AI is changing financial PR…for the better

Key takeaways:

- AI tools make it easier to match your pitch to the right reporter.

- AI can help create custom pitches and refine pitching strategy.

- These tools can help evaluate coverage and streamline reporting.

Every few months, Lowe Group holds what we call “Office Hours,” an open call for financial PR and digital marketing professionals to show up and discuss a topic affecting our work. Next Wednesday, May 21, our Office Hours will focus on the ways AI can get us all further, faster (our firm's mantra). Our team will share some examples of how AI can enhance both PR and digital marketing initiatives. Register here. Working industry professionals only, please.

In front of that, I'd like to jumpstart the conversation with a few of the AI-fueled changes we’ve implemented in our day-to-day PR work. While PR, especially media pitching, has already transitioned from old school strategies like mass pitching and generic releases to much more personalized, data-driven strategies, AI has accelerated that change. And we are excited about it.

PR is more than generating buzz. Getting people talking about your people or products is not enough. PR is now charged with building deeper relationships, driving awareness and visibility, helping your brand earn trust and credibility, and measuring the impact of your activities. In all of these areas, AI can accelerate those goals.

Journalist matching and custom pitching

We squirm when we see reporters call out an inappropriate or poorly targeted pitch on social media. It happens all too often. Most often, the pilloried publicist sent a pitch on a topic the journalist doesn’t cover or care about. or the reporter misunderstood what the journalist needs to do their job. And that provokes them enough to complain on LinkedIn.

But even seasoned pros occasionally send a bum pitch. In the past, we were proud of the custom lists we built focused on the key coverage areas—say equity or bond market writers, private equity or credit reporters, wealth management or estate planning industry scribes. But those lists would quickly become dated as journalists moved beats or publications or left journalism all together.

Now matching the right journalist and sharpening the pitch, with help from AI, has never been easier. Consider tools we now regularly use on the media database Muck Rack. When undertaking a campaign, it's possible to search by topic area and Muck Rack will assemble links to reporters writing on that topic now. And when building lists in Muck Rack, given a few names to start, Muck Rack will suggest other reporters covering the same subject.

“AI tools can help you find the right angles that might be of interest to a reporter.”

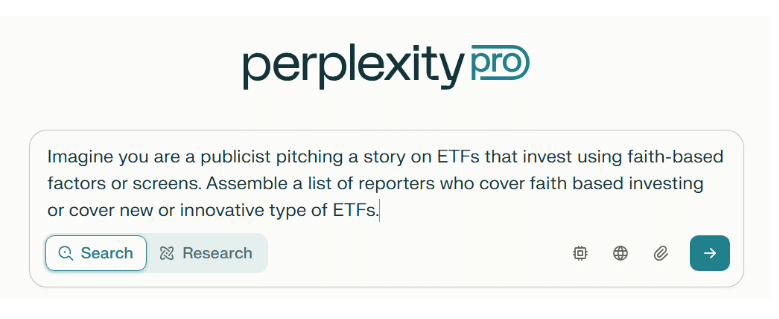

Even more helpful are prompts on LLMs like ChatGPT or Perplexity. As show below, in just a few seconds with the right prompt, we can identify relevant media, read their coverage and often find contact information.

This prompt delivered the following response:

Reporters and Journalists Covering Faith-Based Investing:

- Niamh Smith

Investigative journalist who has covered faith-aligned investing, including in-depth reporting for FaithInvest.

- Catherine Pepinster

Contributor to The Tablet, has interviewed faith-based investment leaders and covered sustainable, faith-driven investment topics.

- Kylie Knott

Reporter for the South China Morning Post, has written about religious groups directing assets into faith-consistent projects.

- Sarah Meyrick

Contributor to The Church Times, covers religion and investment, including environmental and faith-driven finance.

Reporters and Editors Covering ETFs and Innovative Investment Products:

- Steve Johnson

ETF correspondent at the Financial Times, covers new and innovative ETFs, including thematic and values-based products.

- Eric Balchunas

ETF analyst and reporter at Bloomberg, frequently covers ETF launches and trends, including values-based and niche ETFs.

- Catherine Cowdery

Reporter for Bloomberg Radio, hosts the Exchange-Traded Funds Report, covering new ETF products and industry news.

- Dave Nadig

CEO and prominent voice at ETF.com, covers ETF launches, trends, and unique strategies, including faith-based screens.

- Gregg Greenberg

Anchor at InvestmentNews, covers faith-based investing and ETF innovation, including interviews with industry leaders.

Notable Outlets and Their Faith-Based ETF Coverage:

| Outlet | Focus Area | Relevant Reporter(s) |

| FaithInvest | Faith-based investing, religious finance | Niamh Smith, Catherine Pepinster, Kylie Knott, Sarah Meyrick |

| ETF.com | ETF launches, trends, thematic ETFs | Dave Nadig |

| Financial Times | ETF industry, innovative products | Steve Johnson |

| Bloomberg/Bloomberg Radio | ETF trends, values-based investing | Eric Balchunas, Catherine Cowdery |

| InvestmentNews | Faith-based investing, ETF innovation | Gregg Greenberg |

| Fox Business | Faith-based investing as an ESG alternative | Will Lofland (quoted expert) |

| Zacks | ETF analysis, rankings, launches | Editorial team |

| Benzinga | ETF news, unique launches | Editorial team |

As with all output from Perplexity and other AI tools, this information is mostly helpful. While I may be less interested in reaching out to the South China Morning Post and the inclusion of Zacks and Benzinga at the end isn’t particularly helpful, many of the other reporters are on target. A little more research on the reporters and selected outlets is needed, but this search is effective in helping create a target list.

One caveat: PR pros need to be cognizant of the settings they use when using LLMs. Under no circumstances should you enter nonpublic or proprietary information about a new product or yet to be released information in free AI tools. They are continuously looking for new data to train on. Professional versions that you pay for have settings to keep what you enter private. Even then, tread very carefully.

Creating and refining your pitch

Should you use AI tools to automate pitching? They're capable of generating and sending pitches without human intervention. These pitches aren’t unlike the type of email sales pitches that I now get regularly that are customized to me based on information available online. They are often weirdly accurate but just slightly wrong in a way that only the recipient knows. The technology is there to train an AI tool to evaluate a reporter’s coverage area and background and send custom pitches.

At this point, we don’t trust these applications to get it right consistently, especially in more nuanced and complex topics like investments and financial services. But we are watching closely and suspect this technology will improve.

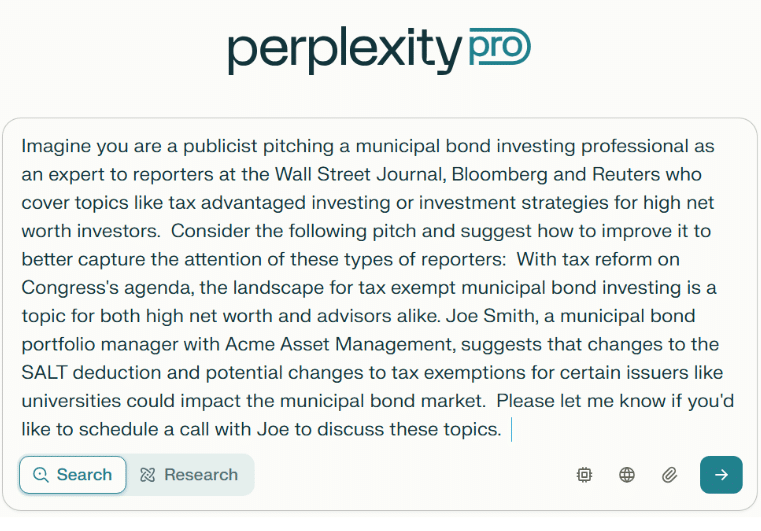

In addition to finding the right media to pitch, AI tools can help you find the right angles that might be of interest to a reporter. One way to do this is to share several recent articles written by a reporter, load a draft of your pitch, and ask AI to improve it.

Here is the result of the prompt, including a powerful subject line:

Here’s how you can improve your pitch:

Subject: How Looming Tax Reform Could Reshape Municipal Bond Strategies for High-Net-Worth Investors

With Congress poised to debate major tax reform-including a possible increase in the SALT deduction cap and potential changes to the tax-exempt status of municipal bonds-high-net-worth investors face a pivotal moment for tax-advantaged investing.

Joe Smith, CFA, municipal bond portfolio manager at Acme Asset Management, is closely tracking how proposed changes-such as raising the SALT cap to $30,000 and reconsidering tax exemptions for issuers like universities-could drive market volatility, alter muni valuations, and shift after-tax returns for affluent clients. Joe has helped clients navigate previous tax law overhauls and brings a data-driven perspective on:

- Which municipal sectors could see the biggest impact if tax exemptions are narrowed.

- How high-tax-state investors may adjust their portfolios if the SALT cap changes.

- Why muni bonds remain a cornerstone for wealth preservation-even amid legislative uncertainty.

Would you like to speak with Joe about how these tax reforms could reshape municipal bond strategies for high-net-worth clients? He can offer actionable insights, historical context, and forward-looking analysis for your next story.

For PR newbies just learning how to pitch, AI tools can help you get started more quickly and accelerate learning. But please share your draft pitches with an experienced team member to get feedback and make sure your pitch will land. Human review is still needed to make sure you don’t end up an example of a bad pitch on some reporter’s social media feed.

Evaluating strategy

We’ve commented previously about the specific considerations for investment brands in AI search. A public relations strategy aimed at distributing thought leadership and earning media results has never been more important. Having an expert or product that regularly appears in top notch media is important to building this visibility for AI models. Recent interviews on well-traveled news sites, placed articles that are timely and relevant, and case studies or white papers that address timely topics can help make sure your brand remains relevant and cited.

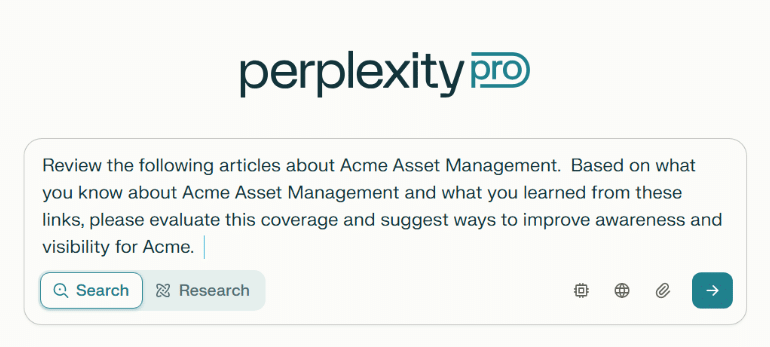

As you look to grow your brand’s reach and improve its standing, AI models can be queried to evaluate your existing brand and recommend ways to improve it. For example, create a list of your brand’s media coverage over the last quarter. Enter the list and the following prompt:

Depending on your goals, you can ask follow-up questions to line up with your company’s stated objectives. For example:

Acme Asset Management is looking to grow its brand awareness among independent registered investment advisors. Please suggest a media outreach plan including potential media targets and story topics.

AI tools can also help you quickly evaluate results. If your firm is receiving significant media coverage—for example, coverage of a leadership appointment or more challenging news of a crisis—AI can help you quickly identify the sentiment of each media outcome. Create a coverage list and ask AI to evaluate each article as positive, negative or neutral. Again, the tools aren’t perfect and still need human review, but they can accelerate the process of gathering and evaluating coverage.

One of my favorite use cases is to ask AI to check my own thinking. To that end, I loaded this blog post into Perplexity Pro and asked “please evaluate this blog post and offer any additional AI tools PR professionals should use.” Perplexity concluded the post is “well-structured, practical and balanced in its assessment of AI’s current capabilities and limitations” and offered a long list of companies offering AI tools for outreach automation, sentiment analysis, content generation and optimization, crisis monitoring and rapid response and others.

We’ll explore these topics as well as a few topics of importance for digital marketers at next week’s Office Hours. Hope to see you there.

Subscribe.

Receive the latest news and insights from Lowe Group.