inflation worries, the strength of the market, its performance before and after the election, the launch of bitcoin ETFs and overall ETF announcements come to mind. The information (text, charts, links) and insights exchanged are why we are nowhere close to leaving X for good.

Fintwit has worked for Bloomberg ETF analyst Eric Balchunas, for example. An informative, super-engaging account to follow, @EricBalchunas gets an average 177 engagements (per Fedica data) on posts that are mostly focused on ETF news. That’s a lot. While it should be noted that his 325,255 followers include very exercised crypto accounts, the fact remains that X as of now remains an appropriate place for ETF analysts, issuers and investors to see and be seen.

But X has faded as an effective platform for many others. For years I’ve maintained an X list of investment managers. Across the board, the posting by this set of 122 firms has declined as most have seen less return for their effort while at the same time associating X with higher risk for their brands. According to Fedica data I track, virtually all of the accounts following the firms on the list are five years or older; investment managers have attracted few new accounts.

With the notable exception of @VanEck and a few other firms during the bitcoin launches, very few asset management tweets were engaged with. The value of Twitter/X for most was visibility—the media was on Twitter and paying attention and so were financial advisors. Investment firms had relevant contributions to make, and their use of relevant hashtags assured they’d be included and possibly attract interest and gain followers.

At its heyday, organic Twitter drove a decent amount of website traffic. Promoted tweets were a go-to move for those promoting webinars or other discrete offers.

Deleted accounts or drastically reduced posting characterizes the other 50 mostly private Twitter/X lists of various market watchers, economists and financial advisors that I’ve built since I joined in 2009.

ETF reporters aside, much of the financial media has left Twitter, some have gone to Threads, others pay closer attention to LinkedIn. Reverse chronological feeds—key to picking up on what’s new—are nearly impossible on both as the algo may serve you posts an hour or week old, depending on the platform’s agenda. Bluesky, on the other hand, supports the ability to customize feeds.

What to do?

“Can I love another social network like I loved Twitter?” I thought to myself as I was checking out Bluesky and liking what I saw. But that’s not the question (and of course, I can!).

Before investing in Bluesky, before working with the third-party apps to customize my experience, before encouraging clients to tiptoe in, I think the prudent move is to pay attention, get ready to proceed but give it a minute.

Simultaneous participation for both will be difficult to sustain. Here’s a take from Bloomberg opinion columnist Conor Sen, and see the responses.

For old times’ sake, I’ve created an Investment Managers list. As of the publication of this post, just two accounts have been added: J.P. Morgan Asset Management and Ark’s Cathie Wood.

It’s too soon to expect most firms to be willing to run the gauntlet required to be posting. But it’s not too soon to claim your account to keep it from being poached—do that today!

While the Lowe Group doesn’t have any regulatory restrictions on what we post, we’re going to go slow on posting. I’m seeing a lot of actual comments being shared as opposed to links being dropped. We’ll follow suit at least until we learn the decorum.

We’re cheering for Bluesky’s success, of course we are. The investment community could benefit from the return of a drama-free, politics-free information flow that brings everyone—managers, advisors, media, investors back together again—like in the glory days.

We’d love to hear your thoughts on the prospects for #finsky.

Subscribe.

Receive the latest news and insights from Lowe Group.