I rejected the report at first. Of course, I did, in solidarity with all who toil on asset manager websites.

J.D. Power’s recent alarming research findings on mutual fund/ETF sites had me sputtering for a day or two. The 18 sites included in the benchmarking study are among the finest in the industry, representing most of the largest firms. But the data, based on 2,500 evaluations from financial advisors, found them lacking on four factors: speed; information/content; visual appeal; and navigation.

“Websites need to be foundationally sound from a design and usability standpoint; information needs to be easy to find and accessible; and they must effectively deliver clear, valuable information and insights,” Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power, is quoted as saying in the press release.

Categories

“The problem is, just 17% of advisors say the asset management websites they use are delivering consistently on all three. Worse, 27% of advisors say at least some of the asset manager websites they’ve visited in the past month do not even deliver the basics for a foundational level engagement.”

After spending some time in denial, my Libra kicked in and I started to make room for the other side of the argument.

I spend a lot of time on fund company websites and they can be slow. I’m forever getting lost and have to back, back, back to where I started. Just in general, I consider trying to navigate websites a waste of time, but it ought to be do-able. On asset manager sites, in particular, I find search not useful in helping find what I’m looking for. Instead, I fall back to site:yoursite.com Google search.

Also, this isn’t the first we’ve heard of the sites’ shortcomings. Annually since 2019 J.D. Power has been reporting on a benchmarking study involving pretty much the same set of firms with similar findings.

Reading Ignites’ headline last week—“Advisors: We’re too busy to slog through shops’ crummy sites” (subscription required)—might have stung but it wasn’t as direct as the deck on the J.D. Power press release: “J.D. Power finds one-fourth of advisors say asset manager websites do not meet basic foundational needs.” Ouch.

“Have you decided to ratchet up the message this year?” I asked study author Craig Martin via email.

His response: “The last couple of years we’ve been a bit more focused on the technical side of the story. This year we are focusing more on the implications, in large part due to the evolving market conditions which we feel increase the urgency for asset managers to improve the digital experience.”

Because the situation isn’t improving, Martin says. “From ’21 to ’22 we saw a significant improvement in study scores but based on our review of the sites/experiences, the real improvement was limited in the aggregate. A handful of brands have shown more material improvement and do appear to be making good progress, but on the whole there definitely seems to be a disconnect.”

Although that’s not the intent, the J.D. Power study makes an example of the largest firms—firms that in many ways represent the best of what the industry does and often lead the way for smaller firms. Way, way back in the day it was the large sites that influenced the organization of asset manager websites. If American Funds or Putnam Funds were going to present their information a certain way and advisors got accustomed to it, it just made sense for smaller firms to follow the same layout—to simplify things for the third-party distributors.

Firms included in the 2023

J.D. Power Study

The following firms were included in the study, producing an industry average score of 639. It’s a weighted average based on market share.

Two firms performed significantly higher than industry average, according to Martin—the top brand scored a 686, the second 677.

- AllianceBernstein

- BlackRock

- Capital Group

- Charles Schwab

- Columbia Threadneedle Investments

- Fidelity Investments

- Franklin Templeton

- Invesco

- J.P. Morgan

- MFS Investment Management

- Morgan Stanley

- Nuveen

- PIMCO

- Prudential Financial

- State Street Global Advisors (SSGA)

- Rowe Price

- Vanguard

Consistency across product manufacturer sites continues to make sense today. Broadridge research recently reported that just 19 asset managers serve as a top five partner to one of the 10 largest distributors, and those 19 asset managers control 49% of mutual fund assets across those distributors. Why would the also-rans (sorry) try to do something different with their sites as they compete for the remaineder of the business?

“It’s atypical to see the top-performers not being stronger,” Martin told me, confirming my suspicions. J.D. Power conducts digital studies across multiple other industries (e.g., automotive, banking, credit card, insurance, and utilities).

“One key factor that tends to impact the level of digital quality (and investment) is the population of end users. Industries/sectors that serve large groups (i.e., banks and credit card) tend to be very strong because it’s a central part of the relationship and has been for many years.”

Here’s the urgency for asset managers of all sizes to get their website acts together, from Martin’s perspective: “If you are big, digital is critical for growth, supports efficiency, reduces costs, improves margins. If you are smaller/niche, [a solid website is] vital to you getting the message out, providing differentiated value and controlling costs.”

Let’s get to work

So, here we are. Are we really going to continue on our merry way until next year’s damning findings from J.D. Powers? While a collective industry response may be too much to expect, here’s hoping this report finally lights a stick of dynamite under at least a few digital teams, including their development and design partners.

Below I offer a few observations and opinions based on my years of experience working with several asset manager websites, including what can be learned from their analytics. The four factors from the research provide a framework for where to get to work.

Speed (representing a 31% weight in the model)

All of the J.D. Power study is based on perception. Speed, explains Martin, is relative to what advisors expect. “While we are asking advisors to review objectively, the aggregate experience with the site (and the brand) will have an impact on how things are scored. Beyond the technical capabilities, digital experiences are also influenced by how comfortable an advisor is with the site.”

The cause of a slow site could be any number of things separate and together, ranging from the baggage of the content management system, the load involved in publishing data to the site, the way images are being handled et cetera. Regardless, every firm needs to dig in and prioritize how fast their site is loading, on the desktop and phone. There’s a reason that speed represents the largest weight in the J.D. Power model. A slow site repels visitors. Also, it’s a direct ranking factor in search, remember.

Of the four factors considered, speed is quantifiable, verifiable—and incontrovertible.

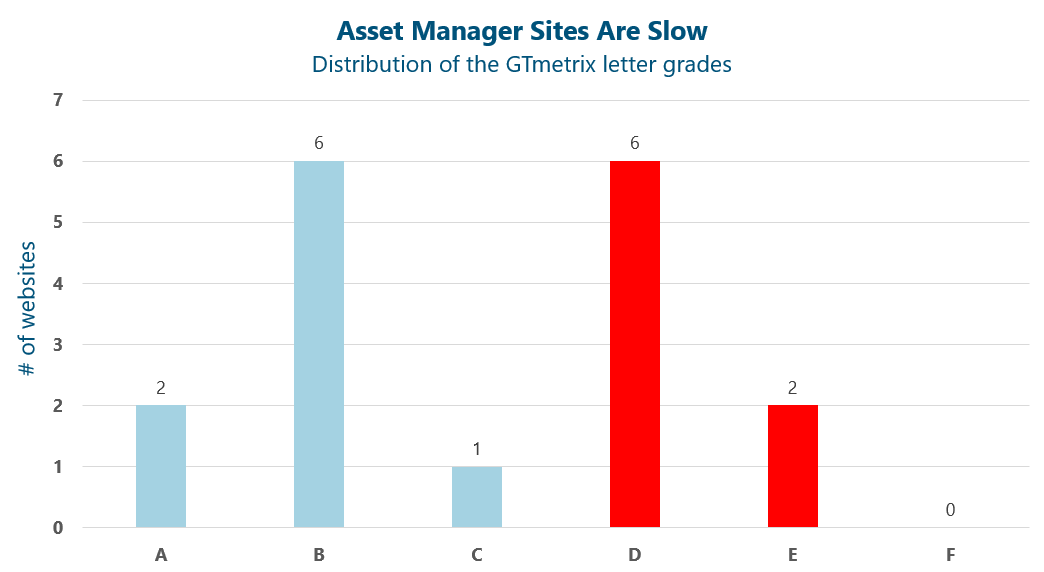

The industry’s largest asset managers’ sites are disappointingly slow. The following chart shows the distribution of the GTmetrix grades of the sites in the study (we’re not naming them), on a scale of A being the best and F being the worst. I should say that I created this chart, it’s not part of the J.D. Power work. Not knowing whether the research distinguished between Northern Trust as a whole and the investment management business, Northern Trust isn’t included in this quick analysis. The fact that almost half of the sites rate a D or an E is a problem that needs solving.

Look, I’ve been there and fielded complaints about the speed of a website or two. You want to believe that the content is just so good that people will hang in there and wait for it. But they won’t—and they’ll think twice before trying again.

3 reasons to get going and fix advisors’ experience on your site

- Millions of dollars are spent by the industry (and by these sites in particular) on advertising, PR and content placements to drive advisors to sites. How much of that is wasted if advisors bite on the bait only to lose their way and bolt?

- All of the above referred to just marketing tactics. There’s also the expensive asset called your sales team—all of which regularly direct their contacts to the site, setting them up for apparent disgruntlement.

J.D. Power links a favorable website experience to the prospects of winning more business from advisors. Provide a favorable experience and more than half (58%) of advisors say they are “extremely likely” to invest new assets with a firm in the next three months. That drops to 31% when sites fail to deliver clear and valuable information. When the sites are difficult to navigate and lack important details, strong future investment intent falls to just 20%.

- Across the industry, serious plans are being drawn up and expectations are being raised about the ability of the digital channel to serve and support a segment of advisors who don’t want to or don’t qualify to meet with wholesalers (again, see the Broadridge research and other recent work on engaging with advisors). A subpar website experience will torpedo those plans.

Navigation (21% weight)

Thus far we’ve focused on the advisor’s experience because that’s the scope of the J.D. Power survey. But when they land on your site, many advisors have an advantage that the average visitor may not—the advisor may be following a direct link provided by a member of your sales team. Pity the guest who lands on the home page and attempts to wing it.

A site’s navigation can be a long-running battle where digital marketers are outmatched when it comes to what others (executive management, investment management, product management, compliance, etc.) insist on. While we’ve thankfully moved away from a site’s architecture needing to reflect an org chart, it’s been replaced with opaque reasoning or business initiatives that the hapless visitor doesn’t have a chance at divining.

From time to time I’ve heard marketers brag about time spent on site. Extended time on a page is almost always a good sign, truly representing engagement. But time on a site? Not always and maybe even rarely.

Few land on a B2B site, let alone an asset manager site, to while away their day. They come to complete a task, and ideally the digital team prioritizes that task completion—or experience, if you will.

Another red flag that your visitors are floundering: watch the traffic to your Contact page. That’s how leads are collected, I get it, but if you’re seeing a lot of traffic to the Contact page and not so many leads, that’s a sign that people had nowhere else to turn. It might have represented a momentary cry for help that they thought better of—and chose to take off instead.

The best time to improve on navigation is during a redesign, informed by lots of data from your web analytics, including path exploration and (from Universal Analytics) navigation summary.

To tide you over until then, continue to work on the connections you’re making on your site. Could you be doing more internal linking? Can you add related content boxes? What can you learn from your on-site search results about what people are continually looking for?

Obsess over how your site is showing in Google and Bing and whether it’s as you intend for keywords and brand-related searches, too.

Firms offer many different types of products (mutual funds, ETFs, separately managed accounts, closed-end funds, UCITs) all with similar names. Here’s a common occurrence: advisors search using just the firm name and “emerging markets,” for example, and the first link they see and click on is for the wrong product or share class. If you see that happening in your analytics, there are ways to head it off. Pay attention and you can take steps to minimize frustration.

Research information and content (24% weight)

I would never agree with any suggestion that the industry’s top sites fail on content. The content that’s produced is of the highest quality.

But the focus of this factor was on researching product offerings and information, using value-add materials and accessing client-specific information and material. In an interview Martin told Ignites that advisors can grow frustrated if information like fund size or returns are difficult to find. That’s interesting. Most fund company sites follow the same model in presenting performance, most in the benchmarking set have made the transition from a tabbed approach to a long scrolling page where the returns are quite visible. I would think advisors know they could search for the word “assets” on the page and find them.

But nobody, including advisors, wants to work any harder than they have to—especially when we know that a voice query to AI could ultimately be quicker, if not (as of this writing and could change tomorrow) fully reliable.

If an advisor is looking at fund performance on your site, I’m going to hazard a guess that it’s Plan B on their part. They likely have a primary source where they can see performance across all investments so maybe this visit begins with the advisor already frustrated at not having found something easily using their usual resource. How could you turn that mood around by doing a better, faster job of serving up what they need? And, your site likely has more data about your products—show it off!

Final thought: The thinking about password-protected advisor sites has gone full cycle, with many firms concluding that they would prefer to keep all content on the public side of a log-in. I was in that camp for years but increasingly think advisor sites have lots of value, if you can commit to the work required. In this case, if only by creating a cocoon for them, an advisor site has the potential to improve the advisor experience. And there’s the bonus of providing additional data analytics insights for you.

Design/visual appeal (24% of the model)

Again, no survey data is going to make me rethink my appreciation for the design happening on the top sites. But, especially on the performance pages, I think we need to be careful of doing too much if it’s at the expense of the advisor getting what they need and on their way. To me, design shouldn’t be what you notice. If they have to look away until the motion calms down or if they need to bat away popups, I can understand advisors’ frustration.

Kudos (and thank you) to you for making it to the end of this post. It likely shows how committed you are to differentiating your firm with a superior website. If you’re with one of the firms included in the study, I assume that you’re convening a taskforce to systematically address all of the above. My further assumption is that you will succeed. For marketers at smaller firms, that just heightens the incentive for you to focus, as well—the J.D. Power work suggests that you are at less of a competitive disadvantage than you may think.

Websites are what we do at LG Digital. If you’re looking for help with yours, send us an email.

Highlights from J.D. Power’s previous benchmarking studies

- 2019: Digital leaders, many of which are among the industry’s largest players, are far outpacing most firms in the industry in engaging advisors through digital channels—and they threaten to take even more market share away from smaller rivals. The 2019 study named American Funds, JP Morgan and Franklin Templeton as leading in digitally engaged advisors. In American Funds’ case, more than one out two advisors said they had high levels of digital engagement.

This work was first to demonstrate the linkage between digital engagement and intent to invest. Two-thirds of advisors with high levels of engagement (using two or more digital channels within the past two weeks) said they are likely to increase their business with the firm.

Another finding: just 42% of advisors accessed the website. Highest engagement channel is email, engaged with by 56% of advisors.

- 2020: The 2020 study now includes BlackRock and MFS along with Capitol Group (American Funds) and J.P. Morgan as among firms enjoying the highest level of investment intent, based on digital engagement.

“Digital engagements that resonate most are those that provide easy access to asset management content and resources.”

This finding was a head-scratcher: Advisors with 16 or more years of experience in the industry are significantly more likely to rely on digital interactions with asset managers than those who have only been in the industry five years or less.

- 2021: What had been called a digital engagement study is now narrowed and renamed as an Advisor Online Experience Study. Focusing on websites—with the conclusion that “Many asset managers still need to fix the basics…just 37% of advisors say it is very easy to find the information they need and only 34% say it is very easy to find the features and tools they need on an asset manager’s website.”

The study reports on “a significant gap in satisfaction between top- and bottom-ranked firms.”

- 2022: “Asset managers that provide an exceptional digital experience for advisors drive significantly higher likelihood of increased investment, but just 13% of asset managers are delivering that superior level of service today,” according to the 2022 study.

“The problem is particularly acute among smaller asset managers who have a tremendous need and opportunity to differentiate and highlight their unique strengths on digital, but often miss the mark with sub-par navigation and tools—and little in the way of compelling brand differentiation.”

The widest gap between small and large: in the areas of research information and content; availability of client-specific information and material; and researching product offerings and information.