Home offices’ growing interest in active ETFs

Key takeaways:

- Gatekeepers at national accounts have strong interest in active ETFs

- Continued adoption will require education, including on total cost of ownership

- ETF share classes are imminent but will stretch the ecosystem

One of the least transparent aspects of fund distribution is how products get vetted by firm gatekeepers. That, and insights on how ETFs trade, were why Jody Lowe and I especially appreciated last week’s CFA Society of Chicago panel discussion on active ETFs, hosted by the Education Advisory Group and Women in ETFs and held at Morningstar.

The sold-out session brought together two representatives of the largest issuers—Rob Harvey, Dimensional Fund Advisors’ Co-Head of Product Specialists, and Michelle Mikos, Invesco’s Managing Director of ETFs—along with Alisa Maute, Executive Managing Director and Head of New Client Development for Mercer Advisors. Until October 2024, Maute had overseen LPL’s product shelf design and due diligence teams as EVP of Investment Product Management. Rounding out the panel were Rob Marrocco, Vice President and Global Head of ETF Listings for Cboe Global Markets, and the always deft Ben Johnson, Morningstar’s head of client solutions, as moderator.

Below we’ve combined our notes to pass on what we heard and learned.

- Active ETFs can be thought of as having evolved through three phases, Mikos said. Early investors of active ETFs, which debuted in 2008, invested in a portfolio manager (e.g., Bill Gross was available via BOND). In the second phase, starting in 2014 and running through 2020 investors bought the issuer’s brand (e.g., JP Morgan, Fidelity, Ark) and investors’ focus was on theme and asset class.

Today, though, there has been a proliferation of product types, and investors are expressly seeking an active ETF. Interest in active ETFs is strong, Mikos said.

“Home offices are making public statements about the asset classes they intend to add to.” ETFs’ transferability, ease of trading, operational ease and shortage of paper all appeal to firms.

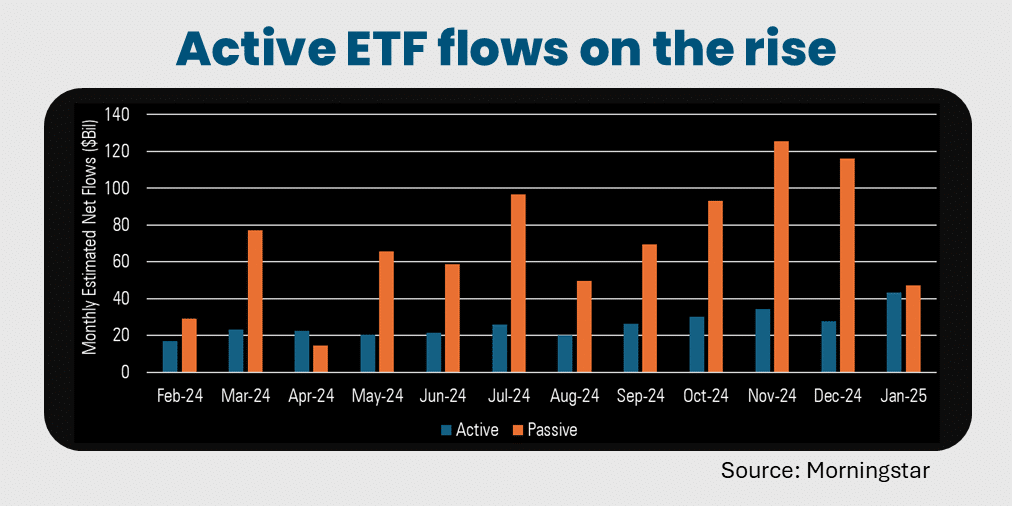

January’s $43.2 billion inflow into U.S.-listed actively managed ETFs marked a new monthly record—and accounted for nearly 48% of overall ETF inflows for the month.

— Ben Johnson, CFA (@MstarBenJohnson) February 14, 2025

On a trailing 12-month basis, active ETFs have soaked up 27% of total estimated net inflows into all U.S.-listed… pic.twitter.com/vv8ttCuJfn

Big Active ETF Milestones on the horizon:

— Ben Johnson, CFA (@MstarBenJohnson) February 20, 2025

1.) At ~$995 Bil active ETF AUM is within spitting distance of the Cuatro Comas Club

2.) By count, active ETFs now represent ~49% of all ETFs. Soon there will be more active ETFs than index ETFs

3.) Fully discretionary active ETFs still… pic.twitter.com/kKkoKd05Xp

- The panel discussed what active includes: systematic, fundamental and all the types represented in Johnson's piechart below, as shared on X. In evaluating funds for their platforms, Mikos said, gatekeepers yearn for a “taxonomy overlay” that enables product comparison. Also, home offices want repeatability, she said.

- Eighty percent of ETFs don’t trade more than 10,000 shares per day, according to Marrocco, which explains why many have larger bid-ask spreads. In the absence of significant trading volume, market makers need to make their money somewhere, he said.

Every issuer has a role to play in educating users about the interplay of cost, volume, liquidity, spreads and returns, said Harvey. The panel commented on the concept of the total cost of ownership (TCO) of an ETF, a topic DFA has produced research on in support of its product line. TCO considers a holistic evaluation that goes beyond focusing just on expense ratios. Reconstitution events, when an index adds or removes holdings, can lead to a passive ETF buying at disadvantaged times and should be considered when comparing active systematic ETFs, DFA argues.

- Marrocco and others commented on structured protection ETFs. While using options to shape the outcome of a portfolio is an established process, the strategy can be a more attractive solution—more efficient, cheaper and with intraday liquidity—in an ETF wrapper. “Ordinarily you’d need additional paperwork from clients for options strategies but with these you don’t need to,” says Marrocco. “The client is just buying an equity.”

Home offices like such ETFs because they’re a way to keep money on the platform, it’s not going out the door to insurance or annuity products, said Mikos.

- Does offering clone ETFs result in cannibalization of existing mutual fund assets? The panel's consensus was no. That was the concern in 2021 when Fidelity introduced the lower-cost Magellan ETF FMAG but it did not materialize, according to Marrocco. Instead, it lifted flows to both products. Calling cannibalization a myth, he said “most people aren’t going to make a move for a few basis points.”

- Marrocco commented on what he expects to be a wave of products coming to market in the next “12 to 18 to 24 months” in the form of ETF share classes. He noted that the Cboe was the first exchange to apply for SEC approval to list and trade share classes of existing mutual funds. Later, Mikos told us that the home offices also expect SEC approval in 2025—they’re just hoping they don’t see products until 2026 to give them time to prepare.

Big Active ETF Milestones on the horizon:

— Ben Johnson, CFA (@MstarBenJohnson) February 20, 2025

1.) At ~$995 Bil active ETF AUM is within spitting distance of the Cuatro Comas Club

2.) By count, active ETFs now represent ~49% of all ETFs. Soon there will be more active ETFs than index ETFs

3.) Fully discretionary active ETFs still… pic.twitter.com/kKkoKd05Xp

- Less likely anytime soon is the introduction of ETFs in 401(k)s, according to the panelists. All the “piping” in retirement plans is for mutual funds, said Mikos. The likelier path, which is happening now, is mutual funds being converted into CITs, Johnson added.

- In response to a question, Marrocco ventured that breakeven on an ETF was $30 million to $50 million, after considering all costs including a capital markets function. For that reason, he said, issuers of “onesie, twosie” product lines may be better advised going the white label route.

Our thanks to the event organizers for producing such a valuable discussion.

Subscribe.

Receive the latest news and insights from Lowe Group.