The data, the content, the CTAs: How the latest ETFs are being marketed

Key takeaways:

- ETF launches are on a record pace for 2025.

- Issuers’ appropriate focus is on the data, the content—less so on social.

- Volatile markets are when ETFs make greater market share gains.

ETF product development—nothing if not opportunistic—has continued unabated through the market volatility. The industry launched 50 ETFs in the first three weeks of April, according to last week's ETF Prime podcast with host Nate Geraci and VettaFi’s Kirsten Chang. That’s just slightly off the average of 75 a month in the first quarter. A total of 288 funds have come to market year to date compared to 120 by the same time last year.

The hardy newcomers that launched during a major market meltdown are a motley collection that includes active equity, leveraged, and single stock ETFs as well as some funds seeking to disrupt by providing new and different market access.

The innovation continues, in other words. So, naturally I wondered whether the disruptors and other issuers—a mix of upstarts and established providers—are bringing anything different to fund marketing. We appreciate how ETF marketing has introduced a level of aggressiveness to the asset management space, and I’m always on the lookout for new entrants’ elevating the state of the art.

So much of the competition for attention for a new fund happens online. While one might expect established fund companies to wield an advantage given their existing content publishing platform and likely more resources, that’s not always the case.

More dominant business priorities (or stakeholders even) can keep the launch of an ETF product line from getting its due on the home page. An inflexible legacy content management system can prevent a firm from being able to properly integrate the ETFs on a site or optimize for mobile, including the iPad.

Conversely, newbie ETF teams may not be privy to some of the go-to moves practiced by fund marketers, especially those familiar with what professional investors expect to find on a site.

Below are observations and best practice notes from a spotcheck of how issuers have supported the new products of 2025 on their websites.

Fund data nuts and bolts

SEC Rule 6c-11 spells out the minimum data that needs to be included on the ETF fund profile, and all issuers hit that mark. Beyond that, there’s some variety.

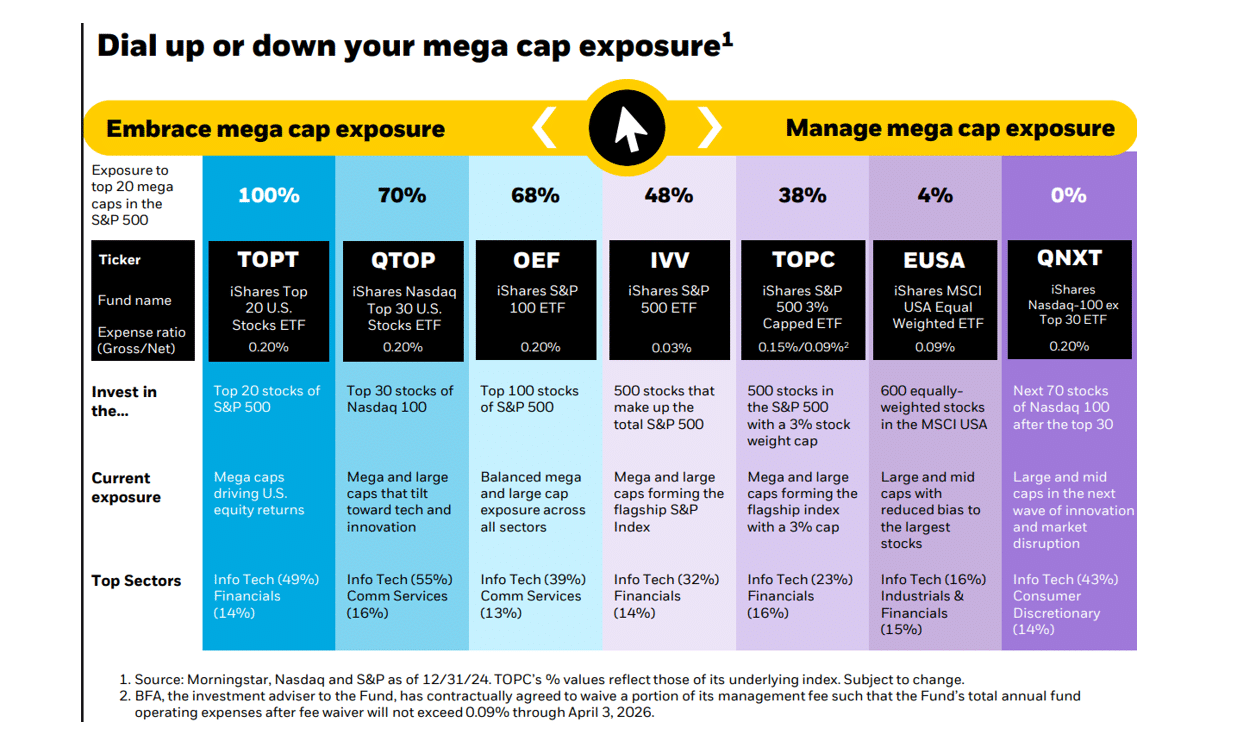

It’s probably not fair to compare how the world’s largest ETF issuer presents its new fund TOPC to the early efforts of an issuer who just endured the harrowing process of launching its first fund. But, as iShares (BlackRock) goes, so goes the industry, on fund websites at least.

One feature that’s now part of iShares profiles but not yet most other issuers’: A chart showing the growth of a hypothetical $10,000 investment, a remnant from mutual fund marketing. (Elsewhere, we’ve also seen a few style boxes pop up on ETF communications, too.) iShares also publishes many more datapoints, including 30-day average volume, daily volume and 30-day media bid/ask spread, likely in response to requests

Is there a launch fact sheet? Where’s the link? Making fact sheets (PDFs) available for every product and offering a link to them at multiple points on the page but most especially at the tippity top has become de rigueur on most established fund company fund profiles. If you don’t yet, we encourage you to follow suit. Financial advisors are known for hitting a new product page, downloading a fact sheet and taking off. Let’s not make them look for the link.

Here’s something you don’t see everywhere: Thornburg and Calamos offer QR codes on their fact sheets.

And this is related to what?

It can be a cold world if you’re launching an ETF in 2025 without providing any context for its value proposition. Don’t expect buyers—advisors or retail investors—to go there alone, you need to make the argument for the product, and how and where to use it.

You don’t have to be iShares to create content. Looks like the Longview Advantage ETF team published five blog posts about their strategy ahead of the April launch of its EBI. Daily Delta ETFs offers options charts on their home page. Thornburg and Brookmont publish related content blog posts to the fund profiles.

Praxis Investment Management, a Lowe Group client, sponsored research to reveal something that’s missing in the client/advisor relationship—and then went on to launch two faith-based equity ETFs.

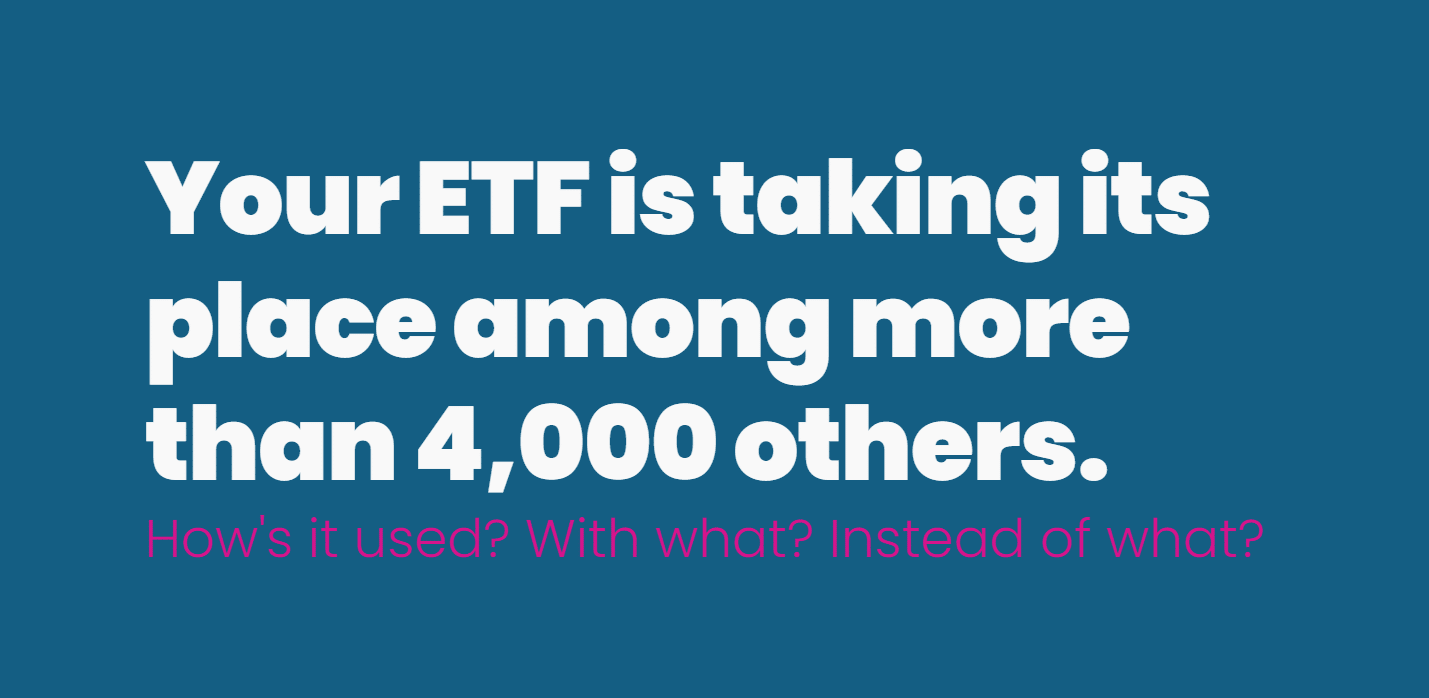

Your product is taking its place among more than 4,000 others. How’s it used? With what? Instead of what? iShares' TOPC is part of a suite called Build ETFs so the firm positioned it in place with the others. The table below appears in a Product Brief, linked to the top of the profile.

A few issuers include mini commercial videos as part of their launches. Check your analytics, not sure you need an introductory video at launch.

Two essential support features

I’ll admit that I consider two features as a measure of how aggressive/competitive an issuer intends to be. But their omission from a site may just mean that a firm hasn’t fully focused on how sales need to happen.

I check:

- Is the firm making an effort to acquire names as a means of gaining some insight to who’s interested in their ETFs, and for follow-up? This screenshot from newcomer Unlimited shows you they’re locked in.

- Where’s that Buy now button on the fund profiles and elsewhere? At every point, you want to reduce any friction that stands in the way of an investor taking action, especially because you’re likely to be meeting retail investors who may not know how or where to buy.

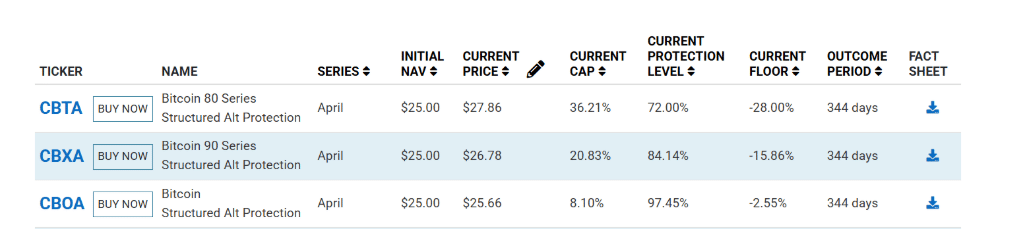

I see that Calamos, my alma mater and issuer of several ETFs this year, has now taken to adding the button to the structured protection fund listing page.

Social media receding?

An ETF launch can use all the attention it can get, and that usually means from the broadest marketing mix possible. There was a time when that included social media and especially X (Twitter, when this was true).

ENDW, the Cambria Endowment Style ETF, has a powerful spokesman in Cambria CEO Meb Faber posting supportive content to X and LinkedIn. Former hedge fund manager Bob Elliott, Unlimited CEO, CIO and Portfolio Manager of the new HFGM, is active on X, LinkedIn and Bluesky. But neither of their websites shows any social icons, and the Unlimited X account hasn’t sent a tweet since 2022.

Lazard and Brookmont are among 2025’s new issuers whose plans also don’t include X. Some of the newcomers show no social icons—not even LinkedIn—on their sites.

There’s more to say on this, but let’s save that for another time.

Best of luck to all those early out of the gate this year. We’re cheering for your success while mindful of the battle ahead.

For more information on how Lowe Group can help, send us a note.

Subscribe.

Receive the latest news and insights from Lowe Group.