ETF issuers, what’s your strategy to reach $100 million?

Key takeaways:

- Active ETFs are gaining ground on passive ETFs, but many ETFs today fall short of the $100 million AUM threshold

- In a crowded space, ETF issuers need to take steps to stand out in order to grow assets

- Before launching, issuers need a concrete plan to reach $100 million

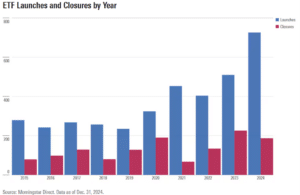

Last year was yet another record year for ETFs. They attracted $1.1 trillion in flows and issuers introduced a record 700 new products. Active ETFs continued to close the gap with their passive brethren, accounting for 77% of new launches.

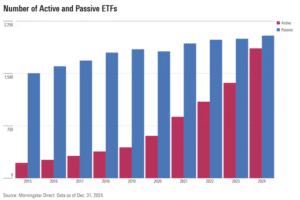

The opportunity for asset managers has never been greater, but this is all amidst intense competition and a sea of competitors. The truth is that many ETFs struggle to break through and reach $100 million in assets. According to Morningstar, more than 1,500 ETFs are below that threshold and 1,100 have less than $50 million. What this means is that, amid record launches, many ETFs are struggling for viability as Morningstar’s chart below suggests.

While a growing percentage of advisors—from RIAs to wirehouse advisors—are using ETFs and are hungry for these products, many are cognizant that ETFs with low AUMs have trading disadvantages and run the risk of closing. Advisors don’t want to recommend an ETF that closes. To be viable, then, ETFs need to have a plan to break out and attract assets.

So we ask all ETF issuers, what’s your plan to cross the key $100 million threshold?

Here are the components of a sustained launch campaign necessary to raise assets:

- Tell your ETF story. Make sure you have a compelling story about where your product fits in a portfolio. Advisors are looking for additional tactical choices. If your ETF has a proven strategy that is differentiated, make the case for the role the product can play in a well-diversified portfolio.

- Rely on your reputation and track record. While the first passive ETF was launched in 1993, active ETFs issuance began to accelerate only a few years ago after the SEC made it easier for them to gain approval. Active managers with an existing track record managing funds or other strategies should remind key partners that their product is available in an ETF wrapper. Initiate a campaign to reach key partners to let them know about your ETF.

- Promote your ETF with PR. Pitch your lead investment professionals, or better yet your ETF product specialist, to the media. Securing interviews on CNBC or key financial media can help support awareness. Make coverage available on your website and social platforms.

- Lean in to active. "While many believe that passive strategies will outperform indefinitely, the truth is that the relative performance relationships can be cyclical," said Scott Opsal, Director of Equities with Leuthold Group in a 2017 report. “In a rip-roaring bull market, the most profitable strategy is to close your eyes, hold on tight, don’t think too much, and ride the trend for all it’s worth. Passive investing is the ideal vehicle in this situation. But in rotating markets that are grinding slowly higher, in high risk and uncertain environments, and especially in bear markets where losing money becomes the ultimate concern, the wisdom, experience, and discretion provided by skilled active managers become valuable attributes.”

- Make it easy for retail investors to find and buy your ETF. Consumers make up a larger proportion of ETF buyers than other investment products. Make it easy for them to find your ETFs on your website and support their desire to buy by linking to the leading brokerage platforms.

- Lead with the ticker. ETFs are known by their tickers. On your website, fact sheets, social posts and all of your collateral materials, make sure your ticker is prominent. Search for your ETF’s ticker and see where you rank. If you aren’t ranking first for your own ticker, take action, whether it’s optimizing the fund profile or planning a pay-per-click campaign.

- Get social. ETF issuers, like no other product sponsor, are breaking new ground on social, especially on X. Celebrate every milestone, even minor ones, with regular posts.

- Get in front of ETF investors. ETF Exchange, VettaFi’s conference, is well attended by advisors and a good venue to meet and talk with interested buyers. If budget allows, webcasts on key advisor-facing media platforms like VettaFi and RIA Channel can get you in front of potential investors as well as score names for your sales team to reach out to.

- Create educational materials. Develop additional communications including videos and calculators that support your strategy and show advisors and individual investors how to use your ETF.

- Monitor your digital presence. Be sure analytics are in place to track what you can about overall interest in your product pages and sources of traffic to those pages. Where possible, do what you can to link visits to named visitors for follow-up by either your distribution or marketing teams.

Whether you’re planning a launch or are looking to revitalize an ETF that has thus far attracted tepid attention, we can help. Send us a note.

Subscribe.

Receive the latest news and insights from Lowe Group.