LoweDown Blog.

Insights on issues impacting the investment industry.

The Latest

2026 FUSE Forecast and the implications for communicators

Key Takeaways: ETF proliferation accelerates with FUSE projecting record issuance in 2026, with active ETFs and ETF share classes expanding Alternative investments democratize and continue…

Most Popular

Before & beyond the launch: PR helping ETF sponsors cut through the noise when introducing share classes and active strategies

Key Takeaways: The SEC’s preliminary approval for dual share class ETFs opens doors for innovation communications around future launches ETF sponsors should focus on early…

Asset and Wealth Management conference season PR and outreach playbook

Key Takeaways: Pre-conference preparation is crucial: Set clear goals, schedule media interviews and one-on-one meetings, create preview content, and coordinate any booth “activations” around high-traffic…

Got an expert on retirement? Here’s an overview of the media covering retirement and the topics they are talking about

Key Takeaways: Retirement is the #1 topic of interest to consumers and is the most frequent personal finance topic covered in the media. Retirement stories…

A legendary private equity PR pro shares some wisdom

Key Takeaways: Strategic PR helped a16z build credibility and stand out in private equity. Communications focused on raising the profile of the entire team, not…

Crisis communications when trust is fleeting: A conversation with crisis veteran Chris Beard

Key Takeaways: Trust is eroding and grievance is rising according the recent Edelman Trust Barometer, so crisis communications may start from a credibility deficit. Prioritize…

Future Proof – A conference like no other

Key Takeaways: Future Proof is redefining the advisor conference experience with its highly successful Breakthru one-on-one meeting format, interactive exhibitor activations and unique outdoor setting. …

10/10, No Notes: The time a Lowe Group client pulled off the perfect pivot, straight out of our media training, on live TV

Key Takeaways: The most effective pivot is to acknowledge the question, answer briefly, and bridge to your message. A strong message triangle keeps you focused…

Future Proof Festival: Advisors can apply elements of the PR toolkit to build authority, grow brand and demand

The conference offers multiple opportunities to get in front of the technology and trends shaping client demand and driving industry news.

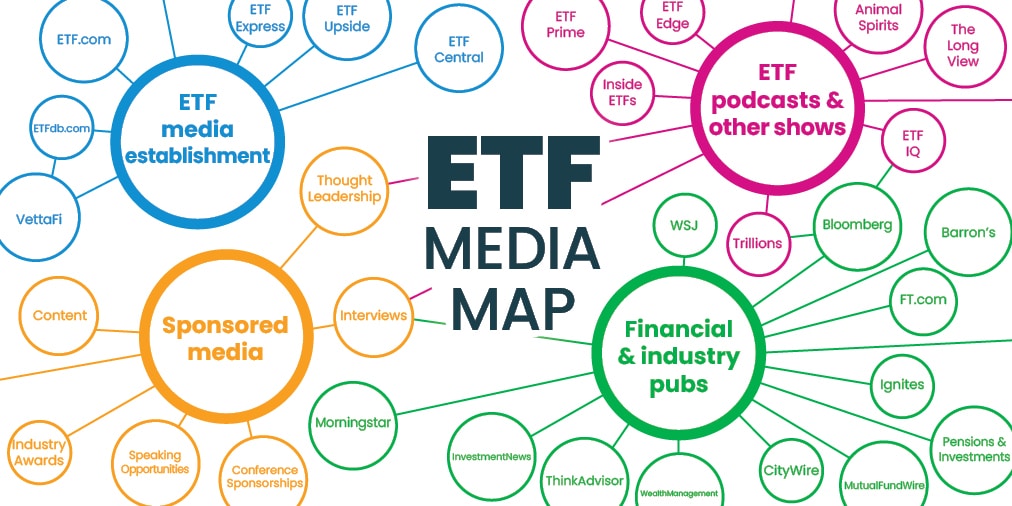

Everything you always wanted to know about the ETF media landscape

Launching an ETF? Here’s your guide to using the media to capture financial advisors’ attention.

Subscribe.

Receive the latest

LoweDown blog posts.