Crisis communications when trust is fleeting: A conversation with crisis veteran Chris Beard

Key Takeaways:

- Trust is eroding and grievance is rising according the recent Edelman Trust Barometer, so crisis communications may start from a credibility deficit. Prioritize timely and appropriate transparency to prevent misinformation from taking hold.

- Build up your “Reputation bank accounts” with deposits before a crisis—thought leadership, visible values alignment, stakeholder-specific programs—earn benefit of the doubt when pressure hits.

- A bright spot: business is perceived as the most competent and increasingly ethical institution, with a 19-point rise in ethics since 2020—an advantage financial firms can leverage to rebuild confidence post-crisis and sustain trust over time.

Communications, especially in the financial services realm, relies on trust and authority.

The Edelman Trust Barometer, published each year by the biggest PR firm in the world, continues to show a steady erosion in consumer trust. This year is the 25th anniversary of the report entitled Trust and the Crisis of Grievance.

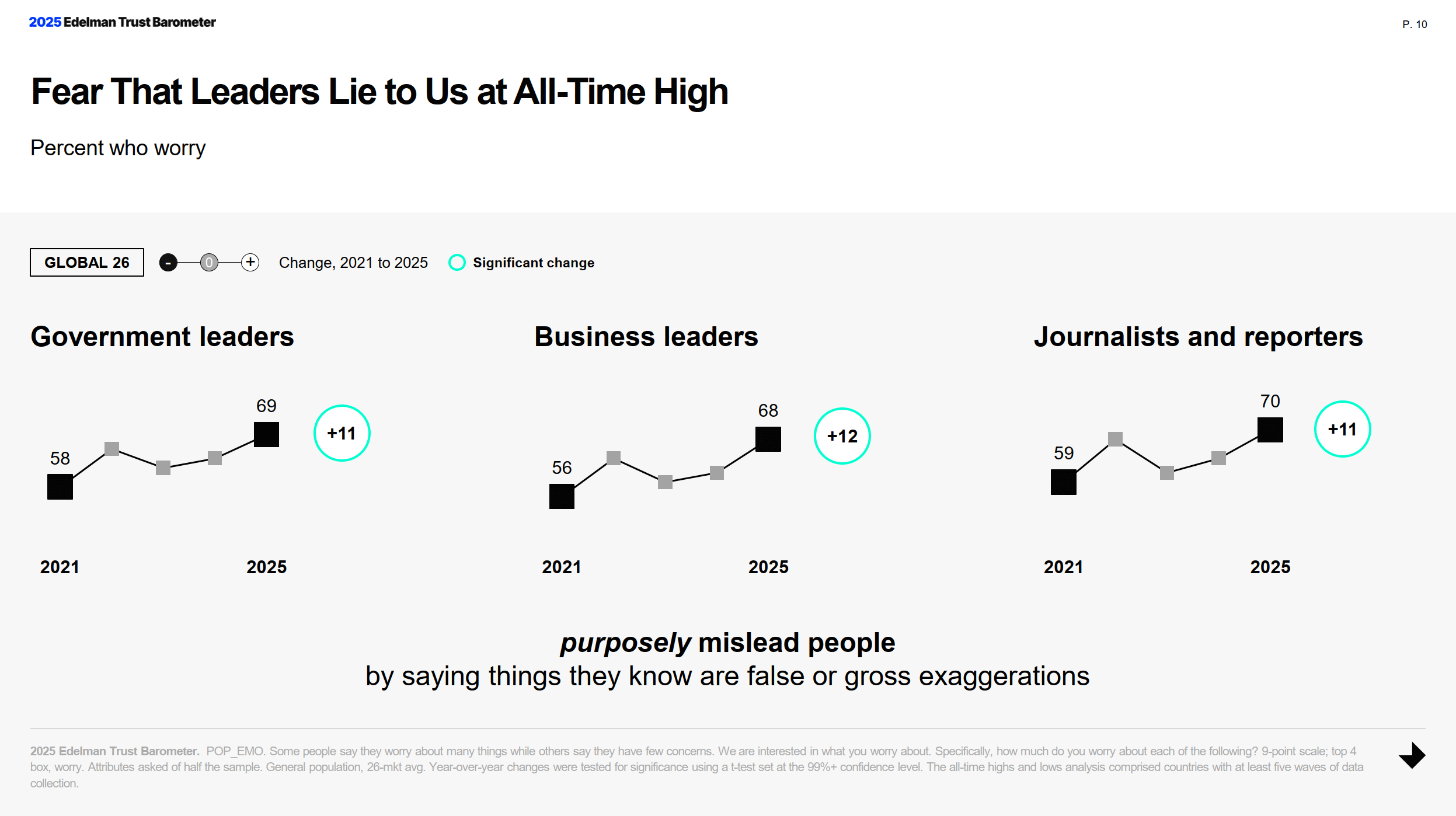

Even in the best of times, establishing authority can be a challenge. But imagine you are dealing with a crisis such as a regulatory issue or a data breech. The Trust Barometer suggests you are facing a deficit even before you issue any comments. Consumers may assume you are not being truthful. This year’s survey noted support for the following statement: “Government leaders, business leaders, journalist and reporters purposely mislead people by saying things they know are false or grossly exaggerated.”

I spoke recently with Christopher Beard, managing director of the Crisis Shop who has spent his career leading crisis communications at Fortune 500 companies, to get his thoughts on managing crises in today’s skeptical world.

Veteran PR pros will all remember the Tylenol tampering crisis as the case study in how to manage during a crisis. President Trump’s recent speech connecting Tylenol to autism must have caused their crisis team déjà vu and another chance at PR history. This week, Chris posted advice for Tylenol parent Kenvue as well as this timely post on the power of allies during a crisis.

Chris and I spoke before the recent Tylenol crisis and instead focused on a number of topics including how he approaches crisis comms when trust is fleeting.

The Edelman Trust Barometer suggests consumer trust in most institutions has plummeted. How does a lack of trust impact how you communicate during a crisis?

A lack of trust means you are starting at a disadvantage. People are more likely to doubt your organization’s messaging and more inclined to believe misinformation. When trust is low, false narratives can quickly gain traction.

That’s why transparency is critical when communicating about an issue. It’s essential not to spin, withhold, or obscure the truth. However, transparency should be appropriate to the situation. For example, a consumer goods company dealing with a product recall must clearly disclose the scope of the recall, which products are affected, and the potential risks to consumers. On the other hand, a financial institution under SEC investigation may not need to disclose every detail publicly but should ensure that directly impacted stakeholders are properly informed, even if broader public statements are unnecessary.

For financial services firms, trust is paramount. What can companies do to put deposits in the reputation bank account?

Financial services firms should align their actions with what their stakeholders value. They should actively develop and then communicate the programs they have in place that support those values. For instance, if trust is a top priority, firms should proactively implement thought leadership initiatives that go beyond regulatory requirements to build and reinforce that trust. Importantly, these efforts should be put in place before a crisis hits, not just in response to an issue. By establishing a foundation of credibility in advance, firms are more likely to earn the benefit of the doubt and maintain stakeholder confidence when issues arise.

What did you learn from your work with a credit reporting agency responding to reports of data breaches, whether those breaches actually happened or not. What guidance do you have for all companies where the protection of personal information and data is critical?

Companies must have robust security measures in place and be fully prepared to respond if a breach occurs. This means not only having incident response plans and systems ready to activate but also ensuring that teams are well-trained and able to execute those plans under pressure.

And remember, it's not enough to have a documented plan; organizations should conduct breach simulation exercises at least annually, ideally twice a year, to test and refine their response.

Companies also need to inform their impacted customers or stakeholders before the rumors and misinformation start flying around the internet.

How do you keep a crisis team, and even the executive, calm and focused as you navigate a crisis?

Few things disrupt a communications team more than a panicked leadership response during a crisis. To prevent this, it’s essential that leadership is familiar with the crisis communication plan, understands the processes, and has confidence in the team executing them. Make sure leaders know that your communications team is well-prepared and regularly conducts simulations. A well-drilled team not only responds more effectively, but also instills confidence in leadership, creating the calm, coordinated environment necessary to manage a crisis successfully.

And make sure the leadership team understands the cadence of updates they will receive as well as when they will need to be involved.

What’s your post-crisis playbook?

Post crisis, it is important to do 2 things. Firstly, debrief what happened and how the crisis communication team handled the issue. Ask yourself:

- Did we achieve our goal?

- Where did the process work and not work?

- Where were there delays in the process, and how could those have been avoided?

- What unexpected things happened?

- What could we have done differently?

- Who else should we have involved?

Secondly, start putting deposits back in your reputation account. Think of programs and initiatives related to the issue that your organization can proactively implement to gain trust and enhance your reputation with key stakeholders.

In the past, we’d help people create a crisis plan that they’d save or literally put in a binder on a shelf. How do you create a living/breathing crisis plan in this age of AI?

Crisis plans and processes need to be living documents. It is important that they update them at least once a year and, importantly, that they conduct crisis simulation exercises. Companies need to develop muscle memory in handling crisis simulations. These exercises may also expose holes in the crisis plan that you can address while the stakes are lower.

Thanks, Chris!

Subscribe.

Receive the latest news and insights from Lowe Group.