Paid search offers visibility benefits, even as costs rise and habits shift

Key takeaways:

- Searchers increasingly click on paid ads, driving clickthroughs and costs.

- Pay-per-click advertising is a common strategy among leading asset managers and wealth management firms with sizable budgets.

- A transactional channel, PPC may face future challenges from longer tail searches migrating to AI search.

Darn, I fell for it again!

Hope springs eternal when I receive emails from vendors promising insight on “your industry.”

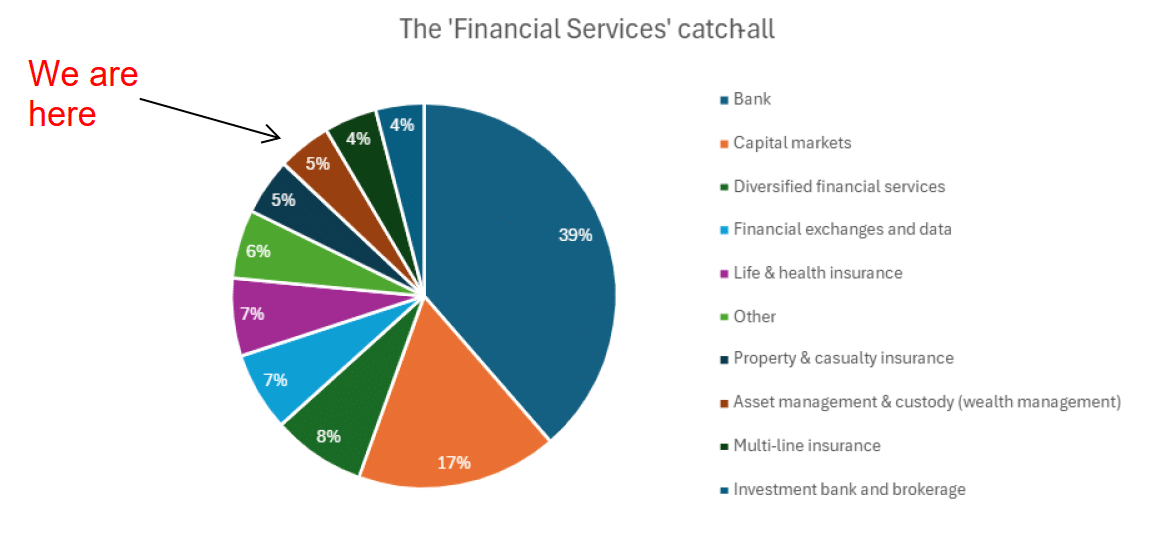

Reality sets in when I click through to see that what’s being represented as my industry is some categorization of Financial Services. With respect, the asset management and wealth management industries are too different to be blithely lumped in with the other subgroups in the general money business. Such “industry benchmarks” are largely useless.

But the email promised trends on Google Ads and Microsoft Ads from 2024 so I checked it out.

The high level, from Wordstream’s report:

- Clickthrough on pay per click (PPC) ads has improved for most industries—including and especially for the advertisers in Wordstream’s Finance & Insurance grouping.

- Cost per click increased for most.

- Conversion rates decreased minimally for half of the industries. It was down 33% for Finance & Insurance, reflecting the fact that conversion often takes place offline or in other channels.

- Cost per lead increased.

The conclusion: “Increases in CTR indicate that the SERP [Search Engine Results Page] is becoming more ad-friendly—for many queries, most results above the fold are ads, and ads continue to blend into organic results.”

Terms asset managers, wealth managers are buying

This research piqued my curiosity about what PPC-advertising asset managers and wealth managers are up to lately so I switched over to Spyfu.com. If you’re not familiar with it, a quick shoutout to the site as a source of some competitive intelligence. You’ll find the Google Ads data like what I show below, but also there’s an SEO Overview tab for each advertiser with some data on organic keywords that might be helpful to you.

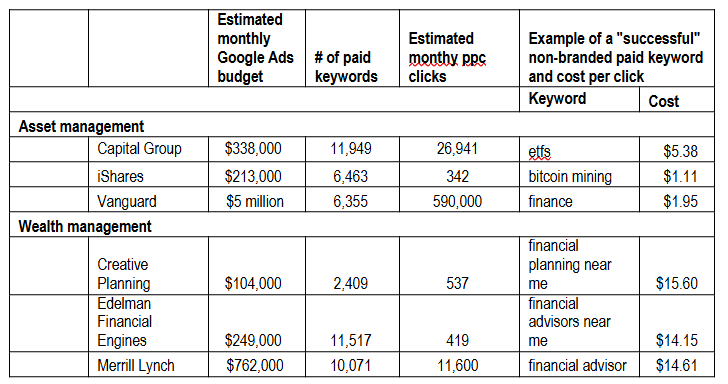

To get idea of the state of play, let’s look at the more prominent industry advertisers, three from asset management (Capital Group, iShares and Vanguard) and three from wealth management (Merrill Lynch, Edelman Financial Engines, and Creative Planning). This data provides a snapshot into how industry leaders, with significant budgets, are making use of a channel that not all firms turn to. It’s always fascinating to see the terms that advertisers are bidding on, how much they're willing to pay to win the auction, and the amount of traffic they’re driving.

These are estimates by SpyFu, a vendor that's been in the business for years. According to their explanation: “We take all of the domain's paid keywords and use the click-through curve to get an idea of how much the domain spent overall. That leaves us with an estimated spending figure that we show at the top of the domain results page. We spread that average over one month to give you a figure you can compare other budgets to.”

What we can’t see is the return on these investments. All advertisers have been using Google Ads for a while—which I’d interpret to mean that they are successful with these strategies. The Vanguard spend is stunning to me, as is the amount of clicks they’re getting. The wealth management data represents a flex on the part of these national firms, with the budgets to scoop up local opportunities.

And yet, we’re looking at these programs at what may be a turning point for traffic heading to Google, given the growing reliance on LLMs for informational searches and the way people search. More on that later.

PPC captures high intent

Pay-per-click advertising is a high wire act. There’s no better motivation to get every piece of the offer right—the ad copy, the offer, the landing page, the conversion path—than knowing you will pay an explicit price for that click. I still remember a former CFO’s horror when he learned that we paid for clicks.

Good thoughts only to the marketers responsible for converting searches for “truck collision attorney,” which at $1,003 is the highest cpc as of May 2025. The source of this datapoint, the ppc.io blog, analyzed keywords by industry. Unfortunately, due to the breadth of their “Finance” category, invoice factoring and business loans dominated the rankings. Two exceptions: “investment banking services” topped the list at $258 per click and “wealth management services” placed at $64 per click.)

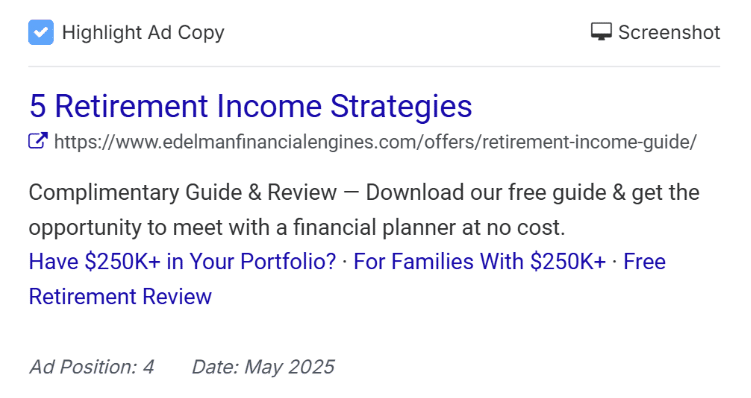

The highest cost per click I saw in our set of six was for this search: “what should you do with your 401k when you retire.” Edelman pays $40.16 for clicks on the ad below—when they can win the auction, that is. From the cost and the data showing that Edelman gets less than 10% share, this is a valuable search, no doubt because of its strong intent. BlackRock, Fidelity and Schwab are among others who pay to rank for the term.

$40 for a lead from the searcher’s download of the advertised guide, in exchange for contact information that an expert salesperson can run with, may in fact be quite cost-effective.

Transactional vs. brand-building

All that said, there’s something about pay-per-click that seems increasingly anachronistic. Are that many people really still searching single words and submitting high level searches like “etfs” and “finance”? And does it represent traffic that the leading firms in the industry—all of whom increasingly communicate directly to retail investors—value and maybe even rely on?

If today, right now, you searched for “what should you do with your 401k when you retire,” you are likely to see an AI overview response at the top of the page, well above Edelman and others’ ads. When I search for the phrase and click on “More” to see the websites cited as having contributed to the synthesized response, I don’t see Edelman or any of the PPC advertisers in the results.

To me this illustrates the transactional nature of pay per click—you’re only as relevant as your budget enables you to be. It’s one reason I tend to discourage smaller firms from wading in. PPC advertising doesn’t help build brand equity like content marketing or SEO does. Going forward, you may be happier that you invested in those tactics. This is notwithstanding Wordstream’s optimistic assessment of the search engine results pages getting more friendly.

It wasn’t by design, but what started as casual research on my part brings us back to a theme that we have been sounding all year: When it comes to online visibility—even when you’re eager and able to pay for it—the sands are shifting. Near-retirees may click on paid ads for some time into the future. That’s good and buys ppc advertisers some time. But long tail searches, like the one about 401(k)s post-retirement? They’re heading toward AI search.

This is just another reminder that there’s no time like now to focus on how to “win” recognition in a new kind of competition—and that’s being considered relevant and having something to contribute that is extractable for AI search.

Subscribe.

Receive the latest news and insights from Lowe Group.