Earned media: The PR workhorse of visibility for ETFs, other investment products and services

Key takeaways:

- Earned media includes coverage or attention your firm gets that is not paid

- Research shows earned media is viewed as more credible than paid activities

- Earned media has important synergies with other marketing activities

Recently, while listening to a podcast about ETF launch marketing strategies, an expert extolled the value of earned media as one of the most important strategies for growing ETF assets. We agree that earned media is the workhorse in the PR toolkit to drive awareness, visibility, engagement and ultimately growth.

What is earned media?

Earned media, at its most basic level, is any publicity or exposure that is not directly controlled or paid for by the company or organization. This includes articles written by reputable news organizations about your firm, your products or your thought leaders. For investment firms, the most powerful earned media can include articles in the Wall Street Journal or Barron’s, broadcast interviews on CNBC or Bloomberg, and podcast invitations from shows like The Compound and Friends, The Long View or Capital Allocators.

These are referred to as earned opportunities for a reason—and no amount of money spent on advertising or other paid activities can deliver the awareness that high profile positive editorial coverage can deliver. These stories have genuine news value and can shed light on your firm’s accomplishments in ways you can’t describe yourself.

Research from the Institute for Public Relations bears this out and suggests earned media plays a larger role than paid strategies in shaping perceptions and influencing actions by providing a third-party validation that boosts credibility. What's more, unlike paid media which is constrained by budget, there is no limit to the amount of earned media a firm can attract. The sky's the limit—as we have seen time after time when a client story resonates.

Earned media also includes the inclusion of a firm, thought leader or company representative in rankings based on tangible measures (asset growth, investment results, number of products/locations) or intangible measures (quality of management, brand recognition) such as gold, silver or bronze parent ratings from Morningstar. We’d include awards and keynote-speaking opportunities as earned outcomes that can help raise visibility.

Earned media builds authority and trust

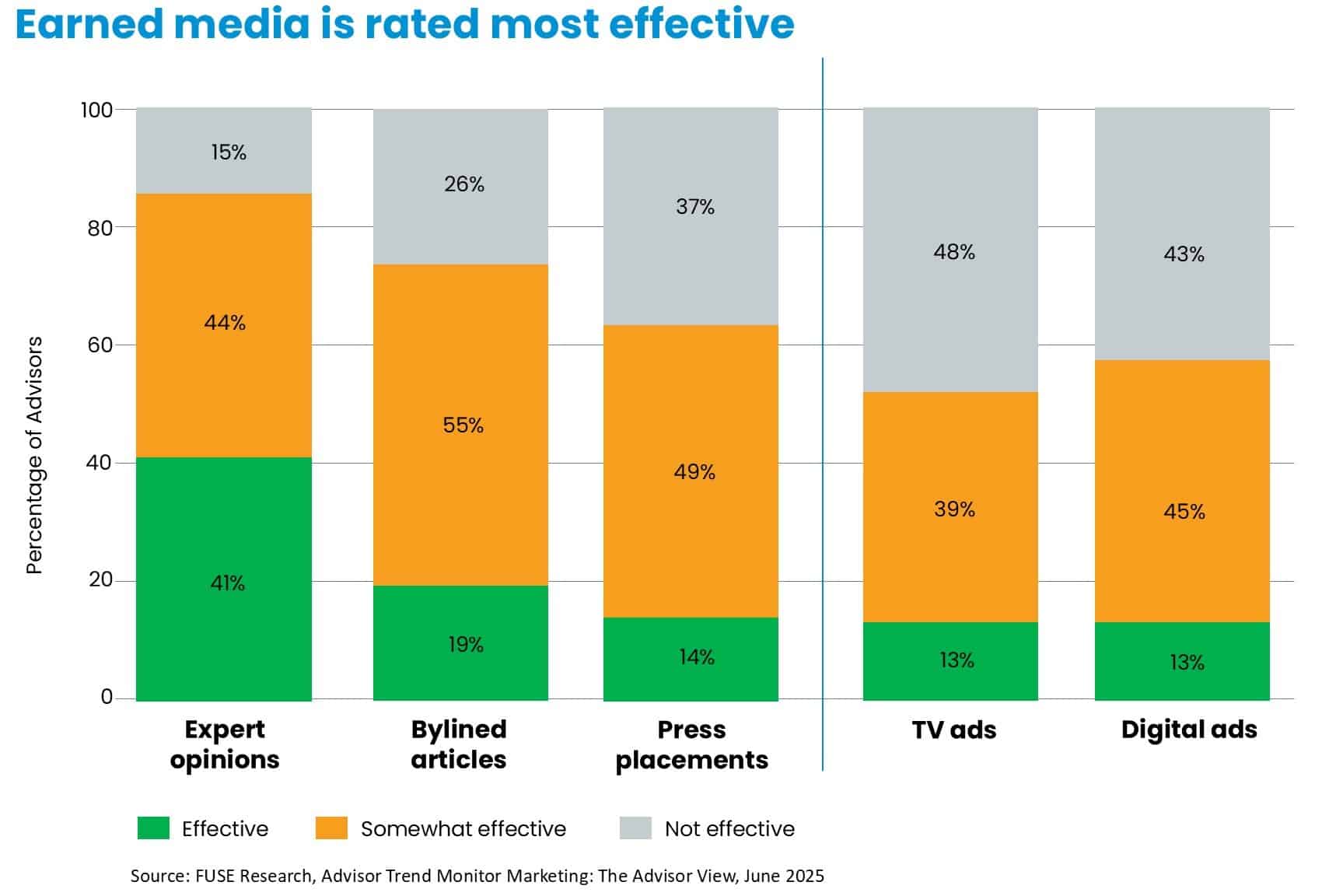

Earned media alone can be one of the most powerful drivers of visibility for financial firms because of this perception that it is more credible than advertising, marketing messages or sponsored content. In some cases, it is almost an endorsement. We’re fond of the research from FUSE Research that repeatedly finds earned media such as press placements and expert opinions useful for reaching advisors.

Earned media and the PESO model

Earned media works best when combined with other marketing and brand-building activities including paid strategies, how your brand is presented on your website, and what is shared on social media.

Those who are fans of Gini Dietrich’s PESO model, as we are, recognize the significant role earned media plays in the synergy among Paid, Earned, Shared and Owned media. Dietrich includes all of the following under what she calls “Earned Media: Credibility” in her most recent updated model:

- Referrals

- Link-building

- Media relations

- Word-of-mouth

- Bogger relations

- Investor relations

- Social media news anchors

- Review sites

- Comments

- Engagement (on X and Reddit, for example)

- Wikipedia

Her updated model also includes Community activities as part of earned strategies including reviews, co-branding, partnerships, community building, brand ambassadors, user-generated content and corporate social responsibility (CSR).

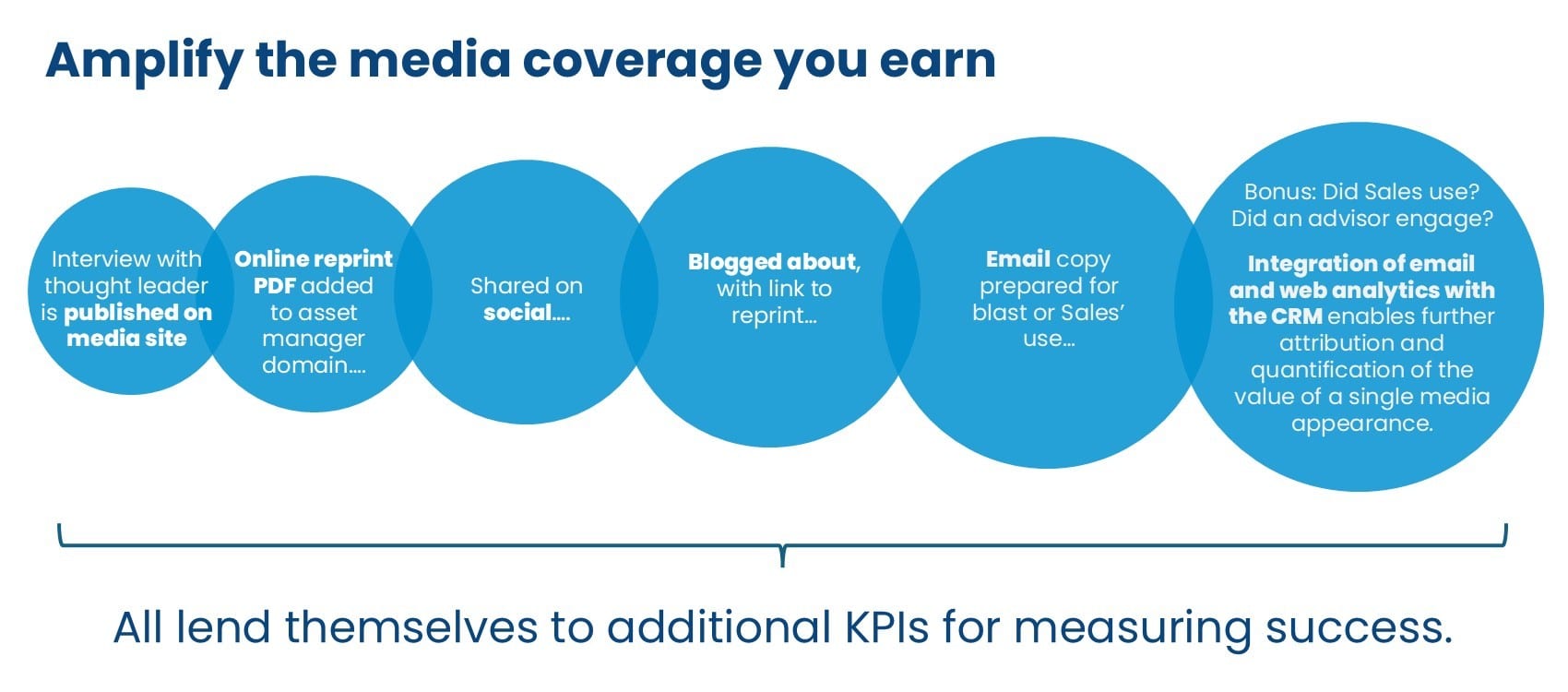

This illustration shows how earned media can work for an asset management firm in conjunction with owned and shared media to amplify its impact.

Earned and paid: better together

Earned media can help amplify the results of paid advertising strategies by helping ad budgets go further.

Take, for example, efforts to raise awareness of the myriad new active ETFs coming to market. Many asset managers for the first time are needing to move beyond professional investor audiences to include direct to consumer marketing strategies. Reaching consumers can be complicated and expensive. But if marketing and PR work together to include earned media strategies for these products, the results can amplify the reach.

How can you improve your earned media results?

- Use traditional PR tactics like news releases, announcements, media relations and story pitching as part of ongoing core PR activities to stay in front of the financial media and increase earned media outcomes.

- Develop relationships with the media covering your firm by sharing research, thought leadership and newsworthy information that can help them better cover your products and the industry. Schedule desk-side briefings to help them get to know your spokespeople (see The New York media trip: Taking investment pros on the road.)

- Be strategic. Provide meaningful information connected to the news. Connect your people and products to what is going on in the world with newsjacking strategies that put your experts in front of media. Seek to shape perceptions and drive interest by sharing research and thoughtful insights that can change perceptions.

- Avoid pitching stories that are self-serving and focus instead on being educational and shedding light on topics important to your key audiences now.

Let us know if we can help you improve your earned media results.

Subscribe.

Receive the latest news and insights from Lowe Group.