Communicating through the volatility: 6 ways it’s different this time

Key takeaways:

- More self-directed investors, heightened investment in easy-to-trade ETFs.

- Buy and hold isn’t the only message from asset managers and financial advisors.

- Social media further amplifies what can be emotional, hyperbolic, polarized analyses.

Let's start at the end and work backward.

Here’s what was learned at the conclusion of previous periods of extreme market volatility and drawdowns:

- On their own, investors get spooked and make mistakes.

- Unfortunate decisions—poorly timed selling, historically—can hurt investment performance. Working with an advisor (i.e., behavioral coaching) is worth about 1.5%–2% in additional annual returns, achieved by avoiding mistakes, according to Vanguard Advisor's Alpha program.

- Market volatility can be a catalyst for self-directed investors to seek financial advice.

- Some asset managers and financial advisory firms distinguish themselves, both with product flows, AUM growth and the retention of assets.

During market dislocations, communications from professionals in the form of market insights and analysis can go a long way to help investors of all types. You and your expertise can make a difference.

But the job of communicating today is very different from even five years ago when the market took its last steep (COVID-related) tumble.

1. More investors in the products you offer are self-directed

Mutual fund investors are traditionally described as “broker-controlled.” Redeeming a mutual fund typically involves going through one’s financial advisor and that intermediary step alone serves as an “emotional circuit breaker,” as Vanguard has said.

What’s different

That scenario has changed since COVID: Today there are far more self-directed investors (one-third of whom have advisory relationships, too, according to Broadridge data), and ETF usage has surged. Oh, and those self-directed, ETF-using investors are likely a growing segment of your firm’s client base, too.

Some believe the intraday tradability of ETFs leads to underperformance related to "ill-timed entries/exits."

As ETF marketers have learned, communicating with retail investors can require extra care and some shifts in approach—for example, more product education and less advisor shorthand. (Also see ETFs adoption by retail investors accelerates fund marketing’s rotation to B2C.)

It can be hotter money, too, depending on your product. The intraday tradability of ETFs leads to underperformance more related to “ill-timed entries/exits rather than poor ETF selection,” according to this study based on German ETF retail investors.

2. The search for information is always-on

Market uncertainty stimulates investor restlessness and search for answers. We see it in the gyrations of the market, but also in a heightened need to understand what’s going on. During the March 2020 crash, CNBC viewership rose 62%, its website traffic was up 56%. Traffic to your site may have been higher too.

Some have criticized the financial news networks for going into full blown "storm-watch" mode in the interest of attracting more viewers. But at least there’s an end to CNBC’s programming day.

What’s different

Today, thanks to always-on social media, market conversations take place at all times day and night. The result, especially during market turbulence, can be continuously advancing news, speculation, rumors, etc. with the potential to sweep investors up in the emotion and anxiety of it all.

Narratives in this environment can form fast. If you don’t already, we recommend you implement a discipline of “listening” to what’s being said online. This can be invaluable when developing timely, relevant content. Sometimes the most effective communication is one that addresses incomplete reports, misunderstandings or rumors head-on.

Traffic last Thursday to ETFdb.com was up 50% from the prior week and up more than 100% year over year. Friday's traffic was even stronger, according to VettaFI.

3. Market and investing insights and opinions are more plentiful

Financial news networks and the COVID superstars, Reddit and X, are still important sources of financial news and commentary for many.

What’s different

But investors today get investing insights (including advice) from a wider array of channels that include newsletters, podcasts, emails and social media accounts. This has a few implications for investment firms eager to share their views. We recommend:

- Prioritize what you can do easily and quickly. That means fire up emails, post to LinkedIn, publish content to your website—starting prominently on the home page, since that’s where people will look for it. But understand that won’t be enough today. Social media platforms, in particular, aren’t the go-to they once were for distributing links. Since 2020 the major sites (LinkedIn, X, Facebook, TikTok, Instagram/Threads) all deprioritize or limit the visibility of content that takes people off the network. A video snippet, short note or infographic posted natively might be your best bet to attract some attention.

- Be open-minded in considering invitations to appear on others’ platforms, to get in front of others’ audiences. When it comes to media, the investment industry is a fragmented marketplace with pockets of diverse opportunities. While your CEO may value the opportunity to talk to Barron’s, your sales team may be just as happy to distribute the highlights of a PM interview with an influential advisor podcaster (see Make the most of your podcast opportunities). If a creator is new to you, they will need to be vetted, of course.

- When you get a mention, run with it! Don’t assume that all will have seen your appearance, market what your market strategist said via email or social media yourself. Make the most of all visibility opportunities that also serve as third-party endorsements.

Being open-minded about invitations can

get you in front of new and bigger audiences.

4. New faces, personalities

Investors have been known to value and even take direction from individuals whose names they recognize. Has Fed Chairman Jerome Powell commented on the condition of the market? What does famed investor Warren Buffett think? What’s Jamie Dimon saying?

What’s different

Traditional media coverage is responsible for this awareness of a relative few commenters that helped shape views and even sentiment. That was back in the day. The widely reported rise of finfluencers and their success in building significant followings online has import for this moment too.

New media personalities are different from the old guard. They rarely represent the establishment and so are less constrained. They tend to comment (post) more often and use a more persuasive, colorful style—both of which adds to their impact. There are lots of them, with varied training and experience. The successful influencers are expert at recognizing the opportunity that is now, especially among younger demographics. At right is a TikTok video from @TheNewsGirl, whose video created yesterday attracted 403,000 views, 41,000 likes in less than 24 hours.

Influencers post frequently and in ways that drive engagement, amplification.

During any uncertainty, investors’ challenge is to consider the source. By now many consumers of investment information have developed an understanding that perspectives are likely to be colored by what’s good for the business of the firms represented. Some OG interviewees use appearances to “talk their book.”

Influencers also talk their own book because they’re compensated based on views and engagement. These are shorter term metrics that provide sufficient incentive to post frequently—especially when there’s high demand—and in ways designed to drive engagement and amplification.

To firms determined to a) cut through the continuous din b) make an impression and c) meaningfully help investors, we recommend you make a deliberate effort to be engaging. Keep it short and tight. Don’t make people work to understand your point. Focus on takeaways. Highlight data that gets to the essence of your position. Tell stories that people can relate to—and ideally share.

Such attributes are showing up in culture-type videos posted on many investment social media accounts. Time to do what you can to adopt the style and the finfluencers’ publishing cycle for market updates, too. What’s to keep you from becoming a bona fide social media guru?

5. The message may have changed. The medium, too.

What message do you have for investors? Back in the day, asset managers went from crisis to crisis, relying on the same playbook. The message was uniform: historical market data shows that the 60% stock/40% bond buy and hold investor is best advised to remain invested through the ups and downs of a market.

To be sure, many will continue to fly that flag over the weeks to come.

What’s different

But the response possible today involves more than just sitting tight.

Buying the dip worked out for many retail investors over the last few years and they are back at it again.

According to Vanda Research data dating to 2014, Thursday, April 3, was the biggest day of retail inflows, with $3 billion of net purchases of both individual stocks and ETFs, followed by $2.1 billion of purchases on Friday. ETFs specifically saw their most active trading day Monday, with $633 billion traded—representing 42% of all equity trading.

Investors today know there's

more to do than buy and hold.

Just a week or so in, we’re seeing promotional messages that advocate the investor take a range of actions—anywhere from “rebalance” to “cash out now.” Investors are being offered private markets as a way out of the public markets drama, crypto as a diversifier, the application of tax loss harvesting to offset capital gains, and any number of ETFs offering protection. All legitimate strategies and at the same time all plenty confusing for an investor whose head is already spinning.

Here again, whatever the solution you offer, there’s a TikTok video posted by a nonprofessional expert about it. We recommend firms and thought leaders match its simplicity and personality. Use the medium—and others that accommodate quick takes—to crystallize your product’s appeal and who it’s suitable for.

Whitepapers serve an important purpose, we’re big fans, we create them ourselves. But we’d caution you against planning them right now for the simple reason that they take too long to produce. These times call for quick hit communicating to do all of what’s described above: to be able to chime in on evolving narratives, to share your perspective and solutions via all opportunities as they arise, essentially to be in the mix and not wrapped up in a long format piece. If you have an extensive message, create a video that covers everything and publish it in chapters, with a transcript.

6. The quality and trustworthiness of the information

The wide variety of freelanced investment and financial content out there guarantees that it is not of equal quality or value, because of limitations in perspective, experience, training or editorial oversight. Blogs, podcasts and other forms of social media are part of the landscape, and most understand the content can be uneven.

What’s different

What’s more pronounced today and looms large as something investors need to deal with: misinformation, fake news and even manipulation or accusations of manipulation. Polarization in the country has made it into coverage of financial news, leading to more emotion and hyperbole than has been seen previously in market reporting. Social media enables “information” to travel fast, heightening investor vulnerability.

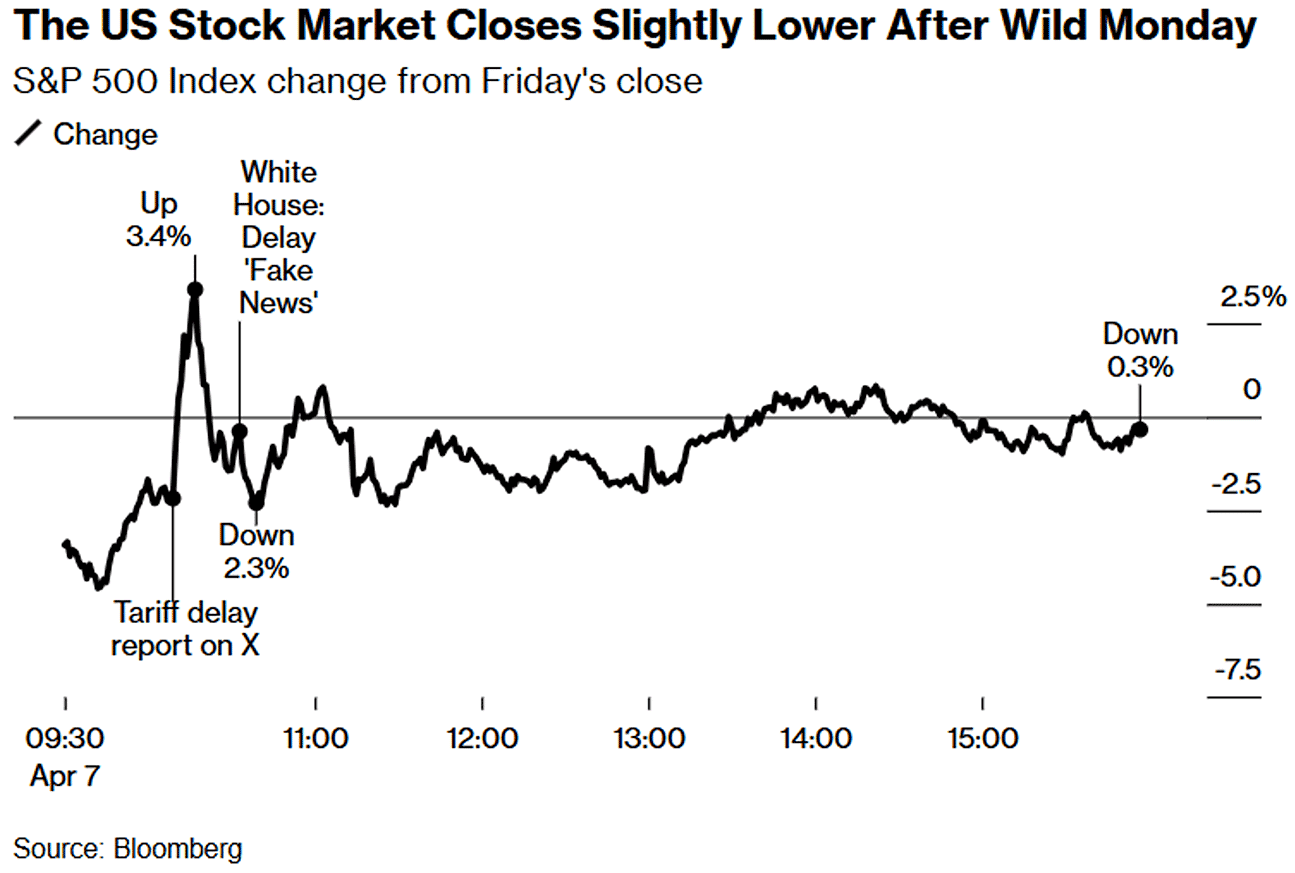

An extreme example of this occurred Monday when a rumor about a 90-day tariff pause drove the S&P 500 to jump 3.4%, only to plunge 2.3% when the White House used a two-word “Fake news” tweet to deny the report. Wednesday's actual pause, announced by Trump and foreshadowed in a post hours earlier, drove a stunning 9.5% jump in the S&P 500.

An extreme example of this occurred Monday when a rumor about a 90-day tariff pause drove the S&P 500 to jump 3.4%, only to plunge 2.3% when the White House used a two-word “Fake news” tweet to deny the report. Wednesday's actual pause, announced by Trump and foreshadowed in a post hours earlier, drove a stunning 9.5% jump in the S&P 500.

Day to day, investor confidence can further be shaken to hear market news reported in a less objective way, such as when a well respected market reporter calls the sitting president insane or another suggests that officials from the administration may be shorting or manipulating the market. It is a lot, for some it is too much.

In these times, during this uncertainty, the investment you’ve made in your brand and the commitment you've shown to investors’ best interests should help you stand apart. Investing requires trust. Every incremental communication you create, every email subject line, every headline on every chart, every datapoint on every chart, every social post is an opportunity to reinforce your firm's trustworthiness. We encourage you and your team to keep the investor’s trust front and center.

If history is any guide, all this too shall pass. Markets will calm down, investors will seek and find the help they need, and quality will prevail. Send us a note if we can help with your outreach, content or digital strategy.

Subscribe.

Receive the latest news and insights from Lowe Group.