Commenting on today’s volatility takes courage

Key takeaways:

- Fast breaking news can require quick pivots.

- Given the uncertainty, it’s acceptable to admit you don’t know.

- Media opportunities provide the occasion to educate, elevate awareness.

The goal, as investment communications pros know, is to build trust, maintain relevance, and help guide clients through uncertainty. But when policy and markets make wide shifts from day to day—even hour to hour—what you say one moment can immediately become irrelevant the next.

This time there is a sense that the typical market volatility playbook may have changed. Sir John Templeton said the most dangerous words an investor can say is “this time is different.” But with tariff news changing from one day to the next and an administration whose economic policies are unlike any we’ve seen in prior administrations, many are suggesting we may be facing a whole new set of rules. We commented last week, via a blog post and video, about how the marketing communications playbook is different.

It takes courage to stick your neck out in this environment. And last week, we saw a few brave souls offering their thoughts on this remarkable market. We believe clients and media alike appreciate thought leaders who are willing to talk when the going gets tough. Below we give the courageous communicators a shout-out.

When on tour...

What do you do when the markets turn crazy in the midst of an in-person media tour? You capitalize on it! Volatile markets present a great opportunity to reach a broader audience as viewership and interest spike, and advisors and investors tune in to make sense of what is going on.

Allspring Global Senior Portfolio Manager Bryant VanCronkhite made the most of scheduled in-person media visits with Bloomberg, Yahoo Finance, and InvestmentNews at the NYSE, sharing the highlights on social. And, while he had our attention, VanCronkhite took the time to provide a thoughtful post on LinkedIn, summarizing how his team is thinking about the markets.

“When volatility spikes, it’s tempting to focus on timing the bottom. But the more durable question for long-term investors is usually 𝘸𝘩𝘢𝘵 happens next—not 𝘸𝘩𝘦𝘯,” he wrote. Below is an excerpt of the post.

Similarly, when markets first began to show signs of cracking in March, Leuthold Group Chief Investment Officer Doug Ramsey provided on-air context on CNBC and Bloomberg about past bear markets. Ramsey shared his view that the markets serve as a great predictor of recession and can even contribute to a downturn due to the wealth effect. More recently, Ramsey offered some historical perspective on “buying the dip,” a topic that was on a lot of minds amid the huge market swings (his answer: no).

Return to fundamentals

Reminding people why they invest is an effective way to divert attention from things they cannot control like tariff policy. Johnson Financial Group CIO Dominic Ceci spoke with a local business journalist at the Milwaukee Journal Sentinel, noting, “It would be rare that I would make some big investment change based on a government policy. We’re paying attention to it but, in general, most people are investing in a time period that’s more than a couple of months.” Ceci’s comments were amplified when the Journal Sentinel story was syndicated by Gannett including in USA Today.

Similarly, in a Financial Planning article offering tips to advisors to help them address client concerns, JFG’s VP and Portfolio Manager Brian Schaefer noted, “Clients don’t respond to clichés and empty phrases like ‘don’t panic. This is when building trust through active listening and consistent communication over the years pays off…It forms the foundation.”

Admitting you do not know

In this environment, you get extra points for simply admitting you don’t know. Talking with National Public Radio last week, Commonwealth Chief Strategist Chris Fasciano noted, “There's just so much uncertainty out there about what the endgame is and what things are going to look like. Until that's understood, I think it's really hard for consumers to make decisions about their spending patterns.”

Fasciano reiterated the point to WealthManagement.com: “Until the endgame is understood, uncertainty will run high. This is true for consumers making spending decisions, companies making capital project decisions, and investors making allocation decisions.”

Be prepared

Bonus points last week went to Allspring Global Chief Investment Strategist George Bory who was Johnny-on-the-spot, jumping on a call with a Reuters reporter just a few minutes after President Trump’s Liberation Day tariff plan was announced. Bory was quoted in this widely syndicated Reuters story discussing the equity markets.

In addition, the equities-focused reporter shared call notes with his bond market colleague who used longer quotes in a rundown story the next day. Bory noted he was waiting to see what was going to happen: "The bond market is not fully pricing in a recession yet—emphasize yet, as the bigger variable here, which is harder to calibrate, is inflation. And while we're expecting slower growth, perhaps meaningfully slower growth, the outlook for inflation is still unclear.”

Similarly, Calamos Wealth Management Chief Investment Officer Jon Adams provided useful context for this USA Today story on the selloff in Treasuries.

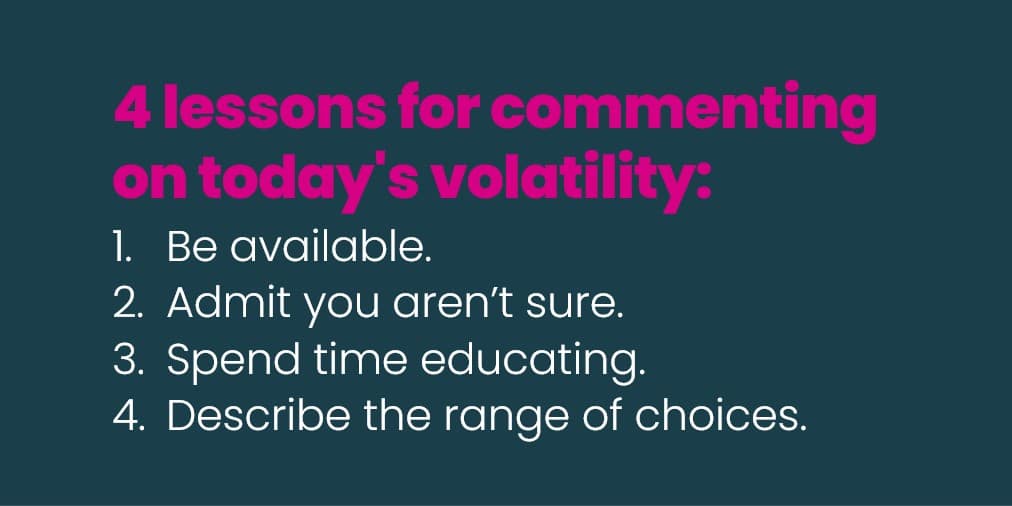

The lessons

Be available. While most financial professionals feel the instinct to hide during market turmoil, periods of market volatility give thought leaders a chance to elevate awareness at a time when audience attention is high.

Admit you aren’t sure. It’s OK to say you don’t know. Describe the information you are looking at and make it clear that you are paying close and thoughtful attention.

Spend time educating. Many of the strategists and CIOs we know spent hours last week in meetings and on conference calls educating advisors and clients on what was happening. Share those insights with the media as well.

Describe the range of choices. While we won’t know whether this time is in fact different, helping clients and advisors through the range of actions from buying the dip, to taking advantage of the down market to harvesting losses for tax purposes, to cutting back on spending and building a reserve.

Periods of extreme market volatility, in our experience, are excellent times to make thought leaders available to talk to the media. Investors’ attention is elevated, and smart prognosticators can offer context and insights elevating awareness to build credibility and trust.

For more information on Lowe Group’s media relations consulting, send us a note.

Subscribe.

Receive the latest news and insights from Lowe Group.