LoweDown Blog.

Insights on issues impacting the investment industry.

The Latest

How would email SEO work for investment firms?

The life of email content could be extended by appearing in Google search results. How would that work exactly? We’re eager to learn more.

The data, the content, the CTAs: How the latest ETFs are being marketed

A look at how 2025 issuers are supporting their product launches.

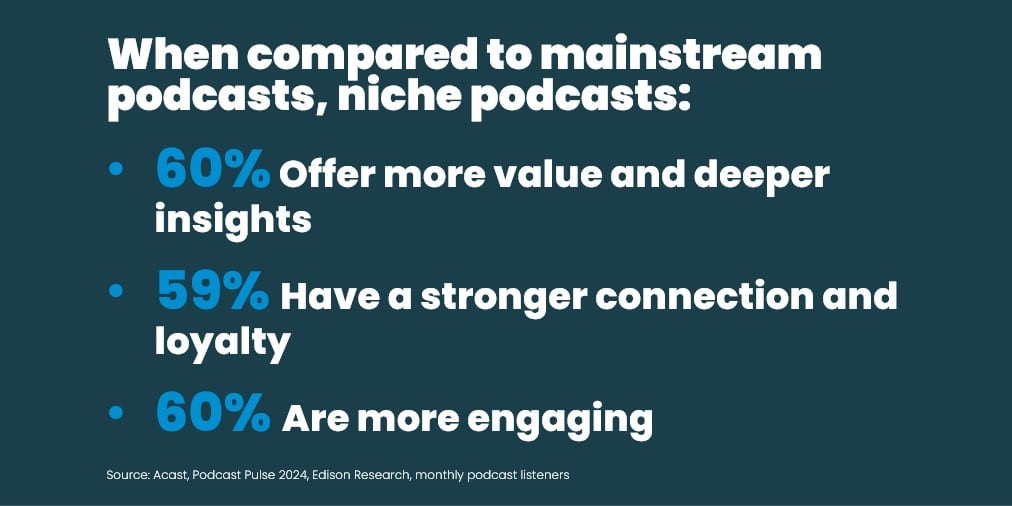

Smaller podcasts can offer just as much value

Niche podcasts provide the opportunity to find your community and assert your authority.

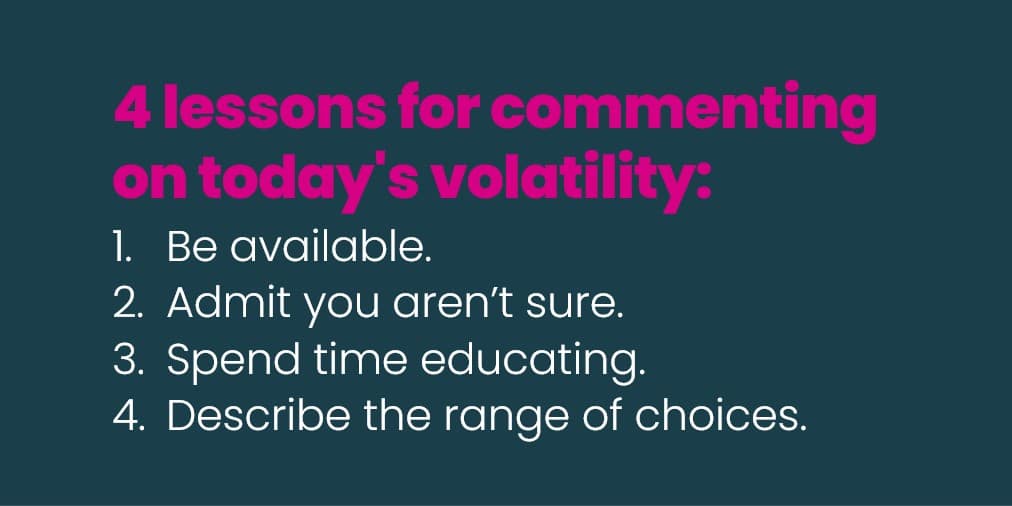

Commenting on today’s volatility takes courage

Jody Lowe offers four lessons for offering insights to the media and others during uncertain times.

Communicating through the volatility: 6 ways it’s different this time

Is it different this time? Maybe not in the markets, but communicating during this drawdown is very different from even five years ago.

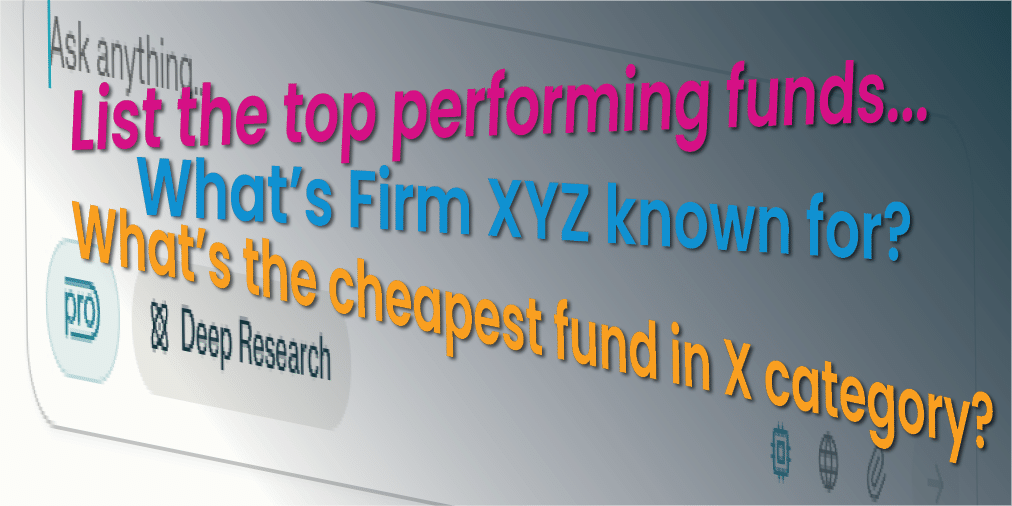

The specific considerations for investment brands in AI search

PR efforts to date should benefit the brand, but LLMs are struggling reading many mutual fund, ETF product pages.

Future Proof Citywide: A refreshing, productive event

The highlight of the upstart conference: one-on-one meetings that facilitate connection between advisors and other participants.

Insider’s list of investing podcasts [March 2025 update]

Eight new titles have been added to the Lowe Group’s Insider’s List of Investing Podcasts.

PR tips for financial advisors: How to secure earned media coverage

Reporters like to quote smart financial advisors who can help them navigate personal finance topics.

Interviews by email? Not always a good idea

Making a bigger investment in time and connection leads to richer, more engaged interviews.

Subscribe.

Receive the latest

LoweDown blog posts.