LoweDown Blog.

Insights on issues impacting the investment industry.

The Latest

It pays to be first: PR lessons from the first ETF share class launch

Key Takeaways: The first ETF share class launch was by F/m Investments The smaller firm beat larger rivals, and the news was widely covered by…

Most Popular

Earned media: The PR workhorse of visibility for ETFs, other investment products and services

Key takeaways: Earned media includes coverage or attention your firm gets that is not paid Research shows earned media is viewed as more credible than…

How to hire the right financial PR firm: 7 critical questions for asset managers to ask

Experience, media relationships, familiarity with compliance, tight collaboration with digital marketing all matter most.

AI tools for financial PR, digital marketing: 5 takeaways from Office Hours

ChatGPT, Claude Sonnet 3.7, and Jasper.ai all discussed by Office Hours panelists and guests.

AI is changing financial PR…for the better

Matching the right journalist and sharpening the pitch, with help from the large language models, has never been easier.

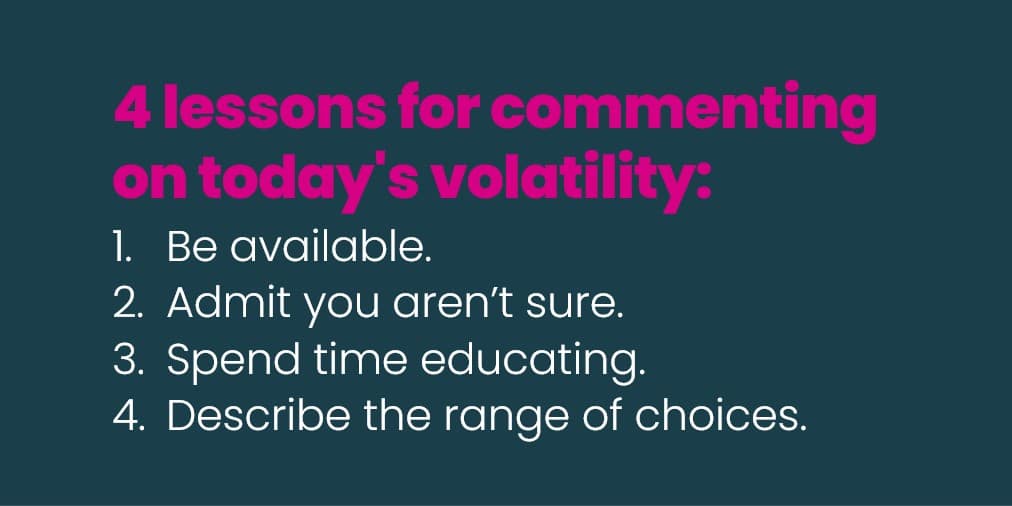

Commenting on today’s volatility takes courage

Jody Lowe offers four lessons for offering insights to the media and others during uncertain times.

Communicating through the volatility: 6 ways it’s different this time

Is it different this time? Maybe not in the markets, but communicating during this drawdown is very different from even five years ago.

Future Proof Citywide: A refreshing, productive event

The highlight of the upstart conference: one-on-one meetings that facilitate connection between advisors and other participants.

PR tips for financial advisors: How to secure earned media coverage

Reporters like to quote smart financial advisors who can help them navigate personal finance topics.

Interviews by email? Not always a good idea

Making a bigger investment in time and connection leads to richer, more engaged interviews.

Subscribe.

Receive the latest

LoweDown blog posts.