Lately, I’ve been picking up on an overall malaise about social media—LinkedIn, in particular, since that’s where the vast majority of asset management industry posting and overall activity takes place (that’s where the financial advisors are).

Many are not sure it’s “working,” they’re asking whether it’s “worth it” and suggesting maybe social media is even “over.”

If you’re starting to question, you’re not alone. Earlier this week Neil Patel opened his webcast Where the Smart Money’s Going: This is what’s really working in 2024 with this data: Organic social media is the channel where marketers are spending most of their time (38.2%)—and it’s the channel, across a total of nine channels, that drives the least revenue (2.3%). Far broader than our slice of heaven, the research was based on 118 businesses with at least $100 million in annual revenue. Those companies are likely doing much more and on many more platforms than just LinkedIn.

My strong hunch is that the LinkedIn algorithm bears some of the responsibility for asset manager marketers feeling deflated. It’s no fun when the exposure of a brand’s organic post is so limited that it’s unrealistic to even hope for likes, comments or reposts. Paid LinkedIn can demonstrate results but that’s advertising, not social media.

The social amplification narrative in this industry has evolved over the years. The original vision was that all employees be encouraged to share LinkedIn company page posts. That met with resistance and it took some cajoling as sharing company posts often required consent for the company to archive the account, private messages included.

Categories

More to the point, what was in it for the average employee? They were open to sharing the company culture posts (which typically doesn’t require archiving) but ask them to share portfolio manager comments and for many that’s a hard pass.

But there was always a clear value proposition for the sales and national account teams: to be on common ground with clients and prospects and to able to (passively) get firm messaging in front of them. Not all but many in Sales took to LinkedIn and built out their networks to be in a position to benefit from amplification.

Sharing company page posts: Is that all there is?

“What’s going on with social?” I asked Todd Kowalski, Vice President of Enterprise Accounts for Hearsay Systems, a compliance-driven engagement platform that enables financial firms’ social media participation. I met Todd a few years ago while exploring using the system to empower wholesalers to share social posts. Now he’s my go-to for his broad perspective on what asset managers and advisory firms are up to on social media.

Today, according to Todd, firms are at a crossroads. Almost every asset manager has a corporate account that posts a few times a week. These company pages tend to have fewer followers than the combined total of the firm’s sales teams in the field, and the followers tend to be less engaged with the home office-written, one-size-fits-all posts. When wholesalers are provided with the brand posts and asked to share as is without commentary, those results can be disappointing too. All of which could explain an overall decline in enthusiasm.

The programs seeing success, he says, are those whose strategies center on empowering their wholesalers with content they select based on relevance to distribution channel, geography, asset class, etc. The wholesaler in the Southeast can select just the right piece of content for their audience of RIAs, focused on their core competency of fixed income.

Hearsay’s latest (seventh annual) financial services social selling content study examined more than 13 million published social media posts from more than 100 leading financial services firms—users of their platform—to uncover content trends and behavioral insights from corporate social media program administrators, field publisher and consumers.

In asset management, specifically, the top three most suggested (by program administrators) and most published (by wholesalers) content categories were news, financial education and corporate brand. But which categories experienced the highest level of engagement? Career and recruiting content—which represented about 3% of suggested and 3% of published content.

At programs that allow even more authentic social posting—which Todd acknowledges are in the minority—wholesalers have the latitude to, for example, take a photo at a conference, draft a non-investment product-related post within prescribed Compliance parameters, and post it. Such personal, in-the-moment posts typically see above average engagement and sharing.

Engagement is a thrill, but here’s why it’s important: The wholesaler that gets likes, comments and shares on one post is teed up for broader exposure from the algo when it’s time to share the next post, which could be about a product or strategy. That’s how the “the flywheel spins,” says Todd.

“It might sound like more work but it’s efficiently supported by technology and it’s what drives business results,” he says. The Hearsay crew plots their users against a user maturity model to consistently demonstrate that the top tier wholesaler social media users tend to be tops in sales production.

And that is what gets distribution management attention. Hearsay may enter an organization through Brand or Digital Marketing but it helps when Sales is involved too, according to Todd. Also on board? Compliance, who Todd says is increasingly showing a “how do we get to yes?” attitude.

Todd described a relatively new large client that is mobilizing to empower the sales team to extend the reach of their content. They expect to demonstrate a greater return than they’ve experienced in paid social. The focus will be on measuring impressions, clickthroughs and overall engagement.

“Are you seeing asset managers dial back on social media?” I asked Todd. His response—“Well, priorities always ebb and flow...”—leads me to believe that there may be some of that. I hope not, at least not before you try the alternative, which is to find a way to more authentically participate, and benefit. Todd finished his sentence by saying “...but holistically we are seeing increasing exploration and use of social as a tool to nurture, convert, and build business relationships.”

Todd’s focus is on enabling field sales teams so that’s his lens. However, the preference for people over brands is not just a Hearsay vision, it’s consistent with a widely reported shift away from brand-controlled channels and toward individuals (including finfluencers). People prefer to engage with people.

Measuring social media results

How confident are we that social media activity is being sufficiently measured? Together Todd and I reviewed some data from FUSE Research Network.

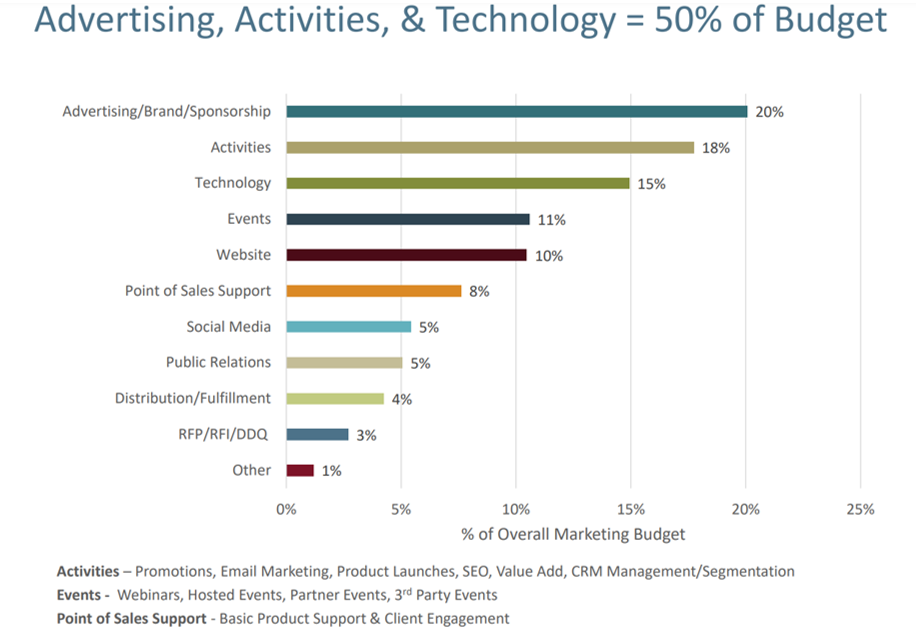

Asset management marketers commit 5% of their marketing budget to social media. Interesting, that’s exactly as much as what’s invested in public relations. Both activities leverage existing assets (people and content) but I’d argue that social media work represents a greater toll on resources, including design.

(On this point and not necessarily agreeing with me on that, Lowe Group Founder and President Jody Lowe jumps in her with her view: “If it’s true that the expenditure for social versus PR is roughly equal, I have to believe—based on our experience—that the outcome per dollar spent on PR is more memorable/impactful. Maybe you'd expect me to say that.”)

I might have more to say about this breakdown (just 10% for the website?!) but let’s move on.

Source: FUSE Marketing Survey, 2023

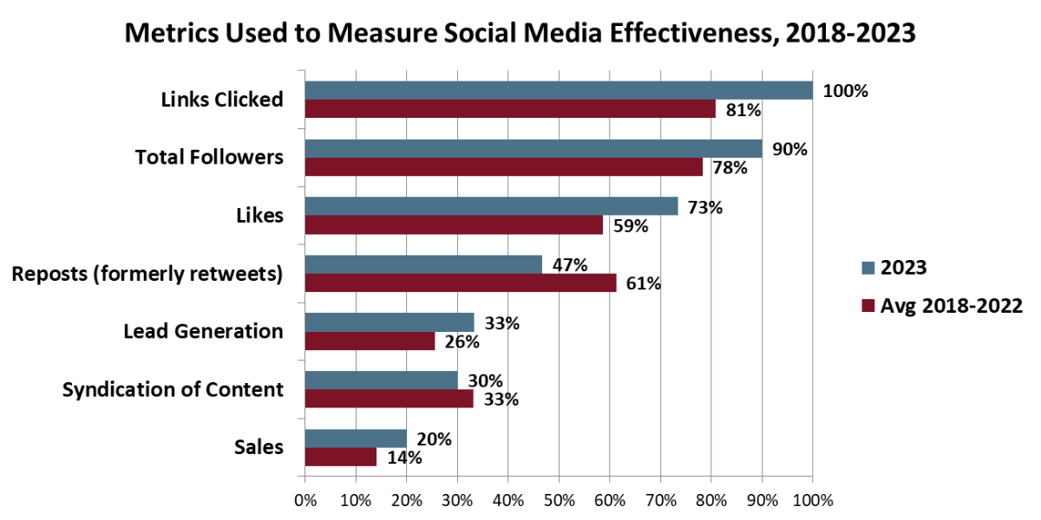

Given that social media is a top-of-the-funnel strategy, these measures look right to me. I wouldn’t necessarily expect marketers to be measuring conversions and sales. But I’d focus on growth over time—growth in traffic, growth in followers, growth in likes, growth in reposts, growth in names acquired (aka lead generation).

Source: FUSE Marketing Surveys, 2018-2023

That 100% of FUSE survey respondents are tracking links from social media content is a promising sign. I’d love to learn more—are the clicks to the website and is that traffic measured, attributed to social media campaigns and reported on in aggregate? Todd cites Hearsay data showing that traffic sourced from organic social media is eight to 12 times more engaged than traffic from other sources.

Yes, organic social traffic can be high quality, but wait, there’s more. Is the traffic able to be attributed to known advisors, shared at the CRM contact level and available both for Sales team intel as well as firm roll-up analysis? Do you know which firms respond most to social posts? Which categories of social posts perform best with which firms? If all that’s in place, don’t sweat the conversions and sales—you’ve completed a handoff for Sales to do its job. (If that’s not where you are, let’s get you there.)

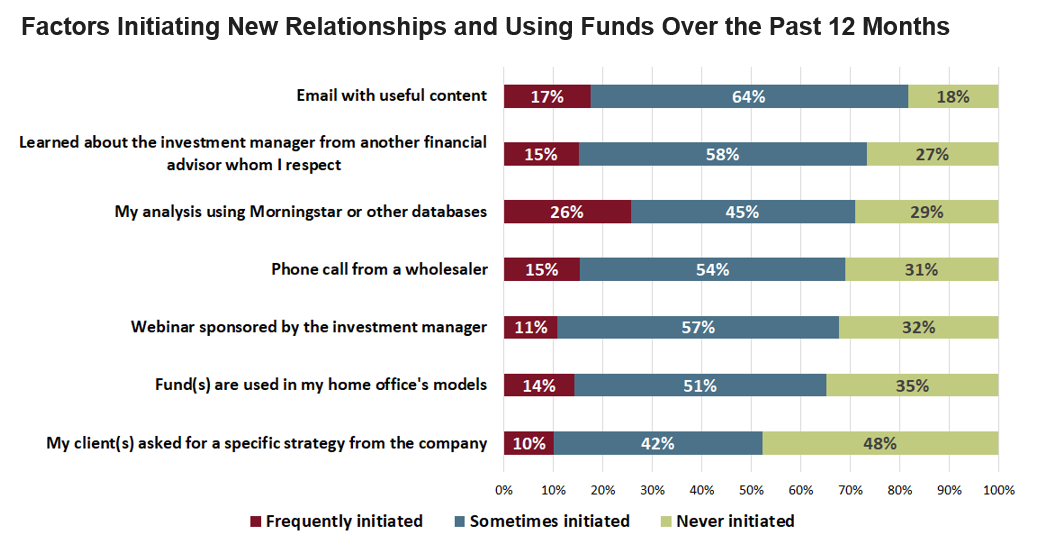

If asset manager social media is helping drive new relationships and product trial, wouldn’t you expect to see the effect of it in the chart below? Email tops the list because of course it does. (If you find yourself stretched between email and social media, prioritize email every time. Please, I’m begging you.)

Where’s social media as a contributing factor? Todd says it’s implied as a catalyst for why an advisor ran a Morningstar analysis or took a call from a wholesaler they didn’t know—they’d seen a social post and interest was piqued or maybe they subsequently invested client assets in a strategy based on macro- or product-level insights they picked up from the wholesaler's social feed after they connected post-conversation.

That's conceivable, but we need to start seeing social media as a difference-maker that shows up in surveys. I asked FUSE, by the way, if social media was anywhere in the results, have not yet heard back. I’ll update the post when I do.

Source: Advisor Trend Monitor Series Report – Wholesalers: The Advisor View, FUSE Research Network

Our time up, Todd’s mouse was hovering on the Zoom Leave button when I squeezed in one two-part question for him.

Q1A. What about asset managers’ use of X?

A:“It’s resilient, there’s still a place for it, for economists, portfolio managers, even a few wholesalers.”

Q1B. And Threads?

A: “Not really, someone will mention it here and there, but we are not hearing it as a network that asset managers view as a place to connect with advisors or institutional investors about business.”

Thanks to Todd for the insights. Reach out if you’d like to work together on social or other digital strategies.

The algorithm is

not your friend

The LinkedIn algorithm is a formula that determines which content gets seen by certain users. Its intent is to make each user’s newsfeed as relevant and interesting to them as possible to increase engagement and time spent on the platform.

Unfortunately, much of what characterizes asset manager brand and employee accounts runs counter to the LinkedIn algo. The algo doesn’t support, and may even penalize, the following:

- Posting links to your own website, because that takes users away from the platform (instead, post your link in the comments).

- Zero to no engagement with others’ accounts except occasionally in response to your own post

- Reposting a company page without comment

- Excessive tagging and hashtagging